Managing a medical equipment loan can sometimes lead to missed installments, which could cause unnecessary stress and financial strain. Understanding the potential consequences of missing payments, along with the steps to remedy the situation, is crucial for maintaining a healthy financial record. Medical equipment loans are typically long-term commitments, and missing even a single EMI (Equated Monthly Installment) can trigger late fees, penalties, and possibly damage your credit score. Fortunately, there are steps you can take to address missed payments, including catching up on arrears or discussing loan restructuring options with your lender. In this guide, we’ll explore what happens if you miss an installment, how to avoid fees, and your options for refinancing or rescheduling your loan to ensure it doesn’t affect your financial stability. By staying proactive and informed, you can ensure your medical equipment loan remains on track.

What happens if you miss medical equipment loan installments?

Missing an installment on your medical equipment loan can lead to a series of negative consequences. Lenders usually impose late fees or penalties, which add to the overall cost of your loan. Additionally, repeated missed payments can negatively affect your credit score, making it more difficult to secure future loans. Your lender may also report the missed payment to credit bureaus, which can impact your creditworthiness. If multiple installments are missed, your loan may be considered in default, leading to possible legal action or asset repossession, depending on the terms of your loan agreement. Furthermore, missed payments could also lead to a rise in the overall loan interest due to penalties, increasing your total debt. To avoid such situations, it’s important to take immediate action if you miss an installment, either by paying the overdue amount or negotiating a repayment plan with your lender.

Steps to pay your missed medical equipment loan installments

Check your loan statement

Review your loan statement to identify the missed payment and confirm the amount due.

Contact your lender immediately

Reach out to your lender to inform them of the missed payment and inquire about the next steps.

Make the payment as soon as possible

Pay the overdue installment either via online banking, cheque, or any other mode as accepted by the lender.

Ask for a revised payment plan

If necessary, request a revised payment schedule to help you catch up on missed payments.

Consider paying multiple installments together

Some lenders allow borrowers to make up for missed payments by paying multiple installments in one go.

Check for penalties

Inquire about any late fees or penalties incurred due to the missed payment and ensure that the payment clears in time to avoid further charges.

Ensure timely payments in the future

Set up EMI reminders or use automatic payments to prevent missing future installments.

Request a loan statement post-payment

After paying the overdue amount, request an updated loan statement to ensure all records are correctly reflected.

How to avoid late fees and penalties on medical equipment loan missed payments?

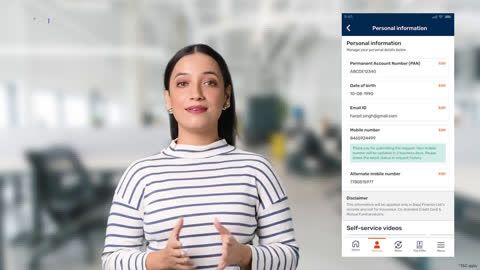

Set Up EMI alerts

Enable alerts via your bank or lender’s mobile app to receive notifications about due payments.

Automate your payments

Set up an automatic payment for your EMIs through your bank to ensure timely deductions.

Review loan terms

Carefully read the loan agreement to understand the grace period and penalties associated with missed payments.

Pay early

Whenever possible, make your EMI payments a few days in advance to avoid last-minute issues.

Track payments regularly

Regularly check your loan balance and payment history to ensure that everything is in order.

Maintain a sufficient balance

Ensure that your bank account has enough funds to cover the EMI before the due date.

Prioritise loan payments

Make timely EMI payments a priority to avoid missing them and accumulating penalties.

Maintain communication with lender

If you anticipate missing a payment, inform your lender beforehand to discuss options and prevent penalties.

Can you pay multiple installments at once to catch up?

Yes, most lenders allow you to pay multiple installments at once if you've missed payments. This is a great option for those who want to catch up on their loan balance and avoid further penalties. When you make these lump-sum payments, it is important to confirm with your lender whether the payment will be adjusted correctly to cover the missed dues. Some lenders may also allow you to request a revised repayment schedule that incorporates the missed payments, while others may offer you the flexibility to pay off multiple dues in a single payment. Paying multiple installments helps prevent the loan from going into default and can also prevent further damage to your credit score. Be sure to check the terms of your loan agreement and consult with your lender to understand the process and avoid any misunderstandings.

Should you consider refinancing or loan restructuring?

Refinancing your loan

Refinancing involves taking out a new loan with better terms to pay off your existing loan. This can help lower your monthly installments or extend the loan tenure.

Loan rescheduling

Loan rescheduling can offer temporary relief by adjusting the repayment schedule to accommodate missed payments and provide more manageable terms.

Eligibility for refinancing

Ensure that you meet the eligibility criteria for refinancing, such as maintaining a good credit score and having a stable income.

Impact on loan interest

Refinancing or restructuring could lead to changes in the interest rate, either lowering or increasing it depending on the loan terms.

Consider the fees involved

Understand the costs associated with refinancing or rescheduling your loan, as there may be processing fees or penalties involved.

Consult your lender

Speak with your lender about the possibility of refinancing or restructuring. They can guide you through the process and help you decide if it’s the best option.

Assess financial stability

Evaluate your financial situation to determine if refinancing or rescheduling is a long-term solution or just a temporary fix.

Conclusion:

Missed medical equipment loan installments can lead to penalties, credit score issues, and potential loan default. However, by taking immediate action—whether through catching up on payments, setting up automatic deductions, or exploring loan restructuring—you can manage these challenges effectively. By staying proactive and in touch with your lender, you can minimise the impact and maintain your financial health. To learn more, visit Loan Rescheduling and Loan Restructuring and Bajaj Finance Loan Details.