Planning your next trip but worried about expensive flight tickets? Goibibo flight offers provide the perfect solution for budget-conscious travellers across India. These exclusive deals make air travel accessible to everyone, whether you are booking a quick domestic getaway or an international adventure.

The best part about these flight deals is how you can make them even more affordable. With the Bajaj Finserv Insta EMI Card, you can convert your flight bookings into easy monthly payments. This means you can book your dream vacation today and pay for it over time.

This article will explore the various flight offers available on Goibibo, compare them with other platforms, and show you how to maximise your savings. We will also discuss how the Bajaj Finserv Insta EMI Card can transform your travel experience by making flights more budget-friendly.

Goibibo flight tickets offers explained

Goibibo offers a comprehensive range of flight deals that cater to different travel needs and budgets. These offers include instant discounts, cashback rewards, and exclusive promotional codes for both domestic and international routes. The platform regularly updates its deals to ensure travellers get the best value for their money.

The discount structure varies depending on the type of booking and payment method chosen. Domestic flights can offer savings up to 20%, while international flights provide different discount percentages. Special airline partnerships also create exclusive deals that are not available elsewhere.

Top domestic flight offers on Goibibo

Domestic travellers can access numerous attractive deals that make flying within India more affordable than ever before.

- Percentage-based discounts: Save up to 20% on select domestic flights with various airlines participating in these offers.

- Flat discount deals: Get instant savings of Rs. 2,000 on domestic flight bookings when you meet minimum spending requirements.

- Airline-specific promotions: Exclusive deals with popular carriers offer additional savings on specific routes and travel dates.

- Bank card discounts: Instant discounts available with select banking partners, making your travel even more economical.

Exclusive international flight deals on Goibibo

International travel becomes more accessible with specially curated deals designed for overseas destinations and global routes.

- Flat percentage savings: Enjoy 3% discount on international flight bookings across multiple destinations and airlines.

- High-value discounts: Save up to Rs. 7,750 on international flights when booking qualifying routes and fare classes.

- Premium service offers: Special baggage allowances and business class upgrades available at discounted rates.

- Route-specific deals: Featured promotions on popular international destinations offer targeted savings for specific travel corridors.

Bank-specific Goibibo flight offers

Financial institutions partner with Goibibo to provide exclusive deals for their cardholders, creating additional savings opportunities.

- Credit card discounts: Up to 15% savings on domestic flights with participating bank cards, subject to maximum discount limits.

- International flight benefits: Flat 10% discount plus no-cost EMI options available for international bookings with select cards.

- Instant discount programmes: Immediate savings of 12% on domestic flights when using specific banking partner cards.

- Premium card offers: Enhanced discounts up to Rs. 2,000 available for premium cardholders with additional benefits included.

Student discounts and offers on Goibibo flights

Educational institutions and students receive special consideration through dedicated discount programmes that make travel more affordable.

- Flat student discounts: Rs. 600 instant savings available for verified students on qualifying flight bookings.

- Senior citizen benefits: Special rates for elderly travellers who meet age requirements and provide necessary documentation.

- Insurance partnerships: Student-specific travel insurance options available through collaboration with leading insurance providers.

- Verification process: Simple documentation requirements ensure eligible students can access these exclusive savings opportunities.

How to apply promo codes for Goibibo flight offers

Applying discount codes during the booking process is straightforward and ensures you receive maximum savings on your flight purchases.

- Flight selection: Choose your preferred flight from available options on the Goibibo website or mobile application.

- Payment page navigation: Locate the promotional code field during checkout, typically labelled as "E-Coupon" or "Promo Code".

- Code application: Enter the valid promotional code and verify that the discount applies correctly to your booking total.

- Payment completion: Complete your purchase using the required payment method specified in the offer terms and conditions.

Comparing Goibibo flight offers with other travel portals

Understanding how Goibibo stacks against competitors helps you make informed decisions about where to book your flights.

| Feature | Goibibo | Other portals |

|---|---|---|

| Maximum domestic discount | Up to 20% | Varies by portal |

| International flight savings | 3% flat discount | Different structures |

| Bank partnerships | Multiple active offers | Limited partnerships |

| Student discounts | Rs. 600 flat discount | Varies significantly |

| Bundle deals | Flight plus hotel packages | Limited bundling options |

| Flash sales frequency | Regular promotional events | Occasional sales only |

The comparison shows that Goibibo provides competitive advantages through diverse discount structures and frequent promotional activities. Regular flash sales and comprehensive bank partnerships create more opportunities for savings compared to other platforms.

Tips to maximise savings on Goibibo flight bookings

Strategic booking approaches can significantly increase your savings and help you get the best possible deals on your flights.

- Bank offer combinations: Research which bank-specific discounts can be combined with existing promotional codes for maximum savings.

- Promotional code verification: Always verify promotional codes from official sources before applying them to avoid disappointment during checkout.

- Flash sale timing: Monitor Goibibo for flash sales and special events that typically offer higher discount percentages than regular offers.

- Bundle booking benefits: Consider flight and hotel packages together as they often provide additional savings compared to separate bookings.

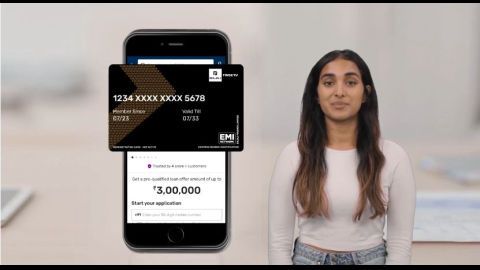

Check your eligibility for the Insta EMI Card insantly. You may already be eligible for a substantial sum, find out by entering your mobile number and OTP.

How to use the Insta EMI Card

The Bajaj Finserv Insta EMI Card transforms expensive flight bookings into manageable monthly payments. This financial tool allows you to book flights immediately while spreading the cost over your preferred repayment period. The card works seamlessly with Goibibo and other major travel platforms for convenient booking experiences.

Step-by-step usage process:

- Add desired flights to your cart on Goibibo.

- Proceed to checkout and select the Insta EMI Card as your payment method.

- Enter your Insta EMI Card details including card number and security information.

- Choose your preferred repayment tenure ranging from 3 to 60 months.

- Complete the transaction and receive instant booking confirmation with EMI schedule.

Benefits of shopping with Insta EMI Card

The Insta EMI Card offers numerous advantages that make flight bookings more affordable and convenient for Indian travellers.

| Benefit | Details |

|---|---|

| Loan amount | Pre-qualified card loan offer amount of up to Rs. 3 lakh for multiple purchases |

| Repayment flexibility | Choose a repayment tenure between 3 to 60 months based on your budget |

| Store acceptance | Accepted at over 1.5 lakh partner stores across 4,000+ cities |

| Interest rates | Minimal interest charges with competitive EMI rates |

| Foreclosure charges | Zero foreclosure charges for early repayment flexibility |

| Credit building | Regular payments help improve your credit score over time |

| Approval speed | Instant approval process for quick access to funds |

| Festive offers | Special zero down payment deals during festival seasons |

These benefits make the Insta EMI Card an ideal choice for travellers who want to manage their expenses while enjoying immediate access to flight bookings.

Eligibility criteria to use the Insta EMI Card

Meeting the eligibility requirements ensures smooth application and approval for your Insta EMI Card, making travel financing accessible to qualified individuals.

- Indian citizenship: You must be an Indian national with valid documentation to prove your citizenship status. This requirement ensures compliance with local financial regulations and policies.

- Age requirements: Applicants must be between 21 years and 70 years old to qualify for the card. This age range ensures financial maturity and reasonable repayment capacity throughout the loan tenure.

- Income stability: A regular income source is mandatory to demonstrate your ability to make monthly EMI payments. Employment proof or business income documentation helps verify your financial stability.

- Credit score standards: A good credit score meeting Bajaj Finserv risk policies is essential for approval. Your credit history demonstrates past financial behaviour and repayment reliability.

- Documentation completeness: Valid PAN card, Aadhaar card, address proof, and bank account details with IFSC code are required. Complete documentation ensures smooth verification and e-mandate registration processes.

Check your offers for the Insta EMI Card insantly online. You may already be eligible, find out by entering your mobile number and completing the OTP-verification.

How to apply for Insta EMI Card

The application process for the Bajaj Finserv Insta EMI Card is designed to be simple and convenient, offering both online and offline options. Quick approval and instant activation mean you can start using your card for flight bookings almost immediately after approval.

Online application process:

- Visit the Insta EMI Card section.

- Enter your mobile phone number and complete OTP authentication for security verification.

- Fill in the detailed application form to determine your pre-qualified credit limit.

- Complete KYC verification using your Aadhaar card or DigiLocker for instant processing.

- Pay the one-time joining fee of Rs. 530/- and complete e-mandate registration.

- Receive instant card activation and start using it for your travel bookings immediately.

Offline application process:

- Visit any nearby Bajaj Finserv partner store with required documentation.

- Provide necessary documents to the store representative for verification and processing.

- Complete the application form with accurate personal and financial information.

- Pay the one-time joining fee of Rs. 530/- upon approval confirmation.

- Receive your activated Insta EMI Card and begin using it for purchases.

Check your eligibility today to discover Insta EMI Card offers that could make your next Goibibo booking more affordable. You may already be eligible, find out by entering your mobile number and OTP.

Making the most of Goibibo flight deals

Goibibo flight offers combined with smart financing options create the perfect recipe for affordable travel across India and beyond. These deals make air travel accessible to more people while maintaining quality service and convenience. The variety of offers ensures that every type of traveller can find suitable deals.

The Bajaj Finserv Insta EMI Card adds another layer of convenience by allowing you to book flights immediately and pay later. This combination of instant booking and flexible payment options removes financial barriers that often prevent people from travelling. Your dream destinations become more achievable when you can spread the cost over manageable monthly payments.

Smart travellers use these tools together to maximise their savings and travel more frequently. The convenience of booking flights with EMI options means you can take advantage of limited-time offers without worrying about immediate payment. This approach helps you build better travel experiences while maintaining financial discipline.

Check your eligibility for the Bajaj Finserv Insta EMI Card today and start your journey towards smarter travel financing. You may already be eligible for this convenient payment solution, find out by entering your mobile number and OTP verification. Transform your travel dreams into reality with flexible payment options that fit your budget perfectly.