When it comes to managing a medical equipment loan, keeping track of the EMI due date is crucial. This date determines when you need to make your payment each month to avoid penalties and ensure smooth loan management. Whether you’ve taken a loan for purchasing equipment for a healthcare facility or personal use, knowing your EMI due date ensures timely repayment, helping you maintain a healthy financial record. This article will guide you through understanding the EMI due date, how to check it, why it’s important, and provide tips to ensure you never miss a payment. By staying on top of this information, you can avoid late fees, improve your credit score, and efficiently manage your loan. If you're looking for more detailed loan information, you can easily access your loan details online via the Bajaj loan details login.

What is a medical equipment loan EMI due date?

The EMI due date refers to the specific date by which the borrower needs to make their monthly repayment towards a medical equipment loan. It’s a critical part of the loan agreement and helps the lender and borrower stay on the same page regarding repayment schedules. For borrowers, this date ensures that they don't miss payments and incur penalties or negatively affect their credit score.

When you take a loan, your lender will provide you with a fixed repayment schedule. The EMI due date is typically the same day of each month, making it easier to plan and organise your finances. Knowing this date is essential to avoid any last-minute rush or late fees. It is also linked to your loan account and can be accessed online or through your lender’s customer service. Timely payments contribute to a smooth loan tenure and help you maintain a positive borrowing history.

How to check your medical equipment loan EMI due date?

Loan repayment schedule: The EMI due date is typically outlined in your loan repayment schedule, which is provided at the time of loan disbursement.

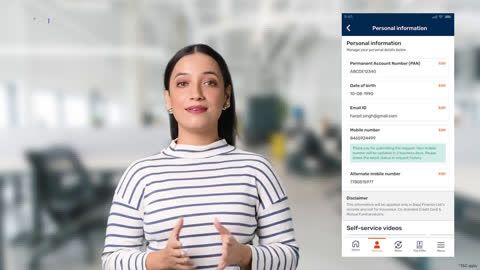

Bajaj loan details login: You can easily check your EMI due date by logging into your loan account on the Bajaj loan details login portal.

Loan agreement: Review the terms and conditions of your loan agreement. The EMI due date will be mentioned there, and it can be referred to throughout the loan term.

Mobile app: Many lenders have mobile applications where you can access your loan details, including the EMI due date.

Customer support: If you're unable to find the EMI due date through the methods above, you can always contact customer support for your lender to get the details.

By using these methods, you can stay informed about your EMI due date and manage your loan more effectively.

Why is it important to know your EMI due date?

Avoid late fees: Missing the EMI due date can result in hefty late fees, making your loan more expensive than anticipated.

Maintain good credit score: Timely payments are crucial to maintaining a positive credit score. Missing payments can harm your credit history and affect future borrowing opportunities.

Plan your budget: Knowing the EMI due date helps you plan your monthly budget around your loan repayment, ensuring that you have enough funds available.

Stay debt-free: Regularly paying on time will help you pay off your loan faster, leading to less interest accumulation and reducing the total cost of your medical equipment loan.

Peace of mind: Staying aware of your EMI due date reduces stress. You won’t need to worry about penalties or damage to your financial reputation.

Access to more loan options: A clean repayment history, including meeting EMI due dates, makes it easier to access loans in the future with better terms.

Tips to ensure timely payment of your medical equipment loan EMI

Set up automatic payments: Link your loan account to your bank account and set up automatic payments to avoid missing the EMI due date.

Set reminders: Use a calendar or a smartphone reminder to alert you a few days before the EMI due date.

Check loan account regularly: Regularly monitor your loan details to stay updated on your EMI due dates and amounts due. How to pay EMI online can also help with this.

Early payments: Try paying your EMI a few days in advance to avoid last-minute hassles, especially during holidays.

Use online payment options: Leverage online payment options for convenience and speed, ensuring your payments reach the lender on time.

Conclusion

In conclusion, knowing your medical equipment loan EMI due date is essential for maintaining a smooth repayment process and avoiding unnecessary fees. By using methods like online portals and setting up reminders, you can stay on top of your payments. Timely repayment also helps you maintain a good credit score, manage your finances better, and reduce financial stress. For more details on your loan, you can easily access your loan information via the Bajaj loan details login portal and explore options on how to pay EMI online.