Loan settlement: Everything you need to know

Loan settlement is a crucial process that ensures your outstanding loan is cleared, either by full repayment or negotiation with the lender for a reduced amount. It is often an option for borrowers facing financial difficulties and struggling to make regular EMI payments. While loan settlement can provide relief, it can also impact your credit score and future borrowing capacity. Whether you are dealing with a personal loan, gold loan, or any other type of credit, understanding the settlement process, its impact, and the necessary steps is essential.

If you have taken a gold loan and find that the loan amount has not been credited to your account, there are several steps to resolve the issue:

Steps to take if your gold loan amount is not credited

1. Verify loan disbursement status with the lender

Before panicking, check with your lender whether the loan has been approved and processed. Sometimes, delays occur due to verification procedures or banking system issues. Contact the loan officer or check your lender’s online portal for updates on the disbursement status.

2. Check your registered bank account details

Ensure that the bank account provided for loan disbursement is correct. Any discrepancies in account number, IFSC code, or other banking details can lead to delays. Cross-check the details with your lender and update them if necessary.

3. Contact customer support for transaction tracking

If your lender confirms that the loan has been disbursed but you haven’t received it, contact customer support. Provide your loan reference number and request them to track the transaction. Banks and NBFCs often have dedicated teams to resolve such payment issues.

4. Request a confirmation email or transaction reference

To have a clear record, ask your lender for an official email confirmation or transaction reference number. This will help you follow up with your bank in case of delays and provide proof of disbursement if required.

By taking these proactive steps, you can quickly resolve disbursement issues and ensure smooth access to your gold loan funds.

How long does it take for the gold loan amount to get credited?

| Type of Lender | Processing Time | Factors Affecting Time |

| Banks | 2-4 hours | Bank working hours, holidays, server issues |

| NBFCs (Non-Banking Financial Companies) | 30 minutes - 2 hours | Instant approval for pre-verified customers |

| Online Gold Loan Providers | 15 minutes - 1 hour | Automated processing, customer verification |

| Co-operative Banks & Small Lenders | 1-2 days | Manual verification, fund availability |

| Branch-Based Processing | 4-6 hours | Depends on queue and manual approval |

- Most gold loans are credited within a few hours, but processing time may vary.

- Online lenders and NBFCs offer faster disbursement compared to traditional banks.

- Delays can occur due to bank holidays, incorrect account details, or verification issues.

- Customers should verify details and track the status to ensure timely fund transfer.

Whom to contact for resolving the gold loan credit issue?

If you experience a delay in receiving your gold loan amount, here are the key contacts to reach out to for a quick resolution:

Lender’s customer service

- Contact the customer care helpline of your bank or NBFC.

- Provide your loan reference number for faster assistance.

- Use official communication channels such as email, phone, or live chat.

Loan branch manager

- Visit the branch where you applied for the loan.

- Speak to the branch manager or loan officer for immediate updates.

- Request an official document confirming the transaction status.

Bank support team (for account-related issues)

- If the lender has disbursed the loan but you haven’t received it, contact your bank.

- Provide the transaction reference number shared by the lender.

- Ask your bank to check for any pending or failed transactions.

Escalation to grievance cell

- If customer service is unable to resolve the issue, escalate the matter to the grievance redressal department of the lender.

- Most banks and NBFCs have a dedicated complaints section on their website.

- Register a formal complaint and request urgent resolution.

Ombudsman or RBI (as a last resort)

- If the issue remains unresolved for an extended period, you can file a complaint with the Banking Ombudsman or the RBI.

- This step is only recommended if all other options fail to provide a solution.

- By following these steps and reaching out to the appropriate authorities, you can ensure that your gold loan amount is credited without unnecessary delays.

What to do if the issue persists?

If the issue of your gold loan amount not being credited continues despite following the necessary steps, consider these advanced solutions:

- Revisit the lender’s branch: Visit the nearest branch in person and request an immediate resolution from the branch manager. Carry all relevant documents, including the loan sanction letter, bank statements, and transaction details.

- Submit a formal complaint: If customer support has not resolved your issue, file a formal complaint through the lender’s online grievance portal or email their complaints department.

- Follow up regularly: Track the complaint status and follow up consistently until you receive a resolution. Ask for estimated resolution timelines and request updates in writing.

- Seek legal help: If all other avenues fail, consider legal action by consulting a financial lawyer who can guide you on your rights and possible legal recourse.

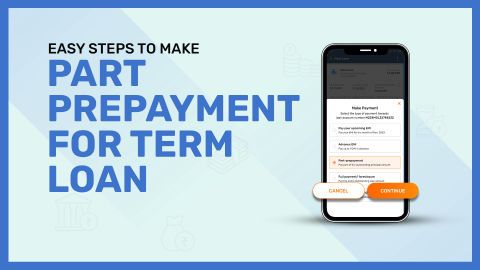

Monitor future transactions: If your gold loan has finally been credited after a delay, ensure that future transactions related to part payment for gold loan or EMI payments are processed smoothly. Also, be aware of potential gold loan EMI delay charges to avoid additional financial burdens.

By taking these steps, you can effectively handle persistent issues and ensure a smooth loan disbursement experience.

Conclusion

Ensuring that your gold loan amount is credited on time is crucial for managing your financial needs. By verifying the disbursement status, checking your bank details, and reaching out to customer support, you can resolve most issues efficiently. If delays persist, escalating the matter to higher authorities or filing a formal complaint can provide a solution. Staying proactive with your financial transactions can prevent such problems in the future. Always keep track of your loan repayment schedule, including part payment for gold loan and possible gold loan EMI delay charges, to maintain a smooth borrowing experience.

By following the necessary steps and staying in constant communication with your lender and bank, you can minimize potential financial disruptions. Being informed about processing times, lender policies, and escalation options ensures you have a hassle-free borrowing experience. Stay vigilant and proactive in tracking loan transactions to avoid unexpected issues.