Prepayment of a medical equipment loan can offer several financial advantages, such as reducing the overall interest burden and shortening the loan tenure. By paying off part of the outstanding loan amount before the due date, you can ease your financial strain and gain more flexibility. Prepayment may also help in improving your credit score and clearing the debt faster. However, it’s important to understand the nuances of prepayment, including the possible fees, its impact on EMI, and the required process. This guide will walk you through all the essential details about prepayment, the steps involved, and how it can benefit you financially. Whether you're looking to make a partial prepayment or clear the loan entirely, knowing your options and understanding the conditions will help you make the right decision.

What is medical equipment loan prepayment?

Medical equipment loan prepayment refers to the act of paying off a portion or the entire outstanding balance of your loan before the scheduled due date. This can be done as a lump sum or in parts, depending on the terms set by your lender. The prepayment option allows you to pay off the loan faster, thus reducing the interest you would have paid over the course of the loan tenure. While prepayment is an excellent way to clear debts earlier and reduce financial strain, it’s crucial to check if your lender imposes any prepayment penalties. Some lenders offer flexible prepayment options, while others may charge a fee, which can influence your decision. Before opting for prepayment, it’s important to understand the impact it could have on your monthly EMI, loan tenure, and overall financial situation.

Why consider prepaying your medical equipment loan?

Prepaying your medical equipment loan can have numerous benefits, especially if you’re financially stable and want to reduce the burden of long-term debt. The primary advantage of prepayment is the reduction in interest payments. By clearing a portion of the principal balance, the interest charges are reduced, which can save you a significant amount over time. Another benefit is the flexibility it offers in terms of loan tenure. By prepaying, you can reduce the tenure, which means you pay off the loan quicker, resulting in faster financial freedom. Additionally, prepayment can improve your credit score, as it reflects positively on your repayment history. However, you should carefully review any potential penalties or fees associated with prepayment. Some lenders may impose a prepayment penalty, so understanding the terms of your loan agreement before proceeding is essential. Ultimately, prepayment helps you get closer to financial independence by reducing debt quicker.

Steps to prepay your medical equipment loan: A detailed guide

Check your loan agreement:

Review your loan agreement for prepayment terms and conditions.

Understand the penalties, fees, or charges for prepayment, if any.

Evaluate financial capability:

Assess your financial situation to ensure you can afford the prepayment without impacting other financial obligations.

Contact your lender:

Reach out to your lender to discuss the prepayment process and confirm the amount you need to pay.

Calculate prepayment impact:

Evaluate how the prepayment will affect your EMI, loan tenure, and interest rate.

Make the payment:

Make the prepayment either as a lump sum or through multiple smaller payments.

Request an updated statement:

Ask for an updated loan statement to confirm the prepayment has been applied.

Adjust EMI or tenure:

Choose whether you want to reduce your EMI amount or shorten the loan tenure based on your preferences.

Keep documentation:

Retain receipts and proof of payment for future reference.

Methods of making prepayment on your medical equipment loan

Lump sum payment:

Make a one-time payment of a larger sum to reduce the principal balance. This method is best when you have access to extra funds.

Partial prepayment:

Opt for paying a smaller amount towards the principal periodically. This helps in reducing the outstanding loan amount without altering your lifestyle.

Online banking transfer:

Use online banking to make the prepayment directly from your account to your lender. Many lenders allow online transfers for prepayments.

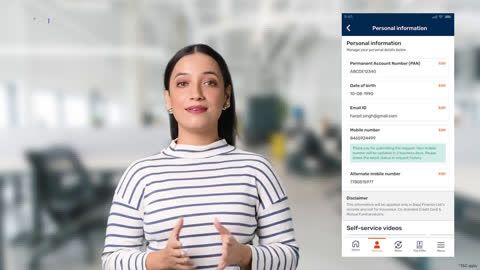

Mobile app payment:

Use your lender’s mobile app to make a prepayment, ensuring convenience and quick processing.

Cheques or demand drafts:

Submit a cheque or demand draft to the lender’s office for prepayment.

Post-dated cheques for future prepayments:

Arrange for post-dated cheques if you want to make prepayments on a specified date.

Using ECS (Electronic Clearing Service):

Set up ECS payments to regularly prepay a portion of your loan if permitted by your lender.

Third-party payments:

If you have someone else funding the prepayment, ensure the payment is made in your name.

How prepayment affects your medical equipment loan EMI and tenure?

EMI reduction:

Making a prepayment can reduce your EMI, as the outstanding balance is lower. The lender may recalculate the EMI based on the remaining principal.

Loan tenure reduction:

Alternatively, the lender may reduce the loan tenure, meaning you’ll pay off the loan faster without changing your EMI amount.

Interest savings:

Prepaying your loan reduces the principal balance, which means lower interest payments over the loan term. The earlier the prepayment, the greater the savings.

Prepayment penalty consideration:

Some lenders charge a penalty on prepayments, especially if done within a specified period. This fee could reduce the overall benefit.

Improved credit score:

Prepayment reflects positively on your credit report, showing responsible financial behaviour and improving your credit score.

Flexibility in payments:

Prepaying helps you stay flexible with your finances, providing relief from the fixed monthly payment structure.

Conclusion

In conclusion, prepaying your Medical Equipment Loan can provide substantial financial benefits, such as reducing the overall interest burden and shortening the loan tenure. By following the correct steps and understanding the available prepayment methods, you can make an informed decision that aligns with your financial goals. Whether you choose to reduce your EMI or loan tenure, prepayment allows greater financial flexibility and the opportunity to save on interest payments. Always be sure to check for any penalties and consult your lender before proceeding. To explore more, consider looking into Bajaj Finance outstanding payment and ECS payment mode