Understanding payment spoofing

Officially Valid Documents (OVD) are government-recognised identity and address proof documents required for completing Know Your Customer (KYC) formalities. These documents are mandated by the Reserve Bank of India (RBI) and other financial regulators to authenticate the identity and address of individuals engaging in financial transactions. OVDs serve as the foundation for establishing a customer’s financial credibility, compliance status, and traceability.

For individuals, documents categorised as OVDs include the Passport, Aadhaar Card, Voter ID, Driving Licence, and NREGA Job Card (duly signed by a State Government official). For non-individual entities, documents like partnership deeds, trust registration certificates, and incorporation certificates are considered valid.

The use of OVDs is central to ensuring KYC compliance and mitigating financial risks like identity theft, fraud, and money laundering. Institutions verify these documents during onboarding or account activation to meet regulatory standards.

In some cases, individuals may need to submit supplementary documents if their primary OVD lacks updated address details. Financial institutions are required to maintain these records digitally or physically, depending on the mode of KYC. Adhering to OVD requirements is critical not just for opening a bank account, but also for investing in mutual funds, applying for loans, and carrying out high-value transactions.

Common types of payment spoofing attacks

- Fake payment confirmation emails: One of the most widespread forms of payment spoofing involves sending fraudulent emails that mimic genuine payment confirmation messages from banks or payment platforms. These emails often include fabricated transaction IDs, payment dates, and sender names to convince recipients that a payment has been completed when it has not.

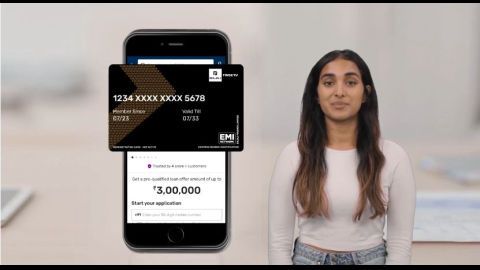

- Doctored payment screenshots: Attackers use graphic editing tools to modify genuine payment screenshots by changing transaction details such as date, time, and amount. These manipulated images are sent via email, messaging apps, or social media to create a false impression that funds have been transferred.

- Invoice manipulation in email threads: Fraudsters may intercept or mimic ongoing email conversations between businesses and their clients. They then alter invoice details, particularly bank account numbers, so that payments are unknowingly directed to the attacker’s account instead of the intended recipient.

- Fake UPI payment notifications: In this attack, the fraudster uses UPI apps to generate a payment request or send a misleading notification that appears like a successful transaction. Unsuspecting merchants may assume payment is complete and release goods or services.

- Phishing websites mimicking payment portals: Cybercriminals may create fake websites that look identical to legitimate payment platforms. Victims who enter their payment details on these spoofed portals unknowingly hand over sensitive financial information.

- QR code spoofing: Scammers replace genuine merchant QR codes with tampered ones that redirect payments to their own accounts. This type of spoofing is especially common in public places or retail environments where QR codes are used for contactless payments.

- SMS spoofing for fake transaction alerts: Attackers use SMS spoofing tools to send fake payment alerts that appear to come from a bank’s official number. The message may state that funds have been credited, misleading the recipient into believing the transaction is legitimate.

- Mobile number impersonation: Fraudsters may use mobile numbers that closely resemble those of known customers or suppliers and send payment confirmations via WhatsApp or SMS to bypass standard verification practices.

- Payment gateway impersonation through calls: Criminals may pose as representatives from payment gateways or banks over the phone and verbally confirm a non-existent payment. This social engineering tactic aims to exploit trust and urgency.

E-commerce seller impersonationAttackers create fake e-commerce storefronts or seller profiles and provide counterfeit proof of payment to buyers or logistics partners to execute fraudulent order fulfilments.

Each of these payment spoofing methods relies on deception, timing, and lack of verification. Staying vigilant and using secure communication channels can help prevent significant financial loss.

Impact of payment spoofing on Indian financial institutions

Payment spoofing poses a serious threat to the integrity and security of the Indian financial ecosystem. With the increasing adoption of digital payments through UPI, internet banking, and mobile wallets, cybercriminals have found new ways to exploit trust-based systems using deceptive tactics. This has created multiple operational, financial, and reputational challenges for banks, NBFCs, fintech firms, and payment service providers.

One of the primary impacts is the erosion of customer trust. When fraudsters successfully spoof payments and customers suffer losses, the financial institutions involved—though not directly responsible—face scrutiny and loss of credibility. Users begin to question the security of the platforms they rely on, which can result in reduced adoption of digital financial services.

Additionally, payment spoofing increases the burden on fraud detection and dispute resolution teams. Institutions are forced to invest in more sophisticated real-time monitoring systems, machine learning algorithms, and fraud analytics to detect and flag suspicious patterns. These measures, while necessary, raise operational costs and slow down transaction processing in some cases.

Spoofing attacks also contribute to a rise in false complaints and transaction disputes, requiring banks and financial service providers to handle a greater volume of grievance redressals. This not only stretches internal resources but can lead to compliance risks if not handled within regulatory timelines mandated by the Reserve Bank of India (RBI).

Moreover, regulatory oversight becomes more intense in the wake of repeated spoofing incidents. Institutions may be compelled to revise their policies, enhance KYC and payment verification protocols, and conduct more frequent audits, all of which add to administrative complexity.

From a broader perspective, payment spoofing threatens the stability of the digital payment ecosystem by introducing vulnerabilities in otherwise trusted channels. To mitigate these impacts, Indian financial institutions are investing in multi-factor authentication, transaction validation tools, and public awareness campaigns to strengthen defences and maintain user confidence in the face of evolving fraud tactics.

Detection techniques using AI and machine learning

Artificial Intelligence (AI) and Machine Learning (ML) have become powerful tools in detecting and preventing payment spoofing in the modern digital financial landscape. As fraudsters use increasingly sophisticated techniques to forge payment confirmations, simulate fake transactions, and manipulate digital communications, AI and ML help financial institutions identify suspicious patterns in real time and respond proactively.

One of the primary ways AI aids in detection is through pattern recognition. Payment spoofing often involves behavioural anomalies that deviate from a customer’s usual transaction habits. Machine learning algorithms are trained to analyse these behavioural data points—such as transaction frequency, location, timing, amount, and device usage—and flag any deviations that may indicate potential spoofing activity.

AI-powered systems also deploy natural language processing (NLP) to scan emails, messages, and communications for keywords or phrases typically associated with fraudulent payment claims. This is especially useful in detecting phishing or invoice manipulation schemes that rely on convincing language and visual mimicry.

Another effective method is image analysis using computer vision, where AI systems evaluate screenshots or payment receipts submitted during transactions. These models can detect visual inconsistencies, font mismatches, image overlays, or metadata alterations that would not be obvious to the human eye.

AI also plays a role in network behaviour analysis, wherein multiple connected accounts or IP addresses are monitored for coordinated activity that could indicate organised spoofing attempts. These systems can detect if the same device is being used across multiple accounts or if IP addresses are masked or spoofed using VPNs or proxies.

Machine learning models continuously learn from historical fraud data, improving their accuracy over time. As they process more flagged and confirmed cases, they refine their detection capabilities, reducing false positives while increasing true fraud detection rates.

In addition, AI-assisted risk scoring allows institutions to assign real-time risk scores to transactions based on a multitude of variables. Transactions that score above a threshold can be automatically flagged for manual review or blocked outright until verified.

AI and ML also enable the development of adaptive security systems, which evolve in response to new spoofing techniques without requiring manual intervention. This agility is essential in an environment where fraud tactics change rapidly.

By integrating AI-driven fraud detection systems into core transaction infrastructure, financial institutions can strengthen their defences against payment spoofing, reduce operational losses, and deliver safer digital experiences to their customers.

Prevention strategies for businesses and individuals

To effectively combat the threat of payment spoofing, both businesses and individuals must adopt a combination of technological safeguards, verification protocols, and awareness-driven practices. Below are essential prevention strategies to reduce the risk of falling victim to spoofed transactions:

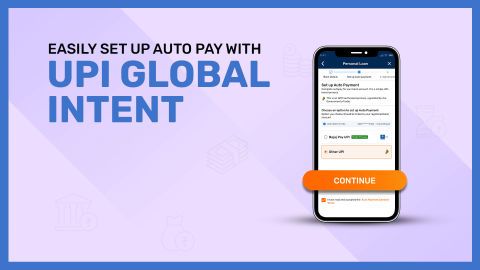

- Always verify payment confirmations independentlyDo not rely solely on screenshots, emails, or SMS notifications to confirm payments. Cross-check transaction details using official banking apps, net banking portals, or UPI confirmation screens.

- Enable real-time payment alertsSubscribe to SMS and email alerts for every credit and debit. Immediate alerts help detect unauthorised or fake notifications quickly.

- Implement multi-level authentication for transactionsUse OTP-based approval, biometric logins, or two-factor authentication to authorise transactions and access sensitive financial data.

- Avoid sharing payment confirmations via unsecured channelsDo not share screenshots or transaction IDs over public platforms or with unknown parties, as these can be tampered with and reused for spoofing.

- Educate staff and employees on payment fraud risksBusinesses should train their employees to detect signs of spoofing, such as suspicious emails, edited receipts, or sudden changes in account details.

- Verify bank details on every invoice or fund requestCross-verify bank account numbers, IFSC codes, and UPI IDs with official sources or previously verified records before making payments.

- Check for changes in communication patternsBe cautious if a known customer or vendor suddenly changes their usual payment methods, email ID, or phone number.

- Use secure, encrypted payment gatewaysAlways process transactions through PCI-DSS compliant and verified payment platforms to minimise exposure to spoofing attempts.

- Deploy anti-fraud software and firewallsBusinesses should integrate fraud detection tools, email filtering systems, and endpoint protection to block spoofed content and malicious attachments.

- Monitor login and access history regularlyKeep track of account access logs, especially for corporate or shared banking platforms, to detect unauthorised entry points.

- Validate QR codes and payment linksAlways verify the source of QR codes before scanning, as attackers may replace genuine codes with spoofed versions that redirect payments.

- Update software and apps regularlyEnsure that all financial apps and operating systems are up to date with the latest security patches and fraud detection features.

By following these prevention measures, individuals and businesses can reduce the risk of payment spoofing and ensure secure digital financial interactions.

Regulatory measures in India against payment fraud

To address the growing threat of digital payment frauds, including payment spoofing, regulatory bodies in India have introduced a range of measures to safeguard consumers and financial institutions. The Reserve Bank of India (RBI), along with other statutory agencies like SEBI and NPCI, has played a crucial role in framing guidelines and monitoring implementation across the banking and fintech sectors.

The RBI has made it mandatory for banks and payment service providers to implement multi-factor authentication for digital transactions. Most commonly, this includes a combination of PIN, OTP, biometric verification, and device-level security. These steps are aimed at reducing unauthorised access and limiting the effectiveness of spoofed transactions.

To promote accountability and faster grievance resolution, the RBI has established the Digital Payment Security Controls circular. It mandates financial institutions to put in place a robust fraud monitoring system, real-time alerts, and customer-friendly complaint redressal processes. Banks are also required to maintain detailed audit trails of all digital payments to facilitate post-incident investigations.

For UPI and mobile wallet-based payments, the National Payments Corporation of India (NPCI) has introduced strict validation mechanisms. These include transaction time-stamps, source app authentication, and wallet-specific fraud detection protocols. The aim is to ensure that payments cannot be spoofed or redirected without proper user consent and verification.

Moreover, the RBI’s Chartered Account Guidelines make it compulsory for financial institutions to report fraudulent transactions above a certain threshold and conduct internal reviews. Failure to report or address such frauds can result in penalties.

The RBI has also empowered consumers with the Zero Liability Policy, which ensures that customers are not held responsible for unauthorised transactions reported promptly. This encourages consumers to remain vigilant and responsive without fear of financial loss.

Together, these regulatory safeguards form a layered defence against payment spoofing and related frauds. As the digital economy continues to grow, ongoing regulatory evolution and technological integration remain essential to protecting both individual users and the financial system at large.

Role of multi-factor authentication in preventing spoofing

Multi-factor authentication (MFA) plays a vital role in safeguarding digital transactions and protecting users against payment spoofing and other cyber frauds. By requiring more than one form of verification, MFA adds an additional layer of security that significantly reduces the risk of unauthorised access and manipulation of financial systems.

Payment spoofing often relies on deceiving the recipient into believing that a payment has been made or that a transaction is legitimate. In many cases, fraudsters present fake payment confirmations, forged emails, or doctored screenshots to support their claims. However, when MFA is implemented effectively, even if one layer—such as a password or PIN—is compromised, the additional verification factor prevents the attacker from gaining full access or completing fraudulent transactions.

MFA typically involves a combination of three factors: something the user knows (like a password or PIN), something the user has (such as a smartphone, OTP token, or smart card), and something the user is (like a fingerprint or facial recognition). In the context of digital payments, this often includes OTPs sent to registered mobile numbers, biometric verification, and device authentication.

For financial institutions, enforcing MFA at critical transaction points—such as login, fund transfers, beneficiary additions, or high-value transactions—acts as a deterrent against spoofing. Fraudsters attempting to spoof a payment would still be required to complete the second authentication step, which is usually out of their control.

Regulators such as the Reserve Bank of India (RBI) mandate MFA for digital banking and UPI-based transactions, recognising its importance in fraud prevention. It not only reduces financial losses but also boosts user confidence in digital banking platforms.

In summary, multi-factor authentication significantly enhances the integrity of the payment ecosystem. It ensures that only authorised users can initiate or approve transactions, making it one of the most effective defences against payment spoofing in today’s digital-first financial landscape.

Educating users: awareness and best practices

Understand what payment spoofing isUsers should be educated on the nature of payment spoofing, including how fraudsters use fake emails, doctored screenshots, and false payment notifications to trick victims into releasing goods or information.

- Verify every payment independentlyAlways cross-check the payment confirmation through official banking apps, SMS alerts, or account statements rather than relying on screenshots or forwarded emails.

- Do not trust screenshots or email confirmations blindlyTrain users to treat images of payment receipts or unofficial confirmations with caution, as these can be easily fabricated using editing software.

- Enable transaction alertsUsers should activate SMS and email alerts for every transaction to receive real-time updates and detect unauthorised activities promptly.

- Recognise red flags in communicationEducate users to identify urgency, unfamiliar sender addresses, or sudden changes in payment instructions as common signs of fraud.

- Promote secure transaction habitsAdvise customers to complete payments only on secure platforms and avoid sharing payment details over social media or messaging apps.

- Use multi-factor authenticationEncourage users to activate two-factor or biometric authentication for financial apps and wallets to add an extra layer of security.

- Keep software updatedRegularly updating apps and device operating systems ensures protection against known vulnerabilities used in spoofing attacks.

- Be cautious with QR codes and payment linksTeach users to verify the source of QR codes before scanning and avoid clicking on unfamiliar or shortened payment links.

- Report suspicious activity immediatelyCreate awareness on how and where to report spoofing attempts to customer care or cybercrime authorities for timely intervention.

- Participate in awareness campaignsFinancial institutions should regularly conduct training sessions, webinars, and circulate educational materials to strengthen user awareness about spoofing threats and digital safety.

Conclusion

In an increasingly digital financial ecosystem, payment spoofing has emerged as a serious threat to individuals and businesses alike. Through deceptive tactics such as fake payment confirmations, doctored receipts, and impersonation, fraudsters exploit trust and trigger premature actions from unsuspecting victims. However, with a combination of robust verification protocols, technological safeguards, and user education, this risk can be significantly reduced.

Implementing preventive measures such as multi-factor authentication, secure payment gateways, and real-time transaction alerts ensures that only verified transactions are accepted. Financial institutions must also invest in AI-driven fraud detection systems and comply with regulatory mandates to strengthen overall defences.

Equally important is the role of awareness—users must be equipped with the knowledge and best practices to detect and report suspicious activity. By fostering a culture of digital caution and vigilance, both service providers and consumers can work together to prevent financial losses and uphold the integrity of digital payments.

Read More

Related videos

Frequently asked questions

Block/Unblock

Card Limit

Fees and Charges

Other

Your Insta EMI Card could be blocked in line with the credit policies of Bajaj Finance Limited. There are several factors that determine this, such as:

- If you do not maintain a good credit score.

- If you fail to repay your due EMIs or your EMI bounces.

- Your card can also be blocked if your payment record is inconsistent.

- If we observe any suspicious or fraudulent activities on your card, we will block it for security purposes.

As a quarterly practice, we review the pre-approved offers available for our customers and make changes if needed. This gets communicated to you on your registered mobile number through an SMS.

If we have blocked your card as per our credit policy, you cannot unblock it at your end. However, you can view the reason for this and the criteria to unblock it. To do so, please click here.

You can easily check the status of your Bajaj Finserv Insta EMI Card on the Bajaj Finserv app and website. To view the status of your Insta EMI Card follow the below-mentioned steps:

- Go to Service section on the home page

- Click on view all under ‘Your Relations’

- Select the EMI Card for which you wish to view the details

- You will be able to view your card status

To enjoy uninterrupted Insta EMI Card benefits, ensure that your EMIs are paid on time and maintain a good credit score. Tip: Your credit score is based on overall credit and credit payment history across different loan types and credit institutions over a period of time.

The pre-approved loan offer amount on your Bajaj Finserv Insta EMI Card is subject to change. These changes are governed by Bajaj Finance Limited. There are several factors that determine the card loan offer amount reduction. Some of these include:

- Credit score: If you have a low credit score, the pre-approved loan offer amount can be reduced.

- Repayment history: Your repayment history also affects the loan offer amount of your card.

- Loan frequency: The frequency of loans availed by you using the Bajaj Finserv Insta EMI Card also affects your card loan offer amount.

We review the pre-approved card loan offer amount available to our customers periodically and make changes (either increase or decrease) if needed. These changes are communicated to you on your registered mobile number through an SMS.

If you have an Insta EMI Card but did not make any purchase in the last one year, you will need to pay annual charges. However, if you have bought at least one product with your Insta EMI Card in the preceding year, you’ll find that this charge is waived off.

For example, if the EMI Network Card is issued in Feb 2019 (referred to as "Member Since" on the EMI Network Card) the date for payment of the annual fee will be March 2020 (if there has been no loan booked from Feb 2019 to March 2020).

You don’t have to pay any additional or annual fee to keep your Insta EMI Card active. Even if you have not used the card for a long time, your card will remain active until the end of the validity period (i.e. the 'Valid Till' date) mentioned on your card.

For security reasons, it’s recommended that only the cardholder use his/ her Bajaj Finserv Insta EMI Card. Loans taken against your card are your responsibility and you’ll be held liable if there’s delay in payments or default.

While we used to issue physical EMI Network Card till a few years ago, the new Insta EMI Card is a virtual-only card. It packs in all the features of the physical card without the need to carry it around. You only need your Insta EMI Card number, and the OTP sent to your registered mobile number to complete a purchase.

You can find your Insta EMI Card number on the Bajaj Finserv app or by signing-in into Service Portal.

While the EMI Network Card is now a virtual-only card, you can still use your physical card to make transactions. You can use this card for shopping on Bajaj Mall, other e-commerce destinations, and at our partner stores. Visit our customer portal – My Account to check details of your existing card.

Personal Loan

Personal Loan Check Eligibility

Check Eligibility Salaried Personal Loan

Salaried Personal Loan EMI Calculator

EMI Calculator Account Aggregator

Account Aggregator

Deals starting @99

Deals starting @99 Min. 50% off

Min. 50% off

Bajaj Pay

Bajaj Pay Wallet to Bank

Wallet to Bank

Smartphones

Smartphones Led TVs

Led TVs Air Conditioner

Air Conditioner Refrigerators

Refrigerators Air Coolers

Air Coolers Laptops

Laptops Washing Machines

Washing Machines Savings Offer

Savings Offer Easy EMI Loan

Easy EMI Loan

Loan Against Shares

Loan Against Shares Loan Against Mutual Funds

Loan Against Mutual Funds Loan Against Insurance Policy

Loan Against Insurance Policy ESOP Financing

ESOP Financing Easy EMI Loan

Easy EMI Loan Two-wheeler Loan

Two-wheeler Loan Loan for Lawyer

Loan for Lawyer Industrial Equipment Finance

Industrial Equipment Finance Industrial Equipment Balance Transfer

Industrial Equipment Balance Transfer Industrial Equipment Refinance

Industrial Equipment Refinance Personal Loan Branch Locator

Personal Loan Branch Locator Used Tractor Loan

Used Tractor Loan Loan Against Tractor

Loan Against Tractor Tractor Loan Balance Transfer

Tractor Loan Balance Transfer Flexi

Flexi View All

View All

Two-wheeler Loan

Two-wheeler Loan Bike

Bike Commuter Bike

Commuter Bike Sports Bike

Sports Bike Tourer Bike

Tourer Bike Cruiser Bike

Cruiser Bike Adventure Bike

Adventure Bike Scooter

Scooter Electric Vehicle

Electric Vehicle Best Sellers

Best Sellers Popular Brands

Popular Brands

Open Demat Account

Open Demat Account Trading Account

Trading Account Margin Trading Facility

Margin Trading Facility Share Market

Share Market Invest in IPO

Invest in IPO All stocks

All stocks Top gainers

Top gainers Top losers

Top losers 52 week high

52 week high 52 week low

52 week low Loan against shares

Loan against shares

Home Loan

Home Loan Transfer your existing Home loan

Transfer your existing Home loan Loan against Property

Loan against Property Home Loan for Salaried

Home Loan for Salaried Home loan for self employed

Home loan for self employed Loan Against Property Balance Transfer

Loan Against Property Balance Transfer Home Loan EMI Calculator

Home Loan EMI Calculator Home Loan eligibility calculator

Home Loan eligibility calculator Home Loan balance transfer

Home Loan balance transfer View All

View All

Term Life Insurance

Term Life Insurance ULIP Plan

ULIP Plan Savings Plan

Savings Plan Family Insurance

Family Insurance Senior Citizen Health Insurance

Senior Citizen Health Insurance Critical Illness Insurance

Critical Illness Insurance Child Health Insurance

Child Health Insurance Pregnancy and Maternity Health Insurance

Pregnancy and Maternity Health Insurance Individual Health Insurance

Individual Health Insurance Low Income Health Insurance

Low Income Health Insurance Student Health Insurance

Student Health Insurance Group Health Insurance

Group Health Insurance Retirement Plans

Retirement Plans Child Plans

Child Plans Investment Plans

Investment Plans

Business Loan

Business Loan Secured Business Loan

Secured Business Loan Loan against property

Loan against property Loans against property balance transfer

Loans against property balance transfer Loan against shares

Loan against shares Home Loan

Home Loan Loans against mutual funds

Loans against mutual funds Loan against bonds

Loan against bonds Loan against insurance policy

Loan against insurance policy

Apply for Gold Loan

Apply for Gold Loan Transfer your Gold Loan with Us

Transfer your Gold Loan with Us Gold Loan Branch Locator

Gold Loan Branch Locator

ULIP Plan

ULIP Plan Savings Plan

Savings Plan Retirement Plans

Retirement Plans Child Plans

Child Plans Free Demat Account

Free Demat Account Invest in Stocks

Invest in Stocks Invest in IPO

Invest in IPO Margin Trading Facility

Margin Trading Facility Fixed Deposit Branch Locator

Fixed Deposit Branch Locator

New Car Loan

New Car Loan Used Car Loan

Used Car Loan Loan Against Car

Loan Against Car Car Loan Balance Transfer and Top-up

Car Loan Balance Transfer and Top-up My Garage

My Garage

Get Bajaj Prime

Get Bajaj Prime

Mobiles on EMI

Mobiles on EMI Electronics on EMI Offer

Electronics on EMI Offer  Iphone on EMI

Iphone on EMI LED TV on EMI

LED TV on EMI Refrigerator on EMI

Refrigerator on EMI Laptop on EMI

Laptop on EMI Kitchen appliances on EMI

Kitchen appliances on EMI Washing machines

Washing machines

Personal Loan EMI Calculator

Personal Loan EMI Calculator Personal Loan Eligibility Calculator

Personal Loan Eligibility Calculator Home Loan EMI Calculator

Home Loan EMI Calculator Home Loan Eligibility Calculator

Home Loan Eligibility Calculator Good & Service Tax (GST) Calculator

Good & Service Tax (GST) Calculator Flexi Day Wise Interest Calculator

Flexi Day Wise Interest Calculator Flexi Transaction Calculator

Flexi Transaction Calculator Secured Business Loan Eligibility Calculator

Secured Business Loan Eligibility Calculator Fixed Deposits Interest Calculator

Fixed Deposits Interest Calculator Two wheeler Loan EMI Calculator

Two wheeler Loan EMI Calculator New Car Loan EMI Calculator

New Car Loan EMI Calculator Used Car Loan EMI Calculator

Used Car Loan EMI Calculator All Calculator

All Calculator Used Tractor Loan EMI Calculator

Used Tractor Loan EMI Calculator

Hot Deals

Hot Deals Clearance Sale

Clearance Sale Kitchen Appliances

Kitchen Appliances Tyres

Tyres Camera & Accessories

Camera & Accessories Mattresses

Mattresses Furniture

Furniture Watches

Watches Music & Audio

Music & Audio Cycles

Cycles Mixer & Grinder

Mixer & Grinder Luggage & Travel

Luggage & Travel Fitness Equipment

Fitness Equipment Fans

Fans

Personal Loan for Doctors

Personal Loan for Doctors Business loan for Doctors

Business loan for Doctors Home Loan

Home Loan Secured Business Loan

Secured Business Loan Loan against property

Loan against property Secured Business Loan Balance Transfer

Secured Business Loan Balance Transfer Loan against share

Loan against share Gold Loan

Gold Loan Medical Equipment Finance

Medical Equipment Finance

Smart Hub

Smart Hub ITR Service

ITR Service Digi Sarkar

Digi Sarkar

Savings Offer

Savings Offer Easy EMI

Easy EMI Offer World

Offer World 1 EMI OFF

1 EMI OFF New Launches

New Launches Zero Down Payment

Zero Down Payment Clearance Sale

Clearance Sale Bajaj Mall Sale

Bajaj Mall Sale

Mobiles under ₹20,000

Mobiles under ₹20,000 Mobiles under ₹25,000

Mobiles under ₹25,000 Mobiles under ₹30,000

Mobiles under ₹30,000 Mobiles under ₹35,000

Mobiles under ₹35,000 Mobiles under ₹40,000

Mobiles under ₹40,000 Mobiles under ₹50,000

Mobiles under ₹50,000

Articles

Articles

Overdue Payments

Overdue Payments Other Payments

Other Payments

Document Center

Document Center Bank details & Documents

Bank details & Documents Tax Invoice Certificate

Tax Invoice Certificate

Do Not Call Service

Do Not Call Service

Hamara Mall Orders

Hamara Mall Orders Your Orders

Your Orders

Fixed Deposit (IFA) Partner

Fixed Deposit (IFA) Partner Loan (DSA) Partner

Loan (DSA) Partner Debt Management Partner

Debt Management Partner EMI Network Partner

EMI Network Partner Became a Merchant

Became a Merchant Partner Sign-in

Partner Sign-in

Trade directly with your Demat A/c

Trade directly with your Demat A/c ITR

ITR My Garage

My Garage

Live Videos - Beta

Live Videos - Beta

Savings Offer

Savings Offer Smartphones

Smartphones LED TVs

LED TVs Air Conditioners

Air Conditioners Refrigerators

Refrigerators Air Coolers

Air Coolers Laptops

Laptops Washing Machines

Washing Machines Water Purifiers

Water Purifiers Tablets

Tablets Kitchen Appliances

Kitchen Appliances Mattresses

Mattresses Furniture

Furniture Music and Audio

Music and Audio Cameras & Accessories

Cameras & Accessories Cycle

Cycle Watches

Watches Tyres

Tyres Luggage & Travel

Luggage & Travel Fitness Equipment

Fitness Equipment Tractor

Tractor Easy EMI Loan

Easy EMI Loan

vivo Mobiles

vivo Mobiles OPPO Mobiles

OPPO Mobiles Xiaomi Mobiles

Xiaomi Mobiles Sony LED TVs

Sony LED TVs Samsung LED TVs

Samsung LED TVs LG LED TVs

LG LED TVs Haier LED TVs

Haier LED TVs Godrej Refrigerators

Godrej Refrigerators Voltas Washing Machines

Voltas Washing Machines

New Tractor Loan

New Tractor Loan Used Tractor Loan

Used Tractor Loan Loan Against Tractor

Loan Against Tractor Tractor Loan Balance Transfer

Tractor Loan Balance Transfer

New Car Loan

New Car Loan New Cars Under ₹10 Lakh

New Cars Under ₹10 Lakh New Cars – ₹10–₹15 Lakh

New Cars – ₹10–₹15 Lakh New Cars – ₹15–₹20 Lakh

New Cars – ₹15–₹20 Lakh New Cars – ₹20–₹25 Lakh

New Cars – ₹20–₹25 Lakh New Car Brands

New Car Brands Petrol – New Cars

Petrol – New Cars Diesel – New Cars

Diesel – New Cars Electric – New Cars

Electric – New Cars CNG – New Cars

CNG – New Cars Hybrid – New Cars

Hybrid – New Cars