Prepayment for a Loan Against Securities (LAS) offers borrowers the flexibility to repay their loan partially or fully before the scheduled tenure, helping save on interest costs and regain control over their pledged investments sooner. When you avail of a LAS, you pledge financial instruments like shares, mutual funds, bonds, or insurance policies as collateral to secure immediate liquidity. While this facility allows you to meet urgent financial needs without selling your valuable assets, prepayment empowers you to reduce your debt burden early. Most lenders offer hassle-free prepayment options, often with minimal or no charges, making it an attractive choice for those who experience improved cash flow or receive unexpected funds. It’s essential to check the lender’s terms regarding prepayment penalties, foreclosure procedures, and impact on interest savings. Ultimately, prepaying your LAS not only enhances your financial flexibility but also restores full ownership of your investments more quickly.

What is loan against securities prepayment?

Loan Against Securities (LAS) is a popular credit facility where you pledge your financial assets—such as shares, mutual funds, bonds, or insurance policies—to secure a loan. It allows you to unlock the value of your investments without liquidating them, providing quick access to funds for personal or business needs. However, as with any loan, you are required to repay it along with the applicable interest. This is where prepayment becomes an important option.

Prepayment refers to the process of repaying your Loan Against Securities, either partially or in full, before the completion of the agreed loan tenure. By choosing to prepay, you can significantly reduce your interest burden, as interest is typically charged only on the outstanding loan amount and duration of usage. Borrowers who come into surplus funds or improved cash flow often prefer prepayment to save on overall borrowing costs and regain full ownership of their pledged securities.

Most lenders offer flexible prepayment options, allowing you to clear the dues at your convenience. While some may impose minimal prepayment or foreclosure charges, many financial institutions encourage early repayment with little to no penalties. Before proceeding, it is advisable to review your loan agreement to understand the specific terms associated with prepayment, such as notice periods, applicable charges, and documentation requirements.

Prepaying your LAS not only brings financial relief but also enhances your credit profile by demonstrating responsible borrowing behaviour. More importantly, it restores your complete control over the pledged securities, enabling you to manage or reinvest them as per your future goals. Whether it’s for reducing liabilities, saving on interest, or regaining your assets, prepayment of a Loan Against Securities is a smart financial move when managed wisely.

Why consider prepaying your loan against securities?

Prepaying your Loan Against Securities (LAS) can be a strategic financial decision, offering both immediate and long-term benefits. When you take a loan against your shares, mutual funds, bonds, or insurance policies, you pledge these valuable assets to access funds without selling them. While this is a convenient way to meet urgent financial needs, prepaying the loan ahead of schedule can lead to substantial advantages.

One of the most compelling reasons to prepay is the potential for significant interest savings. Since interest on LAS is usually charged on the outstanding loan amount and for the actual duration of usage, repaying early helps reduce the overall cost of borrowing. This is especially beneficial if you have surplus funds from bonuses, profits, or other windfalls.

Another advantage is regaining complete control over your pledged securities. Until the loan is fully repaid, your investments remain with the lender as collateral. By prepaying, you can unlock these assets sooner, allowing you to reallocate, reinvest, or sell them based on your evolving financial goals and market conditions.

Prepayment also positively impacts your creditworthiness. Clearing the loan ahead of time demonstrates strong repayment capability and financial discipline, which can improve your credit score and make future borrowing more accessible and affordable.

Moreover, many lenders offer flexible prepayment terms with minimal or no penalties, making early repayment an even more attractive option. However, it’s essential to review your loan agreement carefully for any applicable charges or procedures related to prepayment.

In summary, prepaying your Loan Against Securities empowers you to reduce financial obligations, save on interest, enhance your credit profile, and regain full control over your investments—making it a wise choice for borrowers aiming for greater financial freedom.

Steps to prepay your loan against securities: A detailed guide

Prepaying your Loan Against Securities (LAS) can be a smooth process if you follow the right steps. Here’s a detailed step-by-step guide to help you manage your prepayment efficiently:

1. Review your loan agreement

Go through the loan documents carefully.

Check for prepayment terms, applicable charges, lock-in periods, and notice requirements.

Understand if partial or full prepayment is allowed.

2. Assess your financial readiness

Evaluate your current financial position and surplus funds.

Ensure you have enough liquidity to prepay without compromising other essential expenses.

3. Contact your lender

Reach out to your relationship manager or the lender’s customer service.

Request details about the outstanding loan amount, accrued interest, and prepayment charges (if any).

Get clarity on the exact amount required for prepayment.

4. Request a prepayment statement

Obtain an official prepayment statement from the lender.

This statement will outline your total dues, including principal, interest, and any applicable fees.

5. Understand the prepayment procedure

Confirm the accepted modes of prepayment (online transfer, cheque, or demand draft).

Ask about the process timeline and documentation needed.

6. Submit a prepayment request

Fill out and submit the prepayment request form as required by the lender.

Attach necessary documents such as ID proof, loan account details, and payment proofs.

7. Make the payment

Proceed to pay the specified amount as per the lender’s instructions.

Ensure the transaction is completed successfully and retain the payment receipt for your records.

8. Obtain loan closure certificate

After successful payment, request a No Objection Certificate (NOC) and loan closure certificate.

This document confirms that your loan is fully repaid and your obligations are cleared.

9. Release of pledged securities

Coordinate with your lender to initiate the release of your pledged shares, mutual funds, or other securities.

Ensure the securities are transferred back to your demat account or custody.

10. Update your records

Maintain copies of all related documents, including NOC, loan closure confirmation, and communication with the lender.

Update your financial records to reflect the closure of the loan.

Methods of making prepayment on your loan against securities

When you decide to prepay your Loan Against Securities (LAS), lenders typically offer multiple convenient methods to complete the payment. Understanding these options helps ensure a smooth and timely prepayment process. Here’s a detailed look at the common methods:

1. Online fund transfer (NEFT/RTGS/IMPS)

Use your net banking facility to transfer funds directly to the lender’s designated loan account.

NEFT and RTGS are ideal for large payments, while IMPS allows instant transactions.

Ensure you mention the correct loan account number and details in the remarks section.

2. Cheque payment

Issue an account payee cheque in favour of the lender with clear details of your loan account.

Submit the cheque at the lender’s branch or collection centre.

Retain the acknowledgment receipt for future reference.

3. Demand Draft (DD)

Obtain a demand draft from your bank payable to the lender.

Useful if you prefer not to use electronic methods or do not maintain an account with the same bank.

Submit the DD at the lender’s branch and keep a copy of the submission slip.

4. Auto-debit facility

Some lenders allow linking your bank account for scheduled prepayment or part-payment.

Authorize the lender to debit your account directly for the prepayment amount.

Verify the auto-debit amount and date in advance to ensure sufficient funds.

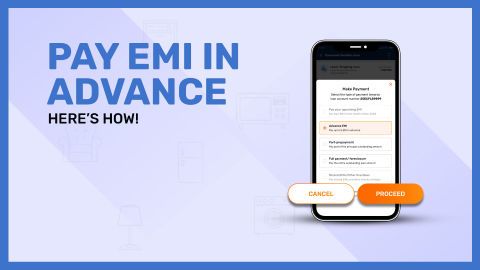

5. Payment via loan account portal or mobile app

Many lenders provide an online loan account portal or dedicated mobile app.

Log in securely, navigate to the payments section, and select the prepayment option.

Use net banking, debit card, or UPI as available payment modes.

6. UPI Payment (if accepted)

Some modern lenders accept UPI payments for loan repayments.

Use UPI apps to transfer the prepayment amount directly to the lender’s UPI ID linked to your loan account.

Confirm the transaction limit and ensure the lender supports UPI for loan payments.

7. Branch walk-in payment

Visit the nearest branch of your lender.

Make the prepayment using cash (if within permissible limits), cheque, or card.

Collect an official receipt immediately after the payment.

How prepayment affects your loan against securities EMI and tenure

Prepaying your Loan Against Securities (LAS) can directly impact both your EMI obligations and the overall loan tenure. Understanding these effects helps you make informed decisions about your repayments and financial planning. Let’s break it down:

1. Reduction in outstanding principal

Prepayment reduces the outstanding principal amount on your loan.

Since interest is usually charged only on the remaining principal, your overall interest burden decreases.

2. Lower EMI amount (if restructured)

After prepayment, you can request your lender to restructure your EMIs.

Reduced principal leads to lower EMI amounts, making monthly payments more manageable.

You can explore convenient repayment options like the ecs payment mode for automatic EMI deductions.

3. Shortened loan tenure

Prepayment can help you close the loan earlier than scheduled.

Even if your EMI amount remains the same, your loan tenure reduces, allowing you to become debt-free sooner.

4. Flexibility to choose between lower EMI or shorter tenure

Many lenders give you the flexibility to decide whether you prefer lower EMIs or a reduced tenure after prepayment.

Choose based on your current cash flow and future financial goals.

5. Impact on interest payable

Whether you reduce EMIs or tenure, prepayment reduces the total interest outgo.

The earlier you prepay, the higher your interest savings.

6. Potential processing or prepayment charges

Some lenders may levy nominal prepayment or processing fees.

Always check the terms before proceeding to avoid surprises.

7. Simplified payment options

Prepayment can often be made using quick digital methods.

Use tools like bajaj finance quick payment for hassle-free and instant payments toward your loan account.

8. Positive impact on credit score

Prepaying your LAS reflects responsible credit behaviour.

Timely loan closure or reduced EMIs can enhance your credit profile.

Conclusion

Prepaying your Loan Against Securities is a smart financial move that can lead to substantial interest savings, quicker loan closure, and improved credit health. Whether you opt to lower your EMIs or shorten the tenure, prepayment gives you greater control over your finances. With multiple payment methods and minimal documentation, the process is quick and hassle-free. Just ensure you review your lender’s terms and choose the option that aligns with your financial goals. By planning your prepayment strategically, you not only reduce your debt burden but also unlock the full potential of your pledged investments sooner.

Loan support made easy—read on — H2

Wrong Linking Account For Loan Against Securities Emi Deduction |

||||