Business loan mandate online: A complete guide

In today’s fast-paced financial landscape, securing a business loan requires proper authorization and documentation. One crucial document in this process is the Business Loan Mandate—a formal authorization that allows a financial institution or loan consultant to act on behalf of a business in securing a loan. With the rise of digital banking and financial services, businesses can now obtain and submit their loan mandates online, making the process faster, more efficient, and hassle-free.

A Business Loan Mandate Online streamlines loan approvals by ensuring that all necessary permissions and details are in place before lenders process a loan application. It eliminates unnecessary delays, reduces paperwork, and enhances transparency in loan negotiations. Whether you're a startup seeking funding or an established company looking for expansion capital, understanding how a business loan mandate works can help you secure financing with ease.

Let’s explore what a Business Loan Mandate entails, why it is essential, and how you can obtain one online.

What is a business loan mandate?

A Business Loan Mandate is a legal authorisation that empowers an individual or entity—such as a financial consultant, broker, or lending institution—to act on behalf of a business in securing a loan. It grants permission to negotiate terms, submit documentation, and finalize agreements with lenders, ensuring a smooth and structured loan application process.

Why is a business loan mandate important?

A Business Loan Mandate plays a crucial role in simplifying the loan process, particularly for companies that seek professional financial assistance. It helps businesses:

Avoid procedural delays by ensuring that a trusted representative handles the loan process efficiently.

Reduce paperwork and administrative burdens by streamlining communications between borrowers and lenders.

Ensure transparency and accountability in financial dealings, as all responsibilities and permissions are clearly outlined.

Key components of a business loan mandate

A well-structured Business Loan Mandate includes:

Authorisation details – Specifies the entity or individual granted authority to act on behalf of the business.

Scope of power – Defines the specific actions that the authorized party can undertake, such as negotiating loan terms or signing agreements.

Loan specifications – Outlines details like loan amount, interest rate preferences, and repayment terms.

Validity and duration – Mention the timeframe during which the mandate remains in effect.

Signatures and approval – Requires the business owner's or board members' signatures to validate the document.

How to obtain a business loan mandate online?

With digital transformation, businesses can now generate and submit loan mandates online through:

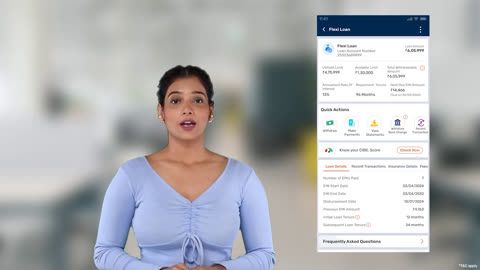

Banking portals that offer digital mandate submission for faster loan approvals.

Financial consultants who provide online mandate documentation services.

Loan marketplaces that streamline the process with electronic verification and approvals.

By leveraging online platforms, businesses can accelerate funding processes while ensuring compliance with financial regulations.

Benefits of registering a business loan mandate online

In today’s digital era, businesses are increasingly opting for online solutions to streamline financial processes. One such advancement is the ability to register a Business Loan Mandate Online, which simplifies loan approvals and enhances efficiency. Below are the key benefits of opting for an online business loan mandate:

1. Faster loan processing

Registering a loan mandate online reduces processing time by eliminating manual paperwork.

Digital submissions ensure quicker verification and approval from financial institutions.

2. Convenience and accessibility

Businesses can submit their mandate anytime, from anywhere, without visiting banks or financial consultants in person.

Online portals provide user-friendly interfaces for easy document uploads and tracking.

3. Reduced paperwork and documentation

Digital mandates minimise the need for extensive paperwork, making the process eco-friendly and hassle-free.

Online platforms often auto-fill details and validate data, reducing errors.

4. Enhanced transparency and security

Online registrations provide real-time tracking and notifications, keeping businesses informed about their mandate status.

Digital submissions use encryption and authentication methods, ensuring data security and preventing fraud.

5. Cost-effective solution

Businesses save on operational costs by avoiding physical visits, courier charges, and document printing.

Many online platforms offer free or low-cost registration services compared to traditional methods.

6. Seamless collaboration with financial institutions

Online mandates facilitate direct communication between businesses and lenders, ensuring smoother negotiations.

Financial advisors and consultants can access mandate details digitally, expediting the loan process.

7. Legally binding and compliant

Digital loan mandates are legally recognized and comply with banking and financial regulations.

They come with digital signatures and authentication, making them valid for legal transactions.

8. Multi-lender access

Businesses can register mandates with multiple financial institutions simultaneously, increasing loan approval chances.

Online systems allow businesses to compare loan offers from different lenders before proceeding.

9. Improved accuracy and error reduction

Automated digital forms minimize human errors that often occur in manual paperwork.

Real-time validation checks help correct discrepancies before submission.

10. Quick modifications and updates

Businesses can easily amend or revoke mandates online if needed, ensuring flexibility in financial dealings.

Updates are processed instantly, avoiding unnecessary delays.

By registering a Business Loan Mandate Online, companies can secure funding efficiently while enjoying a streamlined, cost-effective, and secure process.

Documents needed for business loan mandate registration

Registering a Business Loan Mandate requires submitting specific documents to verify the business’s identity, financial status, and authorisation details. These documents help financial institutions process loan applications smoothly and ensure compliance with banking regulations. Below is a comprehensive list of essential documents needed for Business Loan Mandate Registration:

1. Business identity proof

Certificate of Incorporation (for Private Limited Companies, LLPs, and Partnerships)

GST Registration Certificate

MSME Registration (if applicable)

Trade License (for specific businesses)

2. Business address proof

Utility bills (electricity, water, or telephone bill)

Rent agreement (if office premises are rented)

Property ownership documents (if owned)

3. PAN card of the business

A valid PAN card of the business entity is required for taxation and verification purposes.

4. Business bank statements

Last 6 to 12 months of bank statements to assess financial health and transaction history.

Helps lenders evaluate the business’s cash flow and loan repayment capacity.

5. KYC documents of Business owners/directors

PAN Card & Aadhaar Card of the proprietor, partners, or directors.

Passport or Driving License (as an alternative ID proof).

Voter ID (if required).

6. Partnership deed or MOA & AOA (if applicable)

Partnership Deed for partnership firms.

Memorandum of Association (MOA) & Articles of Association (AOA) for private limited companies and LLPs.

Defines the business structure and authorization rights.

7. Board resolution (for companies & LLPs)

A board resolution approving the loan mandate and authorizing a representative to act on behalf of the company.

Ensures compliance with corporate governance.

8. Business financial statements

Audited balance sheets for the last 2-3 years (for established businesses).

Profit & Loss (P&L) statement to assess financial stability.

Income Tax Returns (ITR) for the last 2-3 years to confirm tax compliance.

9. Loan-specific documents

Loan application form, if required.

Project reports or business plans (for large loan amounts).

10. Digital Signature Certificate (DSC) or E-Signature (if applicable)

Required for online submissions to authenticate the mandate securely.

By preparing these documents in advance, businesses can fast-track their Business Loan Mandate registration and secure funding efficiently.

Step-by-step guide to registering a business loan mandate online

Registering a Business Loan Mandate Online is a simple and efficient process that allows businesses to authorize financial institutions, consultants, or lenders to act on their behalf. Below is a step-by-step guide to completing the registration process seamlessly.

Step 1: Choose a lender or financial institution

Research and select a bank, NBFC, or financial consultant that offers online loan mandate registration.

Compare loan options, interest rates, and processing fees before proceeding.

Step 2: Visit the official online portal

Go to the official website of the chosen financial institution or loan consultant.

Navigate to the Business Loan Mandate Registration section.

Step 3: Create an online account (if required)

Some platforms require businesses to sign up and create an account.

Use the business’s registered email ID and mobile number for authentication.

Step 4: Fill out the loan mandate form

Provide essential business details such as:

Business Name & Type (Proprietorship, Partnership, Pvt. Ltd., LLP)

Business Registration Number

GST and PAN Details

Loan Amount and Purpose

Enter the details of the authorised representative who will act on behalf of the business.

Step 5: Upload the required documents

Submit scanned copies of the necessary documents, including:

Business identity and address proof

PAN Card of the business and authorised representative

Board resolution (for companies)

Bank statements and financial reports

Ensure all uploaded documents are clear and in PDF/JPEG format as per the portal’s guidelines.

Step 6: Verify and authenticate the mandate

Some portals require OTP-based verification on the registered mobile number.

If needed, use Digital Signature Certificate (DSC) or e-Signature to authenticate the mandate.

Step 7: Submit the application

Review all the entered details and uploaded documents for accuracy.

Click on Submit to complete the online registration process.

Step 8: Track application status

Most online platforms provide a tracking feature to check the mandate’s approval status.

Keep an eye on email/SMS notifications for updates from the financial institution.

Step 9: Receive mandate approval

Once verified, the lender or consultant will approve the mandate and issue a confirmation.

The authorized representative can now proceed with the loan application process.

Step 10: Modify or revoke the mandate (if required)

Businesses can update or revoke the mandate online if needed.

Log in to the portal and follow the modification or cancellation steps as per the platform’s process.

By following these steps, businesses can register a Business Loan Mandate online quickly and securely, ensuring faster loan approvals and hassle-free transactions.

Common issues and solutions in business loan mandate registration

Registering a Business Loan Mandate Online is generally a smooth process, but businesses may encounter certain challenges. Below are some common issues faced during the registration process, along with practical solutions to resolve them.

1. Incomplete or incorrect documentation

Issue: Missing or incorrect documents, such as mismatched business details, can lead to rejection.

Solution:

Double-check all required documents before submission.

Ensure business registration details, PAN, and bank statements are up-to-date and correctly formatted.

2. Authorisation errors

Issue: The authorised representative’s details may not match business records, leading to delays.

Solution:

Verify that the authorized signatory’s details match the company’s official records.

Submit a properly signed board resolution (for companies) or a partnership agreement (for partnerships).

3. Technical glitches on online portals

Issue: Slow websites, submission errors, or system timeouts can cause registration failures.

Solution:

Use a stable internet connection and clear browser cache before retrying.

If the issue persists, contact the lender’s technical support team for assistance.

4. Digital Signature Certificate (DSC) or OTP authentication issues

Issue: Failure to authenticate the mandate due to expired DSC or OTP delivery failures.

Solution:

Ensure the Digital Signature Certificate (DSC) is valid and registered with the lender’s portal.

For OTP issues, verify the registered mobile number and check SMS spam folders.

5. Processing delays from financial institutions

Issue: Lenders may take longer to verify documents and approve the mandate.

Solution:

Follow up with the lender’s support team for status updates.

Opt for a trusted financial institution with faster processing times.

6. Mismatch in business loan details

Issue: Loan amount, tenure, or terms differ from what was originally discussed.

Solution:

Review all loan mandate details carefully before submission.

If discrepancies arise, contact the lender to rectify them before approval.

7. Challenges in loan foreclosure or overdue payments

If a business needs to pre-close a loan, understanding the foreclosure charges for business loan is essential.

In case of late payments, businesses should be aware of their business loan overdue payment obligations to avoid penalties.

By addressing these common issues proactively, businesses can ensure a smooth and hassle-free Business Loan Mandate Registration process.

Conclusion

Registering a Business Loan Mandate Online is a crucial step in securing funding efficiently. By understanding the process, preparing the required documents, and addressing potential challenges, businesses can streamline loan approvals and avoid unnecessary delays. Digital registration offers benefits like faster processing, reduced paperwork, and enhanced security, making it a preferred choice for modern businesses. Additionally, staying informed about key aspects such as foreclosure charges for business loans and business loan overdue payments helps in better financial planning. Taking a proactive approach ensures smooth transactions and maximizes the benefits of business financing.