Why paying your Lawyer Loan EMI on time is important

Paying your Lawyer Loan EMI on time is not just a financial obligation but a smart move to keep your financial profile healthy. Timely payments help you maintain a good credit score, which in turn improves your eligibility for future loans or credit cards. Consistent EMI payments demonstrate financial discipline and enhance your credibility in the eyes of financial institutions.Late EMI payments often attract penalties, increased interest charges, and a negative impact on your credit history. These penalties can accumulate quickly, increasing your financial burden and reducing your disposable income. Moreover, missing EMIs repeatedly can lead to loan default, which could result in legal action and severely limit your access to future credit facilities.

Additionally, lenders may offer benefits such as lower interest rates or special offers to borrowers with a good repayment track record. Therefore, timely EMI payments not only ensure smooth loan repayment but also open the door to better financial deals.

Being punctual with your EMI payments also supports long-term financial planning. It allows you to avoid sudden expenses due to penalties and ensures that you can allocate funds towards savings, investments, or other essential needs.

In conclusion, regular Lawyer Loan EMI payments help in preserving your financial health, improving creditworthiness, and creating opportunities for smarter borrowing.

Different ways to pay your Lawyer Loan EMI

When it comes to paying your Lawyer Loan EMI, having multiple payment options gives you the flexibility to choose what works best for your schedule and comfort. Here are the most common and reliable methods used by borrowers across India:1. Auto-debit facility This method automatically deducts the EMI from your bank account on the scheduled date. You can set it up through your lender or bank by submitting an auto-debit mandate. It ensures that you never miss an EMI due to forgetfulness.

2. Internet banking You can log in to your bank's internet banking portal and pay your EMI through the NEFT or IMPS service. It is convenient and secure, especially if you prefer handling finances digitally.

3. Mobile banking apps Most lenders have their own mobile apps that allow you to make EMI payments quickly. Additionally, you can use your bank’s app to make direct payments. Visit Bajaj Finance loan payment through debit card for a step-by-step guide.

4. UPI payments Apps like Google Pay, PhonePe, and Paytm offer UPI-based payment methods. Simply enter the lender’s UPI ID or scan the QR code to complete the transaction.

5. Debit card payments You can also pay your EMI using your debit card directly through the lender’s website or app.

6. Cash or cheque payments Although not widely used anymore, you can still pay EMIs via cash or cheque at your lender’s branch. Ensure you take a receipt for the same.

7. Standing instruction on credit card If your lender allows it, you can link your EMI payment to a credit card, which automatically deducts the amount monthly.

Having various payment methods ensures you can choose the most suitable and convenient option and always stay on top of your Lawyer Loan EMI schedule.

How to set up auto-debit for Lawyer Loan EMI payments

Setting up auto-debit is one of the best ways to ensure your EMIs are paid on time. Here is how you can do it:1. Visit your lender’s website or nearest branch Go to the official website or visit the nearest branch of your lender.

2. Log into your loan account Use your credentials to log into your loan account. If you are unsure about this, check loan account number to find your details.

3. Go to the ‘EMI Payment’ or ‘Repayment Settings’ section Under the EMI or repayment section, look for the auto-debit or NACH mandate option.

4. Fill in the auto-debit mandate form You will be asked to provide bank account details and authorisation.

5. Verify with OTP or e-signature Once submitted, you may need to verify the mandate with an OTP or Aadhaar e-sign.

6. Submit and wait for confirmation After submission, you will receive a confirmation once the mandate is approved.

7. Check activation status It usually takes 3-5 working days for the auto-debit service to become active.

Auto-debit is ideal for salaried professionals or anyone with regular monthly income who want to avoid missing payments.

How to pay Lawyer Loan EMI using a mobile app

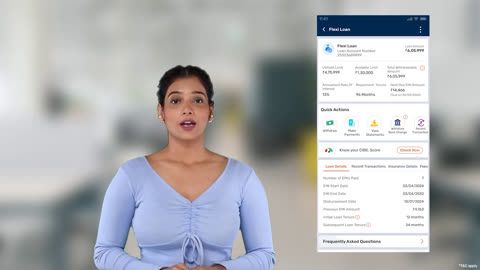

Paying your Lawyer Loan EMI using a mobile app is fast, safe, and user-friendly. Here is how to do it:1. Download your lender’s mobile app Install the official app from Google Play Store or Apple App Store.

2. Register or log in Log in using your registered mobile number and OTP, or enter your credentials.

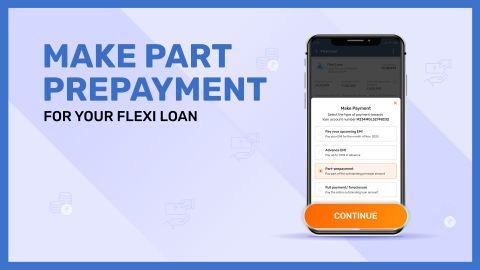

3. Navigate to ‘My Loans’ or ‘Loan EMI Payment’ section Locate the EMI payment section. You can also refer to loan part prepayment if planning additional payments.

4. Select the active loan account Choose the Lawyer Loan account for which you want to make the payment.

5. Choose payment mode Options include debit card, UPI, wallet, or net banking.

6. Enter EMI amount and confirm Verify details, enter the EMI amount, and proceed.

7. Authenticate and receive confirmation Complete the payment using OTP or payment credentials. You will receive a confirmation SMS/email.

This method ensures 24x7 access and payment flexibility.

How to pay Lawyer Loan EMI using online banking

Online banking is another secure and widely used option for EMI payments. Here is the step-by-step process:1. Log into your bank’s internet banking portal Use your username and password to log in.

2. Navigate to ‘Payments’ or ‘Fund Transfer’ section Go to the section where NEFT, IMPS or Bill Pay is listed.

3. Add your lender as beneficiary Use the lender’s account number and IFSC code. You can find these on your EMI schedule or lender’s site.

4. Enter EMI amount Key in the exact EMI amount that is due.

5. Schedule or make the payment Choose whether to pay immediately or schedule it for a future date.

6. Confirm and save the transaction Authenticate using OTP or password and save the payment receipt for reference.

7. Set recurring payments (optional) Enable a recurring monthly payment if your bank offers the option.

Online banking is safe, trackable and helps you maintain a digital record of all your payments.

Fees and charges for Lawyer Loan online EMI payments

Here are the common fees and charges associated with online EMI payments:

1. Processing fees Generally, there are no fees for EMI payments, but verify with your lender.

2. Late payment charges Missing your EMI deadline can lead to penalties ranging from Rs. 500 to Rs. 1,200.

3. Payment gateway charges Some lenders may levy 1-2% fees for payments made via credit cards or third-party gateways.

4. Bank charges A nominal charge may apply if you use NEFT or IMPS for payments.

5. Auto-debit bounce charges If your auto-debit fails due to insufficient funds, bounce charges of up to Rs. 500 may apply.

Always read the lender’s terms to avoid surprises.

Safety and security of online payments

Online EMI payments are secure if you follow these practices:1. Use official apps and websites only Always pay through verified and secure channels.

2. Enable 2-factor authentication Use OTPs and biometric logins for added security.

3. Avoid public Wi-Fi Make transactions only on secure, private networks.

4. Do not share passwords or OTPs Keep your banking credentials confidential.

5. Monitor your loan account regularly Check your statements and loan payment through debit card status frequently.

6. Update your apps and OS Keep mobile apps and software updated to prevent security loopholes.

Following these tips ensures your EMI transactions are protected against fraud.