In the dynamic world of healthcare, staying equipped with the latest medical technology is crucial. However, financing these expensive acquisitions often involves taking out loans. Part-prepayment of a medical equipment loan can be an effective strategy for borrowers looking to save on interest and reduce their loan tenure. By making partial payments towards the principal amount, you can significantly cut down the overall interest burden and gain greater financial flexibility. This guide will cover everything you need to know about part-prepayment: from understanding what it entails, to the benefits it offers, eligibility criteria, step-by-step instructions, and various methods to execute a part-prepayment. Additionally, we’ll explore how part-prepayment impacts your EMI and loan tenure, ensuring you make informed decisions to optimize your financial health. Whether you aim to improve cash flow or expedite your loan repayment, part-prepayment is a powerful tool to enhance your financial strategy.

What is part-prepayment for a medical equipment loan?

Part-prepayment for a medical equipment loan refers to the process of making an additional payment towards the principal amount of the loan before the scheduled repayment dates. Unlike full foreclosure, part-prepayment involves paying a portion of the outstanding loan balance, which helps in reducing the overall principal amount and subsequently lowering the interest burden.

Key aspects:

Reduction of principal: The main objective of part-prepayment is to decrease the principal loan amount, thereby reducing the total interest payable over the loan tenure.

Flexible payments: Borrowers can make part-prepayments according to their financial capacity, without the need to repay the entire loan amount at once.

Interest savings: By reducing the principal amount early, borrowers can save on the interest that would have otherwise accrued on the higher principal.

Impact on EMIs and tenure: Part-prepayment can lead to a reduction in the monthly EMI or the loan tenure, depending on the borrower's preference and the lender's policies.

Importance:

Part-prepayment is an effective financial strategy for borrowers who come into additional funds and wish to reduce their debt burden. It provides flexibility in loan repayment and can lead to significant interest savings, making it an attractive option for financially savvy borrowers.

In essence, part-prepayment allows borrowers to take control of their loan repayment schedule, reduce their interest costs, and achieve financial freedom sooner.

Benefits of part-prepaying your medical equipment loan

Part-prepaying your medical equipment loan offers numerous benefits:

Interest savings:

Reducing the principal amount early results in lower interest payments over the loan tenure, leading to substantial savings.

Reduced loan tenure:

Part-prepayments can shorten the loan duration, allowing borrowers to become debt-free sooner.

Lower EMI:

By decreasing the principal amount, borrowers can opt to reduce their monthly EMI, making it more manageable.

Financial flexibility:

Part-prepayments provide borrowers with the flexibility to adjust their loan repayment according to their financial situation.

Improved credit score:

Demonstrating the ability to make additional payments can positively impact the borrower's credit score.

Enhanced financial planning:

With lower loan liabilities, borrowers can better plan their finances and allocate funds to other investments or expenses.

Peace of mind:

Reducing the debt burden through part-prepayments can provide mental relief and financial peace of mind.

Eligibility for future loans:

Lenders may view borrowers who make part-prepayments favorably, improving their eligibility for future loans.

Better interest rates:

Borrowers with a history of part-prepayments may be offered better interest rates on future loans.

Customizable repayment:

Borrowers can choose the frequency and amount of part-prepayments based on their financial capacity.

By taking advantage of part-prepayments, borrowers can enjoy these benefits and optimize their loan repayment strategy.

Eligibility criteria for part-prepayment of medical equipment loans

To be eligible for part-prepayment of medical equipment loans, borrowers typically need to meet the following criteria:

Minimum lock-in period:

Some lenders require borrowers to complete a minimum lock-in period (e.g., six months to a year) before making part-prepayments.

Loan agreement terms:

The terms and conditions outlined in the loan agreement must allow for part-prepayments. Review the agreement to understand any restrictions or conditions.

Sufficient funds:

Borrowers must have sufficient funds to make the part-prepayment without affecting their financial stability.

No outstanding dues:

Ensure that all EMIs are paid up to date and there are no pending dues before making a part-prepayment.

Prepayment charges:

Some lenders may charge a prepayment fee. Ensure you are aware of any applicable charges and have the funds to cover them.

Minimum prepayment amount:

Lenders may specify a minimum amount for part-prepayments. Ensure that your prepayment meets or exceeds this minimum threshold.

Loan type:

The loan type (fixed or floating interest rate) may affect part-prepayment eligibility. Review the loan agreement for specific terms.

Documentation:

Prepare necessary documents such as loan account number, ID proof, and prepayment request form.

Meeting these eligibility criteria ensures a smooth part-prepayment process and helps borrowers reduce their loan burden effectively.

For more information on how to repay your loan, visit how to repay loan.

Step-by-step guide on how to part-prepay your medical equipment loan

Follow these steps to part-prepay your medical equipment loan:

Review loan agreement:

Understand the terms and conditions related to part-prepayments in your loan agreement.

Calculate prepayment amount:

Determine the amount you wish to part-prepay based on your financial capacity.

Check for charges:

Inquire about any prepayment charges or fees that may apply.

Inform the lender:

Contact your lender to notify them of your intention to make a part-prepayment.

Submit request form:

Complete and submit the part-prepayment request form provided by the lender.

Prepare required documents:

Gather necessary documents such as loan account number, ID proof, and payment receipts.

Choose payment method:

Select a payment method (online banking, cheque, etc.) for the part-prepayment.

Make the payment:

Transfer the prepayment amount to the lender's account using the chosen method.

Get acknowledgment:

Obtain an acknowledgment receipt from the lender confirming the part-prepayment.

Verify loan statement:

Check your loan statement to ensure the prepayment amount is accurately reflected.

By following these steps, you can successfully make a part-prepayment and reduce your loan burden.

For more details on loan account numbers, visit loan account number.

Methods to make a part-prepayment on your medical equipment loan

There are several methods to make a part-prepayment on your medical equipment loan:

Online banking:

Use your bank's online banking portal to transfer the prepayment amount directly to the lender's account.

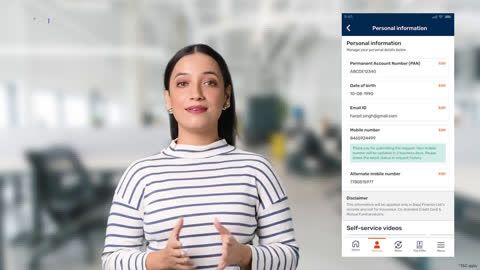

Mobile banking app:

Utilize your bank's mobile app to make the part-prepayment conveniently from your smartphone.

NEFT/RTGS transfers:

Make an electronic funds transfer (NEFT/RTGS) to the lender's account for the prepayment.

Cheque payment:

Write a cheque for the prepayment amount and submit it to the lender's branch.

Demand draft:

Obtain a demand draft for the prepayment amount and submit it to the lender.

Cash payment:

Visit the lender's branch and make a cash payment for the part-prepayment.

Auto-debit:

Set up an auto-debit instruction to deduct the prepayment amount from your bank account on a specified date.

Third-party payment portals:

Use third-party payment portals that facilitate loan prepayments.

In-person at branch:

Visit the lender's branch and make the prepayment in person.

Choosing the method that best suits your convenience ensures a smooth part-prepayment process.

How part-prepayment affects your medical equipment loan EMI and tenure?

Part-prepayment of your medical equipment loan can affect your EMI and loan tenure in the following ways:

Reduced EMI:

By decreasing the principal amount, part-prepayment can lead to a lower monthly EMI, making it more manageable.

Shortened loan tenure:

Borrowers can choose to maintain the same EMI but reduce the loan tenure, resulting in early loan closure.

Interest savings:

With a reduced principal amount, the total interest payable over the loan tenure decreases, leading to savings.

Flexible options:

Borrowers can choose between reducing their EMI or shortening their loan tenure based on their financial goals.

Improved cash flow:

Lower EMIs improve monthly cash flow, allowing borrowers to allocate funds to other expenses or investments.

Higher prepayment frequency:

Frequent part-prepayments can accelerate loan repayment and further reduce the interest burden.

By understanding how part-prepayment affects your EMI and tenure, you can make informed decisions to optimise your loan repayment strategy.

Loan support made easy—read on