Managing EMIs (Equated Monthly Instalments) is important for responsible financial planning. Whether it is for a home loan, car loan, or any other smaller purchase, repaying EMIs on time is crucial to maintain a good credit score.

How can you effectively manage your EMI?

1. Create a budget

The foundation of effective EMI management is a well-structured budget. Assess your monthly income and expenses and allocate a portion of it to cover your EMIs comfortably. Deciding and sticking to a budget will give you a clear picture of your financial capabilities and prevent you from draining yourself with debt.

2. Prioritise high-interest repayments

If you have multiple EMIs, prioritise the repayments wisely and add more focus to the high-interest EMIs, as they can accumulate substantial interest over time. By tackling high-interest loans early on, you can reduce the overall interest burden and quicken your journey towards financial freedom.

3. Choose shorter tenures

While opting for EMIs, consider choosing shorter tenures if your finances allow. Though longer tenures might reduce the monthly EMI amount, they also lead to higher interest payments. On the other hand, shorter tenures help you save on interest and clear the debt sooner.

4. Maintain an emergency fund

Creating an emergency fund is vital for any responsible EMI planning. This fund acts as a safety net during unexpected events such as medical emergencies or job loss, preventing you from defaulting on your EMIs and maintaining a healthy credit score.

5. Consolidation and refinancing

If you find managing multiple EMIs challenging, consider consolidating your debts or refinancing at a lower interest rate. Debt consolidation merges multiple loans into one, simplifying your repayments. Similarly, refinancing can help you get a better interest rate, reducing the financial strain.

6. Avoid new debts

Avoid taking on new debts while you are still repaying existing ones. Taking on more debt without a stable financial plan can lead to a debt trap, making EMI management more difficult. Be cautious with your spending habits and prioritise existing obligations.

7. Stay informed about offers

Keep yourself informed about any offers or discounts provided by your lender. Some lenders may provide special interest rate reductions or cashback offers, which can help ease the burden of EMIs.

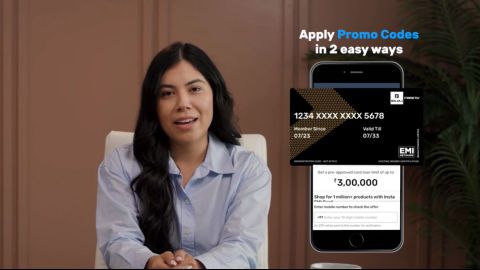

8. Get the Bajaj Finserv Insta EMI Card

One of the most effective ways to manage EMIs efficiently is by using the Bajaj Finserv Insta EMI Card. This card offers a plethora of benefits that can streamline your EMI management process and make it more rewarding. Some key benefits of the Insta EMI Card include:

- Easy EMI: The Bajaj Finserv Insta EMI Card allows you to make purchases on low-cost instalments, spreading the cost over easy EMIs without high interest charges. This feature makes high-value purchases more affordable.

- Instant approval: Applying for the Insta EMI Card offers the advantage of instant approval with minimal documentation. This means you can make your purchases without delays, perfect for planned and unplanned expenses.

- Flexible tenures: The Insta EMI Card provides a flexible tenure of 3 months to 60 months to choose from, enabling you to pick one that best aligns with your financial situation.

- Wide acceptance: The Insta EMI Card is widely accepted across a vast network of 1.5 lakh+ online and offline partner stores, making it convenient to access and manage your EMIs.

- Pre-approved offers: Bajaj Finserv extendsa pre-qualified card loan limit of up to 3 lakh. This pre-approved limit allows you to start shopping immediately, without waiting for any approval or processing.

By following these tips, you can ensure that EMIs remain manageable and fit well within your budget. Additionally, leveraging the benefits of the Bajaj Finserv Insta EMI Card, such as Easy EMI, instant approval, flexible tenures, and pre-approved offers, can make the EMI management process even more convenient and rewarding. Make informed financial decisions, plan responsibly, and use tools like the Insta EMI Card to pave the way for a secure and stress-free financial future.