The evolution of business loan payments: Exploring convenient digital payment modes

Securing a business loan is a crucial step for entrepreneurs and enterprises looking to expand, manage cash flow, or invest in growth opportunities. While obtaining a loan is important, how you make repayments is equally significant. With rapid advancements in financial technology, traditional payment methods like cash and checks are being replaced by faster, safer, and more efficient digital payment options.Business owners today have access to multiple payment modes, including bank transfers, online payment gateways, mobile wallets, UPI, auto-debit facilities, and credit cards. These modern methods not only enhance convenience but also improve financial management with real-time tracking and automated payments. Moreover, digital payment options reduce the risk of late payments, ensuring better credit scores and stronger lender relationships.

In this article, we’ll explore why digital payment modes are the preferred choice for business loan repayments and how they contribute to a seamless and secure financial experience.

Why choose digital payment modes for business loans?

In today’s fast-paced digital world, businesses must leverage technology to streamline their financial operations. One critical area where digital transformation has made a significant impact is in the repayment of business loans. Traditional payment methods, such as cash and checks, are becoming obsolete, making way for faster, more secure, and highly efficient digital payment modes. Here’s why choosing digital payment methods for business loans is beneficial:1. Enhanced convenience and accessibility

Digital payment modes eliminate the hassle of visiting banks or issuing physical checks. Borrowers can make payments from anywhere using internet banking, mobile banking apps, UPI, and payment gateways. This level of accessibility ensures that loan repayments are made on time without any delays.2. Multiple payment options

With digital advancements, businesses can choose from various payment modes, including:Internet Banking & NEFT/RTGS: Secure fund transfers through banking networks.

UPI (Unified Payments Interface): Instant and seamless transactions via mobile apps.

Auto-Debit Facility: Scheduled payments directly deducted from the business account.

Credit & Debit Cards: Quick and easy repayments with flexible credit options.

Mobile Wallets & Payment Apps: Fast transactions using digital wallets.

3. Faster and real-time transactions

Unlike traditional methods, digital payments are processed instantly, reducing the chances of delayed or missed payments. Real-time processing ensures that loan instalments reach the lender promptly, avoiding penalties or negative impacts on credit scores.4. Security and transparency

Digital payment platforms use advanced encryption and multi-layer authentication, ensuring secure transactions. Additionally, businesses receive instant transaction notifications and digital receipts, promoting transparency in financial dealings.5. Automated payments and reminders

Most digital platforms offer automation features where businesses can set up standing instructions for loan repayments. This reduces the burden of manual processing and prevents defaults by ensuring timely deductions.6. Better financial management and tracking

Using digital payment methods allows businesses to maintain a well-organized financial record. Transactions can be easily tracked through bank statements, mobile apps, and digital receipts, aiding in budgeting and financial planning.7. Cost-effective and paperless transactions

Digital payments eliminate the need for chequebooks, courier services, and paperwork, reducing administrative costs. Additionally, there are fewer banking charges compared to traditional modes.Benefits of digital payments for business loan repayment

Convenience and time-savingDigital payments allow businesses to make loan repayments anytime and anywhere.

Eliminates the need to visit banks or financial institutions physically.

Reduces manual paperwork, streamlining the repayment process.

Enhanced security

Digital payment platforms use encryption and authentication protocols to protect transactions.

Reduces the risk of fraud and identity theft compared to cash or check payments.

Provides secure transaction records for reference and dispute resolution.

Automated payment options

Businesses can set up automated EMI deductions, ensuring timely loan repayments.

Helps in avoiding late payment penalties and maintaining a good credit score.

Reduces human error and the risk of missing repayment deadlines.

Cost-effective and reduced processing fees

Digital transactions often have lower processing fees compared to traditional payment methods.

Eliminates costs associated with issuing and depositing checks.

Reduces administrative overhead for businesses managing multiple loans.

Better cash flow management

Digital payment platforms provide real-time transaction tracking.

Helps businesses monitor expenses and manage their cash flow efficiently.

Allows easy scheduling and budgeting for loan repayments.

Faster transaction processing

Digital payments are processed instantly, reducing payment delays.

Loan repayments reach lenders faster, improving the borrower-lender relationship.

Eliminates check clearance waiting times.

Increased transparency and accountability

Digital payments provide clear transaction records with timestamps.

Enables easy reconciliation of payments for businesses and lenders.

Reduces the chances of disputes or miscommunication regarding payments.

Accessibility to multiple payment methods

Businesses can choose from various digital payment modes like NEFT, RTGS, UPI, credit cards, and mobile wallets.

Flexibility to select the most suitable payment method for convenience and cost-effectiveness.

Encourages wider adoption of digital financial solutions among businesses.

Improved credit score and financial reputation

Consistent and timely digital repayments contribute to a positive credit history.

A better credit score increases the chances of securing future business loans at favourable interest rates.

Demonstrates financial discipline and reliability to lenders.

Eco-friendly and paperless transactions

Digital payments reduce the need for paper invoices, checks, and receipts.

Supports environmental sustainability by minimizing paper waste.

Encourages businesses to adopt a digital-first approach in financial transactions.

Top digital payment methods for business loan

Net Banking (NEFT/RTGS/IMPS)Secure and reliable method for loan repayments.

NEFT (National Electronic Funds Transfer) is ideal for scheduled payments.

RTGS (Real-Time Gross Settlement) allows high-value instant transactions.

IMPS (Immediate Payment Service) enables 24/7 instant fund transfers.

Unified Payments Interface (UPI)

Fast and seamless peer-to-peer and business transactions.

Works through mobile apps linked to bank accounts.

Enables instant fund transfers with minimal processing fees.

Credit and Debit Cards

Allows businesses to make secure loan payments online.

Credit cards offer flexibility with EMI options for better cash flow management.

Debit cards directly deduct the amount from the linked bank account, ensuring immediate payment.

Mobile Wallets

Popular wallets like Paytm, Google Pay, and PhonePe facilitate quick transactions.

Provides an alternative payment option without bank account dependency.

Can be used for small-scale business loans and micro-financing repayments.

Automated Clearing House (ACH) Transfers

Used for recurring loan repayments via scheduled auto-deductions.

Ensures timely payments, reducing the risk of late fees.

Widely adopted for EMI-based business loans.

Electronic Funds Transfer (EFT) through Payment Gateways

Enables online transactions through secure payment platforms.

Integrated into business banking systems for convenience.

Helps in managing multiple loan accounts with scheduled payments.

QR Code Payments

A quick and contactless payment method for loan repayments.

Can be scanned via banking apps, UPI, or digital wallets.

Ensures seamless and error-free transactions.

Standing Instructions (SI) and Auto-Debit Facilities

Businesses can set up automated loan repayments through their bank accounts.

Reduces manual effort and ensures timely payments.

Enhances financial discipline and avoids penalties for missed EMIs.

Blockchain-Based Digital Payments

Emerging method using cryptocurrencies and decentralized finance (DeFi).

Provides secure and transparent transactions.

Ideal for international business loan repayments with minimal processing fees.

Payment through Business Apps and ERP Systems

Many business management apps integrate payment gateways for easy loan repayments.

ERP (Enterprise Resource Planning) systems streamline financial operations, including automated payments.

Enhances financial tracking and loan management.

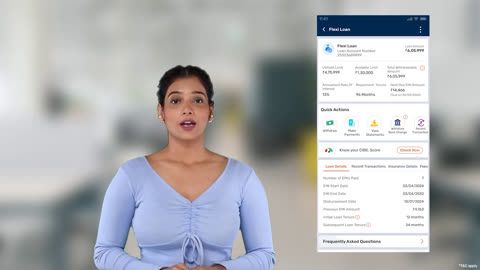

How to make digital payments for business loan repayments with Bajaj Finserv?

Login to Bajaj Finserv AccountVisit the Bajaj Finserv website or open the Bajaj Finserv mobile app.

Sign in using your registered mobile number or email address.

Navigate to the ‘Service’ section.

Select the loan account

Choose the active business loan from the list of loans linked to your account.

View loan details, outstanding balance, and EMI due date.

Choose the payment method

Bajaj Finserv offers multiple digital payment options for loan repayment:

Net Banking (NEFT/RTGS/IMPS) for quick transfers.

UPI Payments via apps like Google Pay, PhonePe, or Paytm.

Debit/Credit Cards for instant payments.

E-Wallets linked to your account.

Auto-Debit/Standing Instructions for hassle-free monthly EMI payments.

Enter payment details

If using net banking, enter your bank details and confirm the amount.

For UPI payments, scan the QR code or enter the UPI ID provided by Bajaj Finserv.

If paying through a debit/credit card, enter card details and CVV securely.

Verify and confirm payment

Double-check the repayment amount and loan account details.

Enter OTP (One-Time Password) for authentication if required.

Click on ‘Confirm’ or ‘Proceed’ to complete the transaction.

Receive payment confirmation

After successful payment, you will receive a confirmation message via SMS and email.

The payment will reflect in your Bajaj Finserv loan account within the stipulated time.

You can download the payment receipt for future reference.

Set up auto-debit for future payments

To avoid missing EMIs, enable auto-debit from your registered bank account.

Set up Standing Instructions (SI) or National Automated Clearing House (NACH) for automatic deductions.

Ensure sufficient balance in your account before the due date.

Check payment history and loan statement

Log in to your Bajaj Finserv account to track previous payments.

Download loan statements for financial records.

Contact customer support for any discrepancies or issues.

Use Bajaj Finserv Wallet for quick repayments

Bajaj Finserv Wallet allows seamless and instant loan repayments.

Link your bank account or debit card to the wallet for one-click payments.

Avail cashback offers or discounts on timely repayments.

Customer support assistance

If you face any issues, reach out to Bajaj Finserv customer support.

Use live chat, email, or toll-free numbers for assistance.

Visit the nearest Bajaj Finserv branch for offline support if required.

Security features of digital business loan payments

End-to-end encryptionDigital payment platforms use encryption protocols like SSL/TLS.

Ensures data remains secure during transactions.

Prevents unauthorized access and data breaches.

Two-Factor Authentication (2FA)

Requires multiple verification steps for login and transactions.

Includes OTP (One-Time Password) via SMS or email.

Adds an extra layer of security against fraud.

Tokenization for card payments

Converts sensitive card details into unique tokens.

Prevents exposure of actual card information.

Enhances security for recurring payments and saved cards.

Fraud detection and AI-Based monitoring

Real-time monitoring detects unusual transactions.

AI and machine learning identify fraudulent activities.

Immediate alerts and transaction blocking for suspicious activity.

Secure payment gateways

Use trusted gateways that are authorised by your bank to ensure safety.

PCI DSS compliance for handling payment data securely.

Reduces risks of data leaks and hacking attempts.

Biometric authentication

Uses fingerprint or facial recognition for login and payment approvals.

Prevents unauthorised access to digital payment platforms.

Provides a seamless yet secure user experience.

Regulatory compliance and KYC verification

Digital payment providers follow RBI and financial regulations.

KYC (Know Your Customer) ensures identity verification.

Reduces chances of identity theft and fraudulent transactions.

Auto-debit security measures

Requires explicit customer consent for standing instructions.

Notifications for scheduled payments to avoid unauthorized deductions.

Customers can revoke permissions anytime for added control.

Time-limited otps for transactions

OTPs expire within minutes to prevent misuse.

Ensures only authorized users complete transactions.

Reduces risks associated with password leaks.

Real-time transaction alerts and reports

Instant SMS and email alerts for every payment.

Businesses can track repayment history and flag issues.

Provides transparency and reduces unauthorized transactions.

Common challenges in using digital payments for business loans

Transaction failures and payment delaysNetwork issues or banking downtime can cause failed transactions.

Delayed payments may lead to penalties or additional charges.

Businesses should verify payment success and keep records for reference.

Security risks and fraud

Cyber threats like phishing, hacking, and data breaches pose risks.

Weak passwords or unsecured networks can lead to unauthorized transactions.

Using multi-factor authentication and encryption can enhance security.

Technical glitches and system downtime

Digital payment platforms may experience temporary downtime.

Bugs in mobile apps or banking portals can cause inconvenience.

Keeping alternative payment methods handy can help avoid disruptions.

High transaction fees and hidden charges

Some digital payment methods have processing fees.

International transactions may include currency conversion charges.

Businesses should review the fee structure before choosing a payment method.

Regulatory and compliance issues

Digital payments must comply with financial regulations.

Frequent policy changes may affect payment processes.

Staying updated with compliance requirements helps avoid legal issues.

Limited acceptance of certain payment methods

Some lenders may not support specific digital payment options.

Restrictions on UPI or wallets for high-value transactions.

Businesses should confirm payment method compatibility with lenders.

Difficulty in tracking and reconciling payments

Multiple transactions may lead to reconciliation challenges.

Errors in recording payments can cause disputes.

Using automated payment tracking systems ensures better financial management.

Auto-debit failures due to insufficient funds

Failed auto-debit transactions can result in penalty charges.

Ensuring adequate balance in the account prevents missed payments.

Check Business loan part payment status to verify loan payments.

EMI delay penalties

Late EMI payments attract penalty charges and impact credit scores.

Setting reminders for EMI due dates helps in timely payments.

Learn more about business loan EMI delay charges to avoid penalties.