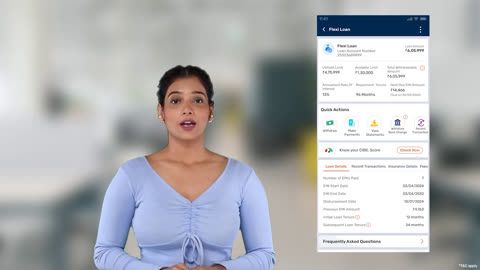

Track your Flexi Loan account

Unlike a regular Term Loan, our Flexi variants offer you a host of additional benefits. These include unlimited withdrawals from your available loan limit, part-prepaying your loan at no extra cost, and more. These benefits allow you to manage your loan repayment as per your financial situation. You can explore all these features and much more by visiting our service portal.

Sign-in to get these benefits on the go.

-

Funds withdrawal

Get funds whenever you need them from your available Flexi Loan limit in just a few clicks.

-

Part-prepayment at no additional cost

Pay a part of your loan ahead of schedule without paying any extra fees.

-

Loan statement

Get your Flexi Loan statement in just a few clicks and track your transactions with ease.

-

Manage your bank account

Update your repayment and withdrawal account online to ensure hassle-free EMI payments and withdrawals.

-

Flexi Lite

A simplified mode for small withdrawals.

OTP-free drawdowns up to ₹5,000

Ideal for daily or weekly expenses

Faster and smoother access to small-ticket funds

-

Drawdown Enhancements

a) Scheduled Withdrawal

Set a withdrawal for a future date

Useful for rent, fees, or monthly expenses

Ensures funds credit automatically on your chosen date

b) Favorite Transactions

Save frequently used withdrawal details

One-tap repeat withdrawals

Saves time and reduces manual effort

-

Feature 3: Drawdown Bank Change

Update the bank account where funds are creditedUseful when you switch banks or want better fund trackingQuick online request and smooth processing

-

Feature 4: Recent Transactions / History

View all your withdrawals, prepayments, and scheduled transactionsHelps track fund usage and plan budgetsComplete transparency for your loan activity

Know your Flexi Loan

Bajaj Finance Limited offers two Flexi variants for some of its loan products - Flexi Hybrid Term Loan. These variants give you the flexibility to manage your EMIs based on your financial situation.

When you choose either of our Flexi variants, a loan limit is assigned to you. You can withdraw funds from this pre-assigned limit whenever you need them and pay interest only on the withdrawn amount. You can also part-prepay your loan at no additional cost.

If you choose the Flexi Hybrid Term Loan, you will also have the additional benefit of paying interest-only EMIs for the initial tenure.

-

Get the most out of your Flexi Loan

- Withdraw as many times as you need from the available loan limit during the loan tenure.

- Part-prepay your loan as many times as you like without any additional charges.

- Pay interest only on the amount you withdraw from your available limit.

Please note that you have to maintain a minimum balance of Rs. 100 or Rs. 1000 as your outstanding amount to keep your Flexi Loan account active as specified in loan agreement.

Also, the minimum amount you can withdraw from your flexi loan account is Rs. 1000.

Feature 1: Flexi Lite

Flexi Lite is a simplified withdrawal mode designed for small, everyday needs.

What is Flexi Lite?

A feature that allows you to make quick, small-value withdrawals without multiple authentication steps.What it offers:

- OTP-free withdrawals up to ₹15,000 in a day

- Smooth, faster daily transactions

- Ideal for customers who make frequent small withdrawals

- Helps manage everyday expenses efficiently

4. Feature 2: Drawdown Functionality Enhancements

a) Scheduled Withdrawal

What is Scheduled Withdrawal?

A feature that allows you to plan and schedule a withdrawal for a future date or time.When to use?

- Bill payments

- Ensuring funds are credited on a specific date

- Budget planning and controlled usage

b) Favorite Transactions

Makes repeat withdrawals faster.

What is a Favorite Transaction?

A saved withdrawal template with pre-filled details like amount.Benefits:

- Faster repeat withdrawals

- Saves time

- Ideal for rent, school fees, recurring fund transfers

Feature 3: Drawdown Bank Change

This feature helps you update the bank account where your Flexi Loan withdrawals are transferred.

What is Drawdown Bank Change?

A facility that allows you to modify your registered withdrawal bank account for Flexi drawdowns.

Why you may need it:

- You changed your primary bank

- Your existing account is no longer active

- You want withdrawals routed to a different account for better fund management

-

-

Check your Flexi Loan account

Sign-in to our service portal in two simple steps and track your loan details easily.

How to place Scheduled Withdrawal request

00:38

00:38

Manage funds withdrawal from your Flexi Loan

Visit the ‘Service’ portal to withdraw funds from your available limit.

-

Withdraw funds from your Flexi Loan

- Click on the 'Sign-in' button on this page.

- Enter your registered mobile number and submit the OTP to sign-in

- Verify your details with your date of birth and proceed

- Go to 'Service' section and click on 'Relations'

- Select your Flexi Loan and click on 'Withdraw Funds'

- Enter the amount needed from your available loan limit and proceed

- Verify your details with the OTP sent to your mobile number

Alternatively, you can click on the below link to withdraw funds. You’ll get funds in your bank account within 3 hours of submitting the request. If there’s any delay, it will be reprocessed within 48 business hours.

Manage your Flexi Loan payment

When you borrow any loan, you usually repay it in equated monthly instalments (EMIs). Your EMI usually consists of principal and interest, and it gets auto-deducted from your registered bank account on a pre-set date. However, if you choose our Flexi Hybrid Loan, you get the option to pay interest-only EMIs for the initial tenure.

If you have surplus funds and have opted for our Flexi variants, you can part-prepay your loan at no additional cost.

You can part-prepay your Flexi Loan or explore other payment options by visiting our service portal

Advance EMIs, foreclosure, and overdue EMIs

If you fear missing your EMI due date, you can use the advance EMI facility and pay your monthly instalments in advance. This will help you in avoiding negative impact on your CIBIL Score. It also helps you in avoiding penal charges applicable in the case of overdue EMIs. You’ll also be not able to use your Flexi Loan account features if your EMI bounces.

You can also use our foreclosure facility to pay your entire outstanding amount in one go and close your Flexi Loan early. However, you may be asked to pay additional foreclosure charges.

If you’ve failed to pay your EMI due to a low account balance or technical error, clear it with our overdue EMI payment option.

Disclaimer: Please note that the amount paid by you towards Advance EMI is applied for repayment of your monthly EMI only and is not to be treated as part-prepayment or foreclosure of the loan, irrespective of the loan variant availed by you. No interest is payable by BFL on the advance EMI amount paid by you.

-

Make your Flexi Loan payments

You can part-prepay your loan, pay an EMI in advance, clear your overdue instalments, or foreclose your loan in your account.

- Visit our service portal by clicking the 'Sign-in' button on this page.

- Enter your registered mobile number, and submit the OTP to sign-in.

- Verify your details by entering your date of birth and proceed.

- Go to 'Service' section and click on 'Relations'.

- Select your Flexi Loan and click on 'Make Payment'.

- Select the type of payment and click on ‘Proceed’.

- Enter the amount and click on ’Proceed to Payment’, review the additional charges if applicable.

- Select the payment method and click on ‘Pay now’.

You can also manage your flexi loan payment by clicking on "Pay your flexi loan EMIs" You will be asked to sign-in to service portal. Once signed-in, select your loan account number, choose the payment type and proceed with the number.

-

You can also download your updated statement of account or check your Flexi Loan details by visiting our customer portal. Click on the respective links at the top of this page for more details.

Manage your Flexi Loan details

When you take any loan, irrespective of the variant you choose, you’re assigned a unique string of numbers known as the loan account number (LAN). Your LAN assists you in tracking details such as loan status (whether active or closed), utilised limit, available limit, and more.

-

View your Flexi Loan details

You can check your loan details in ‘Service’ portal by following these simple steps:

- Click on the ‘Sign-in’ button on this page to visit our service portal

- Sign-in with your registered mobile number and the OTP.

- Enter your date of birth for verification and proceed.

- Go to ‘Service’ section and click on ‘Relations’.

- Select the Flexi Loan.

- You can check the details of your Flexi Loan here, such as the utilised limit, the available limit, the EMI amount, the next due date, and more.

You can directly go to our ‘Service’ portal by clicking on the ‘Check your Flexi Loan details’ option below. Once signed-in, you’ll be redirected to the your relations section, where you can select your loan account to view its details.

-

You can also check other details such as registered repayment bank account, number of EMIs paid and tenure by visiting our customer portal.

What is a Flexi Loan Statement?

A Flexi Loan statement is a detailed record of all transactions related to your Flexi Loan account. Unlike a traditional loan where you receive a fixed amount with set EMIs, a Flexi Loan allows you to borrow funds from a pre-approved limit as per your requirement and repay them at your convenience. The statement provides a transparent view of your withdrawals, repayments, outstanding balance, applicable interest, and more—helping you manage your loan efficiently.

Issued periodically, typically monthly, the Flexi Loan statement helps track your borrowing behaviour, EMIs paid, interest charged on utilised amounts, and any prepayments made. It also includes critical information such as account number, loan limit, and tenure. By reviewing this document, you can monitor your available limit, interest obligations, and repayment status. The statement ensures you stay informed about your finances and enables you to plan your repayments wisely to minimise interest and maintain financial discipline.

Key Components of Your Flexi Loan Statement

Component |

Description |

Account Details |

Includes loan account number, sanctioned limit, and tenure. |

Statement Period |

Reflects the period for which the statement is generated. |

Opening Balance |

Outstanding loan balance at the start of the statement period. |

Withdrawals |

Lists all amounts withdrawn during the statement period. |

Repayments Made |

Shows EMIs or partial payments made towards the loan. |

Interest Charged |

Details the interest charged on the utilised loan amount. |

Available Limit |

Displays the remaining amount you can withdraw from your loan limit. |

Closing Balance |

Indicates the loan balance at the end of the statement period. |

Charges & Fees (if any) |

Any applicable charges, such as processing or bounce charges. |

Total Outstanding |

The sum of principal and interest yet to be repaid as of statement generation. |

Why regularly checking your flexi loan statement is important?

- Tracks Usage: Helps monitor how much of the loan limit has been utilised and how much remains.

- Manages Repayments: Ensures you keep track of EMIs or partial payments to avoid defaults.

- Monitors Interest Charges: Lets you review the interest being charged and plan prepayments to reduce it.

- Detects Errors Early: Identifies any unauthorised transactions, duplicate charges, or technical issues.

- Improves Financial Planning: Assists in budgeting and ensures your loan fits into your overall financial plan.

- Avoids Penalties: Keeps you informed about due dates and charges, preventing late payment fees or penalties.

- Maintains Credit Health: Timely repayments reflected in the statement contribute to a good credit score.

View your Flexi Loan statement

Your statement of account is a very important document as it helps you track your loan repayment status. Your loan statement is a detailed transaction history that includes total instalments paid, principal outstanding, a part-payment summary, or missed instalments if any.

It’s necessary to check your loan statement regularly as it helps you keep a record of every transaction, you make against your loan account. You can also report errors if there are any.

-

How to download your flexi loan statement?

You can download and view your statement of account in your service portal.

- Click on the ‘Sign-in’ button on this page to visit our customer portal.

- Enter your registered mobile number and submit the OTP to sign-in.

- Verify your details with your date of birth and proceed.

- Go to 'Service' section.

- Select your loan account number from 'Relations'.

- Click on 'Repayment Schedule' to download it.

You can also find your statement of account and other loan-related documents by clicking on ‘View your Flexi Loan statement’ below. You’ll be asked to sign-in to the ‘Service’ portal. Once signed-in, you can select your loan account number and click on 'Statement of Account' to download it.

-

You can also download your other Flexi Loan-related documents such as repayment schedule and loan agreement by visiting our service portal

Manage your bank account details

When you choose any of our Flexi Loan variants, you can register two different bank accounts. This includes your repayment bank account and the withdrawal bank account.

Your repayment bank account is the one from which you’re EMIs get deducted every month. While your withdrawal bank account is used to receive the funds, you withdraw from the available limit of your Flexi Loan.

If either of your bank accounts undergoes any change, it’s critical to update the information in our records. This will ensure that your loan repayment goes smoothly and that you receive the funds from your Flexi Loan without any problems. Please note that any change in your repayment bank account doesn’t change your withdrawal bank account details.

You can manage your bank account details in just a few clicks by visiting our ‘Service’.

Note: If you have initiated any change in your profile details, you have to wait at least 90 days to update your withdrawal bank account details.

-

Update repayment bank account details

You can change your repayment bank account in our ‘Service’ portal by following these simple steps:

- You can sign-in with your registered mobile number and the OTP.

- Enter your date of birth to verify your details and proceed.

- Go to ‘Service’ and click on ‘Relations’

- Go to ‘Bank details’ and click on ‘Change bank account’.

- Enter the bank details such as bank name, IFSC and more.

- Click on ‘Proceed’ to change the account.

Alternatively, you can visit our ‘Service’ portal by clicking on ‘Manage your repayment bank account’ below. You’ll be asked to sign-in. Once signed-in, you’ll be redirected to our ‘Mandate Management’ section. You can then select your loan account, enter the details of your new bank account, and proceed.Once your bank account details get updated, you’ll receive a confirmation message on your screen. A confirmation SMS will also be sent to your registered mobile number.

-

Change your withdrawal bank account details

You can manage your withdrawal bank account details by visiting our ‘Service’ portal

- Sign-in with your mobile number and the OTP and verify your details with your date of birth.

- Go to ‘Service’ section and click on ‘Relations. '

- Click on ‘Withdrawal bank change’ to change the bank details.

- Click on ‘Proceed’.

- Enter the OTP and click on ‘Proceed. ’

- Enter the ‘New bank details’ and click on ‘Proceed. ’

Alternatively, you can also click on ‘Manage your withdrawal bank account’ below to get started. You’ll be asked to sign-in. Once signed-in, select your loan account from ‘Relations’ and click on ‘Withdrawal Bank Change’. You can find your existing bank details and proceed to update your withdrawal bank account.

- Sign-in with your mobile number and the OTP and verify your details with your date of birth.

-

You’ll have three attempts to update your drawdown bank details correctly. Please note the personal details mentioned in our records need to match the personal details of your bank account.

Similarly, if you’re a corporate customer, your customer details mentioned in our records need to match with the details of your new bank account.

If there’s any technical issue, you can update your drawdown bank account only after 24 hours.

Know all about the applicable fees and charges

Unlike a regular Term Loan, you can part-prepay your Flexi Loan without paying any additional charges. However, there are a few fees and charges that are applicable to your Flexi Loan.

You can check our website, app, or loan agreement to know about the complete list of fees and charges related to your Flexi Loan.

Check the complete list of fees and charges

-

Annual maintenance charges

Annual Maintenance Charge (AMC) is a fee levied on Flexi Loans on an annual basis. This flexi facility enables multiple withdrawals and/or repayments on your loan account from time to time within the overall Sanctioned Limit.

-

Foreclosure charges

When you have surplus funds and you wish to pay your entire outstanding loan amount in one instalment, you can use our foreclosure facility.

However, if you choose to close your Flexi Loan early, you’ll have to pay additional charges known as foreclosure charges.

-

Bounce charges

In case you don’t have sufficient account balance or facing a technical error due to which you failed to pay your EMI on time. In such a situation, you'll be charged an additional fee called penal interest or bounce charges, that is charged by your respective banks and not from Bajaj Finserv.

Frequently asked questions

There are several reasons due to which your withdrawal facility gets blocked:

- In case you have any overdue instalment on your loan account, your drawdown facility gets blocked. In such case, you can clear all your dues before placing any withdrawal request.

- Due to our internal risk policy like low CIBIL Score, credit behaviour across financial institutions, repayment history, and other factors checked by our risk team.

- If your withdrawal amount is higher than your current available limit or due to any connectivity issue.

- If your reason isn’t there in the above-mentioned list, you can raise your concern with us by using our raise a request facility.

If you place a withdrawal request before 4 p.m. on weekdays, i.e., Monday to Friday, you’ll receive funds in your bank account on the same day. However, if you place any request after 4 p.m. or on Saturdays or national holidays, you’ll receive the requested funds on the next working day.

If there’s any delay, you can raise your concern using our raise a request facility.

Our Flexi variants allow you to withdraw funds as many times as you need from the available limit during the loan tenure. You can do this without incurring any additional fees.

However, when you choose any of our Flexi variants, you’ll be charged with annual maintenance charges. Your AMC fee will be adjusted from your utilised Flexi Loan limit.

This fee is charged to ensure that you can use other facilities such as part-prepaying at no extra cost and multiple withdrawals.

You can withdraw funds as many times as you need from your available limit during the loan tenure.

Annual maintenance charges (AMC) for the Flexi Loan account are to be paid on an annual basis as per rates prescribed in your loan agreement.

With effect from April ’23, AMC will be adjusted from your utilised Flexi Loan limit. However, for the benefit of our customers, their Flexi Loan limit will be increased as much as the AMC charge.

If your Flexi Loan limit isn’t available, the AMC charge will be recovered from your registered bank account through the ECS or NACH facility, as the case may be.

You can manage payments like advance EMI, part-prepay, or foreclose your loan by following the steps below:

- Click on the ‘Manage your Flexi Loan payments’ text below to go to My Account.

- Enter your registered mobile number and the OTP to sign-in.

- For verification, enter your date of birth and proceed.

- Choose the loan account for which you wish to make payment.

- Select the payment option from the list.

- Enter the required details and proceed to make payment.

Manage your Flexi Loan payments

Also, you can visit the nearest Bajaj Finance branch if you want to use a cheque or demand draft to make the partial payment.

Note: Please deposit the cheque in favour of Bajaj Finance Limited. The cheques and demand draft clearance process will take approximately three business days.

The Withdrawal funds facility can be unblocked by consistently making your EMI payments on time. Our team will review your credit and repayment records in the upcoming quarter, and the block may be automatically removed based on their evaluation.

Once you place the withdrawal request, the amount gets credited to your registered bank account within 2 hours. However, for requests placed on weekends and national holidays, the amount may get credited on the next business day.

In case of any delay, raise a request.

If the withdrawal amount requested is higher than the limit in your flexi loan account, this error message will appear while trying to withdraw funds. Please enter an amount within the available limit and try again. You can go to my relations to check your current available limit.