A business loan excess payment occurs when a borrower pays more than the required instalment amount on their loan. This can be a strategic move for businesses looking to reduce debt faster, save on interest, and improve financial flexibility. Excess payments can be made as a lump sum or as extra contributions on regular instalments, depending on the loan agreement. While many lenders allow excess payments without penalties, some may impose fees or restrictions, so it's crucial to review the loan terms before making additional payments.

By making excess payments, businesses can shorten the loan tenure, improve credit scores, and free up capital for future investments. However, it’s important to balance loan prepayment with other financial priorities, such as maintaining cash flow and funding operational expenses. Understanding the benefits and potential limitations of excess payments can help businesses make informed financial decisions that align with their growth strategies.

Step-by-step guide to requesting a business loan refund

If you have made excess payments on your business loan and wish to request a refund, follow this step-by-step guide to ensure a smooth and hassle-free process.

1. Check your loan account statement

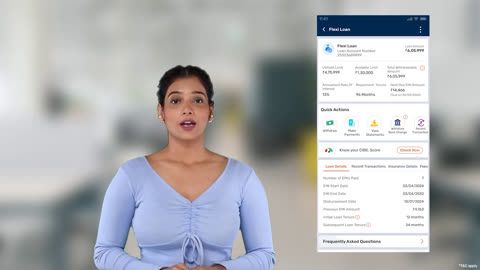

Log in to your lender’s online service portal or mobile app.

Download your loan statement to verify any excess payments.

Ensure that the overpayment amount is clearly reflected.

2. Review the loan terms and conditions

Check your loan agreement for prepayment and refund policies.

Ensure there are no penalties or restrictions on requesting a refund.

Confirm if the excess amount can be adjusted against future EMIs.

3. Contact customer support

Call the lender’s customer care number or visit the nearest branch.

Provide your loan account number and personal details for verification.

Explain the reason for your refund request and confirm eligibility.

4. Submit a formal refund request

If required, submit a written refund request via email or through an online portal.

Include necessary details like:

Loan account number

Excess payment amount

Mode of payment used for the extra amount

Bank details for the refund (if applicable)

5. Provide supporting documents

Attach copies of:

Loan statement showing excess payment

Bank transaction receipts for proof of extra payment

Any other documents requested by the lender

6. Follow up on the refund status

Keep track of your request through the customer portal or via email updates.

If there are delays, follow up with customer support for resolution.

7. Receive the refund

Once approved, the refund amount will be credited to your registered bank account.

Ensure that the refund reflects in your account and verify the details.

By following these steps, you can efficiently request and receive your business loan refund without unnecessary delays.

Documents required for a business loan refund application

When applying for a business loan refund, submitting the correct documents is crucial for a smooth and hassle-free process. Proper documentation helps verify your loan details, excess payments, and eligibility for a refund. Below is a list of essential documents required, along with a description of their importance.

1. Loan account statement

A copy of your latest loan account statement from the lender is required to verify your loan details.

This statement should clearly show the total loan amount, EMI payments made, and any excess payment that qualifies for a refund.

2. Proof of excess payment

To validate that an overpayment has been made, you must submit proof of the transaction.

Acceptable proofs include:

Bank statements showing the extra payment deduction.

NEFT/RTGS or UPI transaction receipts for the overpaid amount.

Cheque/DD payment copies, if applicable.

3. Loan agreement copy

A copy of the original loan agreement helps in confirming the terms and conditions regarding refunds and prepayments.

It ensures that the refund request aligns with the agreed loan policies.

4. Identity and address proof

To confirm the borrower’s identity, the following KYC documents are required:

PAN Card (mandatory for financial transactions).

Aadhaar Card/Voter ID/Passport (for identity and address verification).

GST Certificate or Business Registration Document (for business verification, if applicable).

5. Bank account details for refund processing

A cancelled cheque or bank passbook copy is needed to verify the account where the refund will be credited.

This ensures that the refund is transferred to the correct business or personal account.

6. Refund request application form

A formal refund request letter or application form must be submitted, mentioning:

Loan account number

Amount of excess payment

Reason for the refund request

Preferred mode of refund

By ensuring all these documents are correctly submitted, you can expedite your business loan refund application and avoid unnecessary delays in processing.

Common reasons for excess payment in business loans

Excess payments on a business loan can occur due to various reasons, ranging from miscalculations to intentional prepayments. Understanding these reasons can help businesses manage their loan repayments effectively and avoid unnecessary financial strain. Here are some common causes of excess payments in business loans:

1. Accidental overpayment

Borrowers may mistakenly transfer more than the required EMI amount due to manual errors while making payments.

This can happen when multiple payments are made in a single month.

2. Auto-debit or standing instruction errors

If an auto-debit instruction is active and the borrower also makes a manual payment, it may lead to an excess amount being deducted.

Sometimes, banks fail to stop auto-debit even after loan closure, resulting in extra payments.

3. Prepayment or foreclosure amount miscalculation

Businesses making part-prepayments or full foreclosure payments might miscalculate the exact amount required, leading to excess payments.

Some lenders adjust excess payments against future EMIs instead of issuing a refund.

4. Additional charges paid unknowingly

In some cases, businesses may accidentally pay processing fees, penalties, or charges twice due to confusion in the loan statement.

Overpayment of interest components can also contribute to excess payments.

5. Change in EMI amount due to loan restructuring

If a borrower restructures the loan or opts for loan tenure changes, the EMI amount may be adjusted.

If payments are still made as per the old schedule, it can lead to overpayment.

6. Loan repayment before EMI adjustment

If a borrower repays a lump sum before the next EMI deduction, the automated EMI process may still deduct the installment, causing an overpayment.

7. Bank processing delays or system errors

Sometimes, technical issues or delays in loan account updates can result in an incorrect excess deduction.

Duplicate payments might occur if the system fails to register a previous transaction correctly.

Understanding these common reasons can help borrowers track their payments better, avoid unnecessary financial errors, and take timely action to claim refunds for excess payments.

What to expect during the refund process?

If you have made an excess payment on your business loan and applied for a refund, understanding the refund process can help you stay informed and manage expectations. Here’s what typically happens once you initiate the refund request with Bajaj Finance.

1. Acknowledgment of refund request

Once you submit your refund request, Bajaj Finance will acknowledge it through an official confirmation via email or SMS.

The acknowledgment will include a reference number that you can use for tracking your request.

2. Verification of loan and payment details

The lender will review your loan account statement to confirm the excess payment.

Your submitted documents, such as bank statements, payment receipts, and loan agreements, will be verified to ensure authenticity.

This process helps confirm that the refund request is valid and adheres to Bajaj Finance’s refund policies.

3. Eligibility assessment and processing

Bajaj Finance will check whether the excess amount qualifies for a refund or an adjustment against future EMIs.

If eligible, the refund request will be processed; otherwise, you may be given an option to use the excess payment to reduce your loan balance.

If any outstanding charges (such as foreclosure fees or penalties) exist, they may be deducted before issuing the refund.

4. Approval and disbursement of the refund

Once approved, the refund is typically processed within 7 to 15 business days, depending on internal processing times.

The refund amount will be transferred to your registered bank account, so it’s important to provide accurate bank details.

5. Tracking and follow-up

You can track your refund request status via the Bajaj Finance customer portal or by contacting customer support.

In case of any delays, you can follow up with the lender using your reference number.

By understanding these steps, borrowers can effectively manage their expectations and ensure a smooth refund process without unnecessary delays.

Tips for avoiding overpayments on your business loan

Overpaying your business loan can tie up valuable funds that could be used elsewhere in your business. By following these tips, you can avoid excess payments and manage your loan efficiently.

1. Monitor your loan account regularly

Frequently check your loan balance and payment history through the business loan Bajaj Finance login.

Reviewing statements helps detect any unintentional overpayments.

2. Set up payment alerts

Enable SMS or email notifications for payment reminders and confirmations.

This ensures you do not double-pay an installment by mistake.

3. Be cautious with auto-debit instructions

If you use auto-debit for EMI payments, make sure to update or cancel it if you make a manual payment.

Verify with your bank that auto-debits stop after loan closure.

4. Verify EMI changes after loan restructuring

If you opt for loan restructuring or tenure changes, confirm the new EMI amount before making payments.

This helps prevent paying an old EMI amount that may no longer be applicable.

5. Avoid duplicate payments

If a payment fails, check whether it has been deducted from your bank account before retrying.

Always wait for payment confirmation before making another transaction.

6. Cross-check prepayment and foreclosure amounts

If you plan to prepay or foreclose your loan, get an official calculation from Bajaj Finance.

Overestimating the required amount can lead to excess payments.

7. Track your loan status

Keep an eye on your repayment progress through the Bajaj Business Loan Status page.

This helps in verifying outstanding balances before making any additional payments.

8. Contact customer support for clarifications

If you are unsure about your payment schedule, excess payments, or loan status, reach out to Bajaj Finance customer service for assistance.

By following these steps, you can efficiently manage your business loan payments, avoid overpayments, and ensure a smooth repayment process.

Conclusion

Avoiding excess payments on your business loan ensures better financial management and prevents unnecessary fund lock-in. By regularly monitoring your loan account, verifying EMI amounts, and being cautious with auto-debits, you can effectively prevent overpayments. If you’ve already made an excess payment, understanding the refund process and submitting the required documents can help you recover the amount quickly. Staying informed about your loan status and reaching out to Bajaj Finance customer support when needed can further streamline your loan management. Smart financial planning and proactive tracking will help you optimize loan repayments and maintain better cash flow for business growth.