Managing your medical equipment loan effectively requires staying informed about your pending EMIs. Tracking your outstanding dues ensures you never miss a payment, helping you avoid penalties and maintain a healthy credit score. With flexible repayment tenures, knowing your EMI status is crucial for budgeting and planning ahead. Checking pending EMIs also allows you to evaluate prepayment options, which can reduce your loan’s overall interest burden. Whether you prefer online banking, lender apps, or other digital tools, tracking your EMIs has never been more convenient. This guide explores why it’s important to check your pending EMIs and the best methods to do so.

Why you need to check pending medical equipment loan EMI?

Monitoring pending EMIs is crucial for effective financial management. It allows you to:

Avoid penalties: Regularly checking your EMI status ensures timely payments, sparing you from late fees.

Maintain credit score: Paying EMIs on time positively impacts your creditworthiness.

Plan your finances: Knowing your dues helps you budget monthly expenses and prioritise repayments.

Evaluate prepayment options: By tracking pending amounts, you can explore part prepayment to save on interest.

Resolve discrepancies: Regular updates allow you to address errors or miscalculations in your payment records.

By proactively managing your loan repayments, you can avoid financial stress and maximise savings throughout the loan tenure.

Check pending medical equipment loan EMI using online banking

Log In to your internet banking account

Access your bank's website and log in with your credentials.

Use your user ID and password or OTP for secure login.

Navigate to the 'loans' section

Once logged in, locate the "Loans" or "Loan Accounts" section on the dashboard.

This section displays all active loans linked to your account.

Select your medical equipment loan

Identify your Medical Equipment Loan from the list of active loans.

Click on the loan to view detailed information.

Check EMI details

In the loan details page, you’ll find a breakdown of the pending EMIs.

View the due dates, remaining principal amount, and interest components.

Download or print EMI schedule

Most banking portals offer an option to download the EMI schedule.

Save or print this document for future reference and financial planning.

Review payment history

Check past payments to ensure all prior EMIs were processed successfully.

Confirm that there are no discrepancies in the payment records.

Utilise additional tools

Use the portal’s EMI calculators or prepayment options if available.

Check for part prepayment facilities to reduce interest costs.

Contact support for queries

If details seem unclear, use the "Help" or "Contact Us" option for assistance.

How to view pending medical equipment loan EMI through your lender’s app?

Download and install the app

Search for the lender’s official app on your mobile device.

Download and install it from the App Store or Google Play Store.

Log in to the app

Use your registered credentials such as phone number, email, or customer ID.

Secure the login with an OTP or PIN for authentication.

Access the 'loan details' section

Navigate to the menu and select "Loan Details" or "My Loans".

Your active loans will be displayed in this section.

Select medical equipment loan

Choose the specific loan to view its details.

Pending EMIs, due dates, and outstanding amounts will be visible here.

Use the EMI tracker

Some apps include a tracker for upcoming EMIs.

Enable notifications to get reminders for due payments.

Download EMI statement

Many apps allow downloading a detailed EMI statement.

Save this for offline access or share it via email if needed.

Explore additional features

Check if the app supports part prepayment or loan foreclosure options.

Use the app’s tools to calculate savings on prepayments.

Contact support for assistance

Use in-app chat or helpline numbers for any loan-related queries.

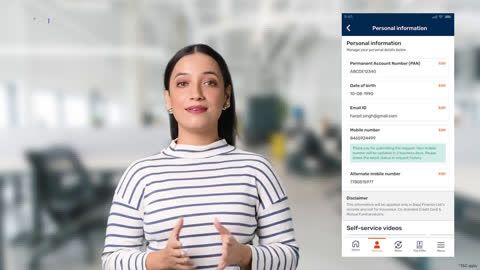

How to view pending medical equipment loan EMI through your lender’s app?

Download the official app

Visit the App Store (iOS) or Google Play Store (Android) to download your lender’s official app.

Ensure you install the authentic app by verifying its publisher.

Register or log in

If you’re a first-time user, register with your mobile number, customer ID, or email.

Existing users can log in using their credentials or through OTP authentication.

Navigate to the ‘My Loans’ section

On the app’s dashboard, locate the “My Loans” or “Loan Details” section.

This section lists all active loans linked to your account.

Select the medical equipment loan

Identify your Medical Equipment Loan from the displayed list.

Click on the loan to access specific details.

View EMI details

Check the pending EMIs, including the due dates and amounts.

The app may also show the interest portion and principal breakdown.

Enable EMI reminders

Set up notifications or reminders for upcoming EMI due dates.

This helps in avoiding late payments and associated penalties.

Download EMI statements

Use the app’s option to download a detailed EMI statement.

Save the statement for your financial records or compliance needs.

Use app features for prepayments

If the app offers prepayment or foreclosure options, explore these features.

Check the impact on your interest savings before proceeding.

Access customer support

For any queries, use in-app support tools like live chat or helpline numbers.

Refer to FAQs or guides for quick assistance.

How to check pending medical equipment loan EMI using the lender’s website?

Visit the official website

Open the lender’s official website on your browser.

Verify the URL to ensure you’re on the correct platform.

Log In to your account

Use your registered credentials like customer ID, mobile number, or email ID.

Authenticate with a password or OTP to access your account.

Navigate to the ‘Loan Details’ section

Once logged in, locate the “Loan Details” or “My Loans” tab on the homepage.

This section displays a list of all active loans associated with your account.

Select your medical equipment loan

Click on the specific loan to access its details.

You’ll find information about the loan balance, EMIs paid, and pending EMIs.

Check EMI details

View the pending EMI amount, due dates, and interest-principal breakup.

Some platforms also highlight overdue EMIs, if any.

Download EMI schedule

Use the option to download the EMI schedule for detailed insights.

Save the document for offline reference or compliance purposes.

Use online tools for calculations

Explore EMI calculators available on the website to plan future payments.

Check the impact of part prepayments or foreclosures on interest savings.

Enable notifications

Subscribe to email or SMS alerts for reminders about upcoming EMIs.

This ensures you stay on track with your repayment schedule.

Review transaction history

Verify your payment history to ensure all past EMIs have been credited.

Report any discrepancies to customer service immediately.

Contact customer support

Use the website’s “Contact Us” section for assistance with pending EMIs.

Access resources like FAQs or chat support for quick resolutions.

Using bank statements to check pending medical equipment loan EMI

Access your bank statements

Log in to your online banking account or mobile app to download the latest bank statement.

Alternatively, visit your bank branch and request a printed statement.

Filter loan-related transactions

Search for transactions linked to EMI payments in your statement.

Look for consistent monthly debit entries under the lender’s name or loan account number.

Identify pending EMIs

Check if all past EMI payments have been deducted.

Missing or overdue entries indicate pending EMIs.

Cross-verify with the loan schedule

Compare the bank statement with the EMI schedule provided by the lender.

Ensure the debited amounts align with the agreed EMI amount.

Monitor payment dates

Verify the exact dates of EMI deductions to avoid discrepancies.

Keep track of any delayed deductions, which may incur penalties.

Detect late fees or charges

Analyse any additional charges in your statement that may indicate late EMI payments.

Contact your lender for clarification if unexpected fees appear.

Highlight overdue payments

Note any overdue payments that are yet to be debited.

Plan to clear these pending EMIs promptly to avoid further penalties.

Download and save statements

Keep digital or printed copies of bank statements for future reference.

Use these records for resolving disputes with your lender.

Seek clarifications

If discrepancies arise, immediately contact the lender with your bank statement details.

Use their customer support services for prompt resolution.

Conclusion

Tracking pending EMIs is vital to ensure seamless loan repayment. Bank statements provide a clear overview of EMI deductions, making them a reliable resource. Stay informed using tools like online portals and apps to streamline your EMI payment process. Learn more about loan repayment here, and discover efficient EMI payment methods here. Taking proactive steps prevents overdue payments and ensures smooth financial management.