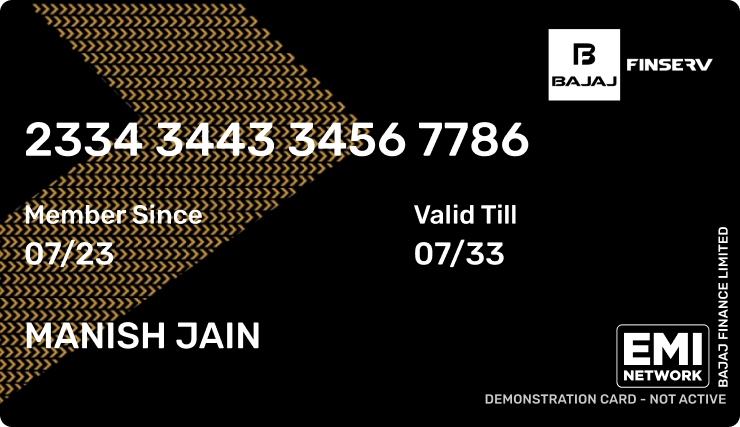

Bajaj Finserv Insta EMI Card

The Bajaj Finserv Insta EMI Card is a financing solution that allows you to shop for 1 million products on No Cost EMIs. With the Insta EMI Card, you get a pre-approved loan limit of up to Rs. 3 lakh that you can use to shop at 1.5 lakh EMI Network partner stores across 4,000+ cities. You also get to choose a flexible repayment tenure of up to 60 months for your purchase.

Features and benefits of our Insta EMI Card

00:38

00:38

Features and benefits of our Insta EMI Card

Insta EMI Card is India's best interest-free card that lets you shop for 1mn+ products.

-

Accepted at 1.5 lakh+ stores

The card is accepted across 4,000 large and small cities. Wherever you are, walk into our partner stores and shop on EMIs.

-

Zero down payment

During festive seasons, we run zero down payment schemes where you do not have to pay anything at the time of purchase.

-

Lower-EMI special schemes

You can opt for our special EMI schemes that offer a longer repayment tenure and reduce your monthly EMI.

-

Everything on EMIs

Shop for daily groceries, electronics, fitness equipment, home appliances, furniture and more, and split the bills into No Cost EMIs.

-

Flexible repayment tenures

Convert your purchases into monthly instalments and pay back over 1 to 60 months.

-

End-to-end digital process

The entire application process is online. It takes less than 10 minutes to complete.

-

Still have not found what you are looking for? Click on any of the links at the top of this page.

Eligibility criteria and documents required for Bajaj Finserv Insta EMI Card

Anyone can get an Insta EMI Card as long as you meet the basic criteria mentioned below. If you meet the criteria, you will need a set of documents to complete your application process.

Eligibility criteria

- Nationality: Indian

- Age: 21 years to 65 years

- Income: You must have a regular source of income

- Credit score: 720 or higher

Documents required

- PAN Card

- Aadhaar Card number for KYC confirmation

- Address proof

- Bank account number and IFSC code for e-mandate registration

How to apply for the Insta EMI Card

00:45

00:45

Pre-approved offers for new customers

Both our new and existing customers can choose from pre-approved offerings. All we need is your mobile number to check.

You do not have to go through the complete application procedure if you are one of our customers who has been pre-approved. Consider it our green channel.

You might not require a card right now or might not have a pre-approved offer. You can still pick from a variety of offerings:

-

Examine your credit standing

Some of the most crucial factors for you are your credit health and CIBIL score. Get our Credit Health Report to keep your credit in tip-top shape.

-

Insurance in your pocket to cover every life event

In order to cover all of your life's events, including trekking, monsoon-related illnesses, car key loss/ damage, and more, we offer more than 400 insurance covers starting at just Rs. 19.

-

Create a Bajaj Pay Wallet

The only four-in-one wallet in India that allows you to pay or transfer money using your digital wallet, a credit card, and UPI.

-

Start an SIP with just Rs. 100 per month

Pick from over 900 mutual funds across 40+ companies such as SBI, Aditya Birla, HDFC, ICICI Prudential Mutual Fund, and more.

Insta EMI Card Applicable fees and charges

The following charges are applicable on Insta EMI Card/ EMI Network Card |

|

Type of fee |

Applicable charges |

EMI Network Card fee |

Rs. 530/- (inclusive of applicable taxes) |

Online convenience fee |

Rs. 69/- (inclusive of applicable taxes) applicable to customers who avail Insta EMI Card exclusively through digital mode. |

EMI Network Card loan limit enhancement fee |

Rs. 117/- (inclusive of applicable taxes) |

EMI Network Card Annual fee |

Rs. 117/- (inclusive of applicable taxes). Annual fee will only be charged to the EMI Network Card holders who have not availed of any loan using the EMI Network Card in the preceding year. The duration of the preceding year is calculated 12 months from last year’s validity month, which is printed on the face of EMI Network Card. For an example, if the EMI Network Card is issued in the month of February 2019 (referred to as ‘Member Since’, on the EMI Network Card) the date for payment of the annual fee will be March 2020. |

Add-on EMI Network Card fee |

Rs. 199/- (inclusive of applicable taxes) |

*Additional fees and charges will apply when utilising the EMI Network Card to avail of loans. |

|

Frequently asked questions

Basis the directive received from Reserve Bank of India (“RBI”) vide its Press Release No. 2023-2024/ 1295 dated November 15, 2023 (“Press Release”), Bajaj Finance Limited has temporarily suspended sanction and disbursal of new loans under ‘Ecommerce’ like Amazon, Flipkart, MakeMyTrip, etc.

Till then you can walk-in to any of our offline partner stores and get your product financed.

Yes. You can walk-in into any of our offline partner stores and get your product financed.

Based on the concerns raised by RBI, the Company will undertake a detailed review of the Key Fact Statement and implement requisite corrective actions to the satisfaction of the RBI at the soonest. We shall have an update published on our website and Bajaj Finserv app.

The Bajaj Finserv Insta EMI Card, also known as the EMI Network Card, lets you convert all your purchases into No Cost EMIs. You can use it to shop for the latest products from our huge network of partner stores across 4,000+ large and small cities.

You will be able to use your Bajaj Finserv Insta EMI Card at offline dealer store near you. However sanction and disbursal of new loans online/digitally on Insta EMI Card have been temporarily suspended.

We can use the Insta EMI Card to shop for merchants like Croma, Vijay Sales, Reliance Digital, Home Town, and more. You can also use the Insta EMI Card to shop across our 1.5 lakh+ EMI Network partner stores.

You can use the Bajaj Finserv Insta EMI Card to shop for electronics, apparel, travel, groceries, home décor, and more. Using the Insta EMI Card is very easy. When you visit a partner store, select the product of your choice, choose your preferred repayment tenure, and provide your Insta EMI Card details at the billing counter; your purchase will be successfully converted into EMIs.

You can contact us online via our customer portal ‘My Account’. You can also call us at +91 8698010101 for all your queries.

If you are unable to transact using the Insta EMI Card, your card might be blocked. You can check your card status on our customer portal My Account or the Bajaj Finserv app.

To check your card status:

Sign-in to My Account

Check your card status and the reason why your card is blocked

In case your card is not blocked please check if you have completed your e-mandate. If not, you can complete it online through My Account or offline by visiting any of our EMI Network partner stores near you.

If you have blocked your card in the past and want to use it again, you can unblock it by visiting our customer portal.

- Sign-in to ‘My Account’ with your registered mobile number and the OTP.

- Enter your date of birth for verification and proceed.

- Select the card you want to unblock from ‘My Relations’.

- Click on the option ‘Unblock Card’ from the ‘Quick Actions’ section.

- Verify with an OTP sent to your registered mobile and proceed.

Get more details on how to block/unblock your Insta EMI Card.

You can apply for the Insta EMI Card if you are between 21 years and 65 years of age.

Click here to apply for the Insta EMI Card.

No physical documents are required to get the Bajaj Finserv Insta EMI Card. You just need the following details:

- PAN Card details

- Aadhaar Card number for KYC confirmation

- Bank account number and IFSC code for e-mandate registration

The Bajaj Finserv Insta EMI Card offers No Cost EMI plans. The No Cost EMI option allows customers to purchase certain products without incurring any interest charges. However, it is essential for customers to review the terms of their EMI plan to understand any associated interest charges.

To apply for a Bajaj Finserv Insta EMI Card, individuals typically need to provide certain documents as part of the application process. These documents may include:

- Identity proof: Valid government-issued identification such as an Aadhaar card, PAN card, passport, or driver's license.

- Address proof: Documents verifying the residential address, such as an Aadhaar card, utility bills, passport, or rent agreement.

- Income proof: Proof of income may include salary slips, bank statements, income tax returns, or Form 16, depending on the requirements of Bajaj Finserv.

The specific documents required may vary depending on individual eligibility criteria and the policies of Bajaj Finserv. Individuals should check the official website or contact Bajaj Finserv directly for the most accurate and up-to-date information regarding document requirements for obtaining a Bajaj Finserv Insta EMI Card.

To register for your e-mandate, you need to:

- Share your bank account number and IFSC code

- Verify all the details entered by you

- Submit OTP for validation purposes

By registering for your e-mandate, you will:

- Never miss on your EMI payments with the auto-debit feature

- Manage your loans in an efficient manner.

The Insta EMI Card is issued digitally and gets activated online instantly. Therefore, you will not receive a physical card; simply access it on the Bajaj Finserv app.

You can view your card details on the Bajaj Finserv app.

If you are viewing your Insta EMI Card details for the first time, follow these simple steps:

- Open the Bajaj Finserv app

- Enter your mobile number

- Enter the OTP sent to your mobile number and tap on ‘SUBMIT’

- Enter your ‘Date of Birth’ (DOB) as per your PAN Card then tap on ‘SUBMIT’

- Click on the “EMI Card” icon at the top of the page

- Next, enter your DOB again and click on ‘Link to Proceed’

- Click on ‘VIEW’ under the Card Detail section to see your card details

With the Bajaj Finserv app, you can:

- Access your Insta EMI Card and all related details

- Get exclusive offers

To get the Insta EMI card, you only have to pay a one-time Insta EMI Card fee of Rs. 599. Apply for the Bajaj Finserv Insta EMI Card.

Check all the EMI Card fees and charges

- Amazon

- Flipkart

- Croma Store

- Home Centre

- Poorvika Mobiles

- Sangeetha Mobiles

- MakeMyTrip

- EaseMyTrip

- Goibibo

- Unacademy

- Godrej

- OnePlus

- Vivo

- Flo Mattress

- Realme

- Voltas

Listed below are some of the uses of the Bajaj Finserv Insta EMI Card:

- Shop on EMI Without a Credit Card

The Bajaj Finserv Insta EMI Card offers a pre-approved loan limit, allowing users to effortlessly convert the purchase cost of appliances, gadgets, and more into convenient and tailored instalments. Moreover, eligible products can be purchased via No Cost EMIs, rendering the shopping experience more economical. - Shopping at Partner Stores

The card extends its utility to offline purchases at over 1.5 lakh partner stores situated across 4,000 cities. Whether it is mobiles, laptops, furniture, or other products, shoppers can avail themselves of the benefits of EMI payment options. - Easy Access via Portal

Gone are the days of carrying physical cards everywhere. Access to the Insta EMI card is streamlined through the Bajaj Finserv wallet app or via management functionalities available on the online Bajaj Finserv customer portal.