What does correct medical equipment loan closure mean?

A correct medical equipment loan closure means that the borrower has fully repaid the loan, and all terms outlined in the loan agreement have been satisfied. It involves several steps, such as clearing the outstanding balance, ensuring all EMIs (Equated Monthly Installments) are paid on time, and confirming that the loan account is settled with no pending dues. After the last payment, the lender issues a closure statement, officially declaring the loan paid off. This statement serves as proof that the borrower is no longer obligated under the terms of the loan.A proper closure ensures that the borrower’s credit history is updated to reflect the completion of the loan, and there are no remaining financial obligations tied to the equipment. It also means that the lender has released any legal hold over the equipment, allowing the borrower to retain ownership without further encumbrances. Correct loan closure is essential for both the borrower and the lender to avoid future legal or financial complications. Moreover, the borrower’s credit score is updated accordingly, which could have an impact on future borrowing opportunities.

Incorrect or delayed closure can lead to discrepancies in the borrower’s financial records, potentially affecting their ability to secure future loans or credit. This is why it is crucial to ensure that the loan closure process is thoroughly reviewed and verified.

Consequences of incorrect medical equipment loan closure

Negative impact on credit scoreIf the loan closure isn’t processed correctly, it could reflect as an unpaid loan, negatively impacting the borrower’s credit score.

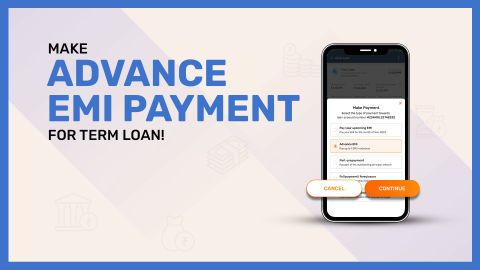

Continued EMI deductions

Incorrect closure may result in EMIs continuing to be deducted even after the loan is meant to be fully paid.

Legal disputes

Improper closure could lead to legal issues, as the borrower might be held liable for an amount that should have been cleared.

Difficulty in obtaining future loans

Incorrect loan closure could lead to misunderstandings with lenders, making it more difficult to obtain loans or credit in the future.

Inaccurate loan statement

An erroneous loan closure may cause discrepancies in loan statements, which can affect financial planning and tax records.

Overdue charges

The lender may still charge late fees or penalties on the loan, even if it has been repaid, causing additional financial strain.

Impact on asset ownership

If the loan isn’t properly closed, the medical equipment may still be considered collateral, which could restrict the borrower’s control over it.

How to identify if your medical equipment loan closure was not processed correctly?

Checking loan closure status

Verify with the lender: Contact the lender to confirm if the loan has been closed in their system.Request a loan closure certificate: Always request an official certificate confirming the loan is paid off.

Online loan portal: If your lender offers an online portal, check for loan status and ensure all dues are marked as cleared.

Reviewing your loan documents

Cross-check the final payment receipt: Ensure that your last payment is marked as the full and final settlement.Confirm no pending EMIs: Double-check that there are no pending EMIs or additional charges indicated in the documents.

Check your credit report: Review your credit report to ensure the loan is marked as ‘Closed’ with no outstanding balance.

Compare loan closure date: Ensure that the loan closure date matches the date when the final payment was made.

Steps to take if your medical equipment loan closure is not processed properly

Contact the lender immediatelyReach out to your lender and explain the situation, requesting clarification or correction if there is a discrepancy.

Provide evidence of payments

Share proof of your final EMI payments, including receipts or bank statements, to support your claim.

Request a loan closure certificate

Ask for an official loan closure certificate if one wasn’t provided after the final payment.

File a complaint

If the issue isn’t resolved promptly, file a formal complaint with the lender’s grievance redressal department.

Check your credit report

Monitor your credit report and request updates once the lender confirms the loan closure is corrected.

Seek legal advice

If necessary, consult a legal professional to understand your rights and take action against improper loan closure.

Tips to avoid medical equipment loan closure issues

Keep track of paymentsRegularly monitor your EMI payments and ensure that the final payment is made on time.

Request regular updates

Request regular loan statements from the lender, especially before and after the final EMI payment.

Confirm loan closure

After the last payment, always request a written confirmation from the lender regarding the closure of the loan.

Avoid pending EMIs

Make sure there are no pending EMIs before you consider the loan closed to avoid future issues.

Maintain documentation

Keep a copy of all loan-related documents, including receipts and statements, until the loan closure is officially confirmed.

Check for any additional charges

Verify that there are no additional charges, penalties, or dues when closing the loan.

For more details on issues like loan emi not deducted or loan pending emi, refer to the relevant resources to assist in resolving your loan closure issues.