Menu

- Loans

- All on EMI

- Bajaj Mall

- Cards

- Investments

- Insurance

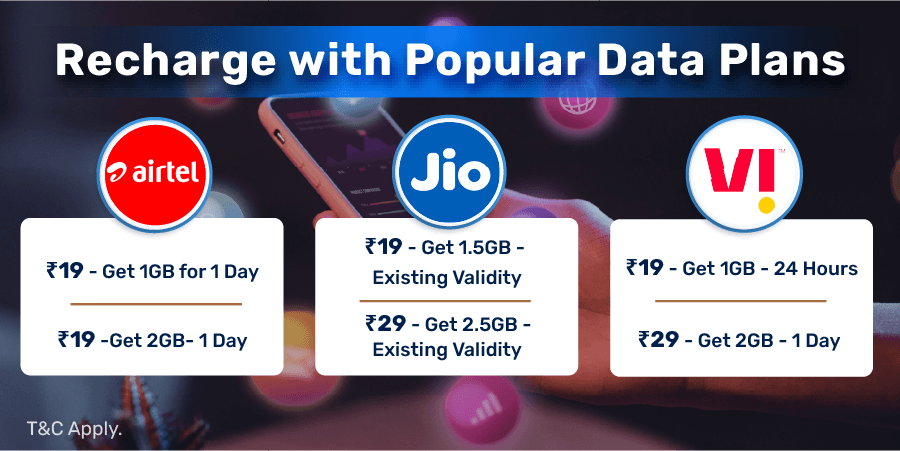

- Payments

- Offers

- Locate Us

- Services

Menu

Loans

-

Personal Loan

-

Gold Loan

-

Used Car Loan

-

Loan Against Car

-

Car Loan Balance Transfer and Top-up

-

New Car Loan

-

Business Loan

-

Loan for Doctors

-

Loan for Chartered Accountants

-

Medical Equipment Finance

-

Loan Against Property

-

Secured Business Loan

-

Loan Against Property Balance Transfer

-

Home Loan

-

Home Loan Balance Transfer

-

Two-wheeler Loan

-

Loan Against Shares

-

Loan Against Mutual Funds

-

Loan Against Bonds

-

Loan Against Insurance Policy

-

ESOP Financing

-

IPO Financing

Deals & Saving

Insurance

-

Health Insurance

-

Wallet Care

-

Waller Care Entertainment +

-

Personal Accident Care

-

EMI/SIP Cover

-

Health Prime Max

-

Fonesafe Lite

-

Mobile Protect

-

Group Sampoorna Jeevan Suraksha

-

Accident Spouse Benefit

-

Wallet Protekt

-

Dengue Cover

-

Niva Bupa Health Plus

-

Health Plus Hospital Cash

-

Accident -2 EMI Protection

-

Two Wheeler Insurance

-

Four Wheeler Insurance

Investment

Rewards

Calculators

-

Home Loan EMI Calculator

-

Home Loan Eligibility Calculator

-

Personal Loan EMI Calculator

-

Personal Loan Eligibility Calculator

-

Good & Service Tax (GST) Calculator

-

Flexi Day Wise Interest Calculator

-

Flexi Transaction Calculator

-

Secured Business Loan Eligibility Calculator

-

Fixed Deposits Interest Calculator

-

All Calculator

Lifestyle

Credit Pass

All on EMI

Articles

Loan Payments

Mandate & Documents

Do Not Call Service

Your Things

Offer World

Offer World

Trading Account

Trading Account Open Demat Account

Open Demat Account Margin Trading Financing

Margin Trading Financing US Investing

US Investing

New Car Loan

New Car Loan Used Car Loan

Used Car Loan Loan Against Car

Loan Against Car Car Loan Balance Transfer and Top-up

Car Loan Balance Transfer and Top-up Hot Deals

Hot Deals Clearance Sale

Clearance Sale Mattresses

Mattresses Kitchen Appliances

Kitchen Appliances Furniture

Furniture Music & Audio

Music & Audio Watches

Watches Camera & Accessories

Camera & Accessories Cycle

Cycle Mixer & Grinder

Mixer & Grinder Tyres

Tyres Luggage & Travel

Luggage & Travel Fitness Equipment

Fitness Equipment Fans

Fans Scooters

Scooters Bikes

Bikes Electic Vehicle

Electic Vehicle Credit Pass

Credit Pass Smart Phone

Smart Phone LED TV

LED TV Refrigerator

Refrigerator Washing Machine

Washing Machine Kitchen Appliances

Kitchen Appliances Laptops

Laptops Mattresses

Mattresses Air Conditioners

Air Conditioners Furniture

Furniture Music & Audio

Music & Audio Air Coolers

Air Coolers Camera & Accessories

Camera & Accessories Tablets

Tablets Cycle

Cycle Watches

Watches Tyres

Tyres Luggage & Travel

Luggage & Travel Fitness Equipment

Fitness Equipment Articles

Articles Overdue Payments

Overdue Payments Other Payments

Other Payments Document Center

Document Center Mandate Management

Mandate Management Do Not Call Service

Do Not Call Service Your Orders

Your Orders

Debit Management Partner

Debit Management Partner EMI Network Partner

EMI Network Partner Fixed Deposit

Fixed Deposit Become a Merchant

Become a Merchant Partner Sign-in

Partner Sign-in