Managing your Loan Against Securities (LAS) responsibly involves more than just securing funds — it’s about staying on top of your repayment schedule, especially your pending EMIs. Loan Against Securities allows you to unlock the value of your investments without liquidating them, providing essential liquidity when you need it most. However, overlooking your pending EMIs can lead to unwanted complications, including penalties, higher interest accrual, and even the risk of your pledged securities being liquidated. Regularly checking your pending EMI status ensures you remain in control of your financial commitments and can plan repayments proactively. Platforms like Bajaj Finserv make it simple to monitor your loan account online, giving you instant access to your outstanding balances, due dates, and payment history. By staying informed, you safeguard both your credit score and your valuable investments. Let’s explore why keeping track of your pending EMIs is crucial for your financial health.

Why you need to check pending loan against securities EMI?

When you take a Loan Against Securities (LAS), it’s crucial to keep an eye on your pending EMIs. Regularly checking your EMI status helps you stay in control of your repayment journey and protects your financial health. Here’s why it matters:

Avoid late payment penalties

Missing an EMI due date can attract late payment charges. By checking your pending EMIs regularly, you ensure timely payments and save money on penalties.

Safeguard your credit score

Your credit score reflects your repayment behaviour. Timely EMI payments, tracked regularly, help maintain a healthy score for future credit opportunities.

Prevent liquidation of securities

Lenders may liquidate your pledged securities if EMIs remain unpaid. Monitoring your dues protects your valuable investments from being sold off prematurely.

Plan finances better

Knowing your upcoming EMIs allows you to manage your cash flow efficiently, making it easier to prioritise expenses and avoid last-minute financial stress.

Detect errors early

Technical glitches or human errors can sometimes reflect incorrect EMI dues. Regular checks help you spot and resolve discrepancies quickly.

Stay informed about loan status

Tracking your pending EMIs keeps you updated about the loan tenure, outstanding principal, interest payable, and repayment schedule.

Ensure peace of mind

Being aware of your pending EMIs gives you confidence and peace of mind, knowing your loan is under control without hidden surprises.

In short, staying proactive with your pending EMIs empowers you to manage your LAS responsibly and keeps your financial goals on track.

Methods to check your pending loan against securities EMI

Staying updated on your pending Loan Against Securities (LAS) EMI is essential to manage repayments effectively. Here are the convenient methods you can use to check your EMI status:

Through the official website

- Visit the Bajaj Finserv official website.

- Log in to your account using your registered credentials.

- Navigate to the ‘Service’ section to view your loan summary and pending EMIs.

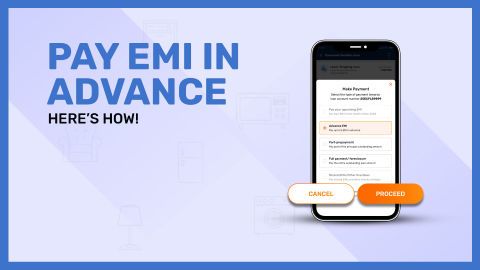

Using the mobile app

- Download the Bajaj Finserv app on your smartphone.

- Log in securely with your customer ID or mobile number.

- Check your loan dashboard to find detailed information about pending EMIs, due dates, and repayment schedules.

By contacting customer care

- Call the customer care number for assistance.

- Provide your loan details for verification.

- The executive will give you real-time updates on your pending EMIs and payment history.

Email support

- Send an email to the official support team with your loan account details.

- You will receive a detailed response about your EMI status within a stipulated time.

Visiting the nearest branch

- Visit a nearby Bajaj Finserv branch.

- Carry valid ID proof and loan documents.

- A representative will assist you in checking your pending EMIs.

Check your loan statement

- Download your latest loan statement via the portal.

- The statement provides a complete overview of your outstanding balance, pending EMIs, and interest breakdown.

Through loan alerts and notifications

- Opt for SMS and email alerts to receive timely notifications about your upcoming EMIs.

- These alerts help you stay informed without manually checking the portal.

Using any of these methods ensures you remain informed about your pending EMIs, helping you avoid late payments and manage your Loan Against Securities responsibly.

Check pending loan against securities EMI using online banking

Online banking is a fast and convenient way to check your pending Loan Against Securities (LAS) EMI. Here’s how you can do it:

- Log in to Your Net Banking Account

- Visit your bank’s official website.

- Enter your user ID and password to access your account securely.

- Navigate to the Loans Section

- Once logged in, go to the ‘Loans’ or ‘Loan Accounts’ section.

- Select your active Loan Against Securities account.

- View Loan Summary

Your dashboard will display key details, including total loan amount, tenure, interest rate, and pending EMIs.

Check Repayment Schedule

- Access the detailed repayment schedule to see upcoming EMI dates and amounts due.

- Download Loan Statement

- Download or request your loan statement directly from the online banking portal.

The statement provides a complete overview of pending EMIs, payments made, and outstanding balance.

Set Payment Reminders

- Use the online banking tool to set automatic payment reminders for upcoming EMIs.

- This helps you avoid missed payments and late fees.

- Enable Alerts and Notifications

- Subscribe to SMS or email alerts for updates on your EMI payments.

Stay informed about your loan status without logging in frequently.

Contact Customer Support via Net Banking

Use the secure messaging or chat feature within the portal for EMI-related queries.

Alternatively, call the customer care number for quick assistance.

Online banking keeps you updated about your LAS EMI status anytime, anywhere, making loan management effortless and efficient.

How to view pending loan against securities EMI through your lender’s app

Your lender’s mobile app offers an easy way to monitor your Loan Against Securities EMI status. Here’s a step-by-step guide:

- Download the Official App

- Install the Bajaj Finserv app from Google Play Store or Apple App Store.

- Ensure the app is updated for the latest features.

- Log in to Your Account

- Enter your registered mobile number or customer ID.

- Verify with OTP for secure access.

- Access the Loan Section

- Once logged in, navigate to the ‘Loans’ section on the app dashboard.

- Select your active Loan Against Securities account.

- View EMI Details

The app will display your upcoming EMI amount, due date, and repayment schedule.

Download the EMI Statement

For detailed tracking, download your EMI statement directly from the app.

Review past payments and pending EMIs in one place.

- Set Up EMI Reminders

- Enable in-app notifications or push alerts for EMI due dates.

- Stay ahead of your repayments without manual tracking.

- Use the EMI Calculator

- The app often includes an EMI calculator to estimate future payments.

- Plan your budget effectively based on upcoming dues.

- Raise Service Requests

- If you spot discrepancies in EMI amounts, raise a service request directly in the app.

- You can also call the customer care number for immediate help.

Check Loan Details Anytime

Use the app to access comprehensive loan details instantly.

Stay informed about your outstanding balance, interest charges, and due EMIs.

With your lender’s app, tracking your LAS EMI status becomes seamless, giving you full control over your loan repayment journey.

How to check pending loan against securities EMI using the lender’s website

Checking your pending Loan Against Securities (LAS) EMI through your lender’s website is simple and convenient. Here’s a step-by-step guide to help you stay updated:

- Visit the Official Lender’s Website

- Open your browser and go to the Bajaj Finserv official website.

- Ensure you’re using a secure internet connection to protect your data.

- Log In to Your Account

- Click on the ‘Sign In’ or ‘My Account’ option.

- Enter your registered mobile number, email ID, or customer ID.

- Authenticate using the OTP sent to your registered mobile number.

- Navigate to the ‘Loan Accounts’ Section

- After logging in, go to the ‘Loan Accounts’ or ‘Loans’ section from the dashboard.

- Select your active Loan Against Securities account for details.

- View EMI Details

- Check the EMI status displayed alongside your loan account.

- You will see upcoming EMI amounts, due dates, and any overdue payments.

- Download the Loan Statement

- Download your detailed loan statement for a complete view of your repayment status.

- The statement will highlight paid and pending EMIs, principal outstanding, and interest details.

- Access the Repayment Schedule

- Review the repayment schedule available on the portal.

- It provides a month-wise breakdown of EMIs, helping you plan future payments.

- Check Payment History

- Use the website to track past payments.

- Ensure all previous EMIs have been correctly credited and identify any pending dues.

- Set Payment Reminders

- Subscribe to email or SMS alerts for timely EMI reminders.

- This proactive step helps you avoid late fees and missed payments.

- Raise Queries or Service Requests

- If you notice discrepancies, raise a service request directly on the portal.

- Alternatively, reach out to the customer care number for quick assistance.

- Regularly Monitor Your Account

- Make it a habit to check your loan details frequently.

- Staying updated ensures better loan management and peace of mind.

By following these steps, you can effortlessly track your pending EMIs and manage your Loan Against Securities more efficiently through the lender’s website.

Using bank statements to check pending loan against securities EMI

Bank statements can be an effective way to track your pending Loan Against Securities (LAS) EMIs. Here’s how you can use them efficiently:

- Download Your Recent Bank Statement

- Access your bank’s online portal or mobile app.

- Download the latest bank statement covering your EMI cycle period.

- Look for EMI Transactions

- Search for entries marked as ‘EMI payment’ or automated debit transactions.

- Use your bank’s search or filter option to quickly locate EMI deductions.

- Identify Loan-Related Debits

- Cross-check entries against your lender’s name, such as Bajaj Finserv.

- This helps you distinguish between EMI payments and other transactions.

- Check for Missed or Delayed Payments

- Review your statement for any months where EMI payments are missing.

- Missing entries could indicate pending EMIs or failed transactions.

- Track Payment Dates

- Verify that EMIs are being debited on the scheduled date.

- Delayed payments could attract penalties and affect your loan repayment track record.

- Verify EMI Amounts

- Ensure the EMI amounts match the agreed instalment figure.

- Any discrepancy should be reported to your lender immediately.

- Monitor Auto-Debit Status

- Confirm if your auto-debit instruction is active and functioning properly.

- A lapse might result in unpaid EMIs.

- Calculate Pending EMIs

- Tally the number of missed payments to estimate your pending EMI count.

- Stay ahead by reconciling this with your lender’s records.

- Raise Queries for Unclear Transactions

- If you notice unidentified deductions, contact your bank or lender.

- Use Bajaj Finserv’s emi payment guide for clarity.

- Maintain Regular Checks.

- Periodically reviewing your bank statements ensures you stay informed.

- It also helps you manage your loan effectively and avoid surprises.

Using your bank statement is a smart and accessible way to monitor your pending EMIs and keep your loan journey on track.

Conclusion

Staying updated on your pending Loan Against Securities EMIs is crucial for maintaining a healthy financial record and avoiding penalties. Whether you choose to check through the lender’s website, mobile app, or even your bank statements, each method offers convenience and clarity. Regular monitoring helps you manage repayments smoothly and ensures you never miss a due date. Additionally, setting up reminders and reviewing your loan details frequently can keep you in control of your finances. If you face any issues, don't hesitate to reach out to customer support for prompt assistance and seamless loan management.

Loan support made easy—read on

Loan Against Securities Disbursed But Amount Is Not Credited |

||||