Our Companies

Bajaj Finserv

The holding company for various financial services businesses of the Bajaj Group.

Bajaj Finance

The lending arm of Bajaj Finserv and one of the most diversified NBFCs in India catering to more than 65 million customers.

Bajaj Allianz General Insurance

A joint venture with Allianz SE, Germany, it is a leading private non-life insurer, with offices in over 1,100 towns and cities.

Bajaj Allianz Life Insurance

A joint venture with Allianz SE, Germany, it offers life insurance solutions across Term, ULIP, Retirement, and Child plans.

Bajaj Markets

A unique and diversified digital marketplace offering financial services and lifestyle products.

Bajaj Finserv Health

The health-tech company of the Bajaj Group aiming to disrupt the healthcare ecosystem in India.

Bajaj Finserv Asset Management

A wholly-owned subsidiary of Bajaj Finserv catering to the investment needs of customers through innovative products and solutions.

Bajaj Housing Finance

A wholly-owned subsidiary of Bajaj Finance offering housing finance products to consumers, corporations, builders, and developers.

Bajaj Financial Securities

A wholly-owned subsidiary of Bajaj Finance disrupting the discount broking space through its unique offerings.

Highlights of the Year

BFS 16th Annual Report FY 22-23

BFS 16th Annual Report FY 22-23

- Our Chairman and Managing Director, Sanjiv Bajaj, shares his outlook on the annual performance of the companies

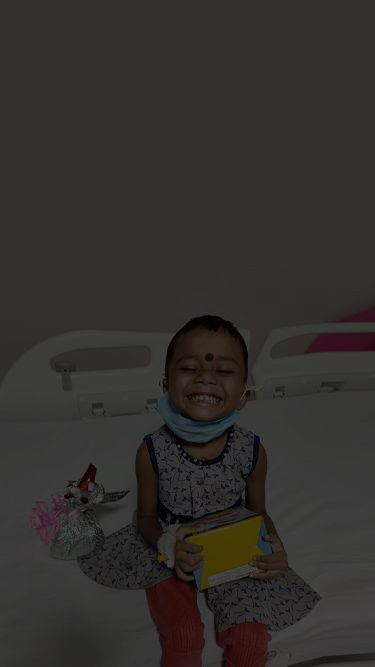

CSR at Bajaj Finserv and its subsidiaries

- Our philanthropic philosophy was articulated by our founder, Shri Jamnalalji Bajaj, which directs all our CSR conduct

- The philosophy states that all business activities should look for opportunities for philanthropy without considering the business motive

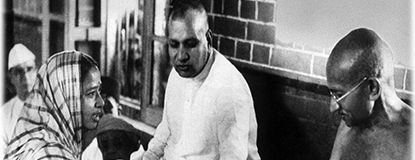

Our Legacy: Azadi Ka Amrit Mahotsav

Our Legacy: Azadi Ka Amrit Mahotsav

- As a part of the joyous celebration of Azadi Ka Amrit Mahotsav, we celebrated our legacy, which traces its roots back to the freedom struggle of India

- We commemorated the ideals laid down by our founder that have led us on this path of honesty over profits, action over words, and common good over personal gain