A medical equipment loan account number is a unique identifier assigned to a loan specifically taken for purchasing medical equipment. Whether it's for setting up a medical practice or acquiring essential devices for home healthcare, this account number plays a crucial role in tracking your loan details. It is linked to the financial institution that sanctioned the loan, helping you access important information such as repayment schedules, outstanding amounts, and loan history. Understanding this number is vital for maintaining proper records and making timely payments. This article delves into what a medical equipment loan account number is, its importance, and how you can easily check or find it both online and offline, ensuring smooth loan management. Additionally, we will explore how to utilise this number effectively to keep track of your finances and facilitate seamless transactions.

What is a medical equipment loan account number?

A medical equipment loan account number is essentially the unique reference number assigned to your loan when you apply for financial assistance to purchase medical equipment. This loan is specifically designed for purchasing expensive healthcare equipment, whether it's for a hospital, clinic, or individual use. The account number serves as a unique identifier that helps financial institutions and the borrower to keep track of loan details. It ensures that all records are accurately attributed to a particular borrower and loan.

Once you take a loan, the number will be issued by the lender, allowing you to access loan-related details such as the loan’s principal, interest rate, repayment schedule, and other terms and conditions. the medical equipment loan account number is vital for managing your finances, making payments, and interacting with your lender. If you're looking for any information related to your loan or making any changes, this number will be essential for identification.

Having this account number is important because it prevents any confusion and ensures that all dealings related to your medical equipment loan are tracked properly. It also helps in quick access to loan-related details and support services when required.

Importance of medical equipment loan account number

Identification: The medical equipment loan account number is a unique identifier that ensures the correct identification of your loan within the lender's system.

Loan management: It allows both the borrower and the lender to easily access loan details such as outstanding amounts, repayments, and interest.

Secure transactions: This account number helps in maintaining the security and privacy of financial transactions associated with the loan.

Easy repayment tracking: By using the account number, you can keep track of your payments, ensuring timely repayment.

Customer service: When you contact the lender’s customer service, this number helps in quickly retrieving your loan details, saving time and improving the support experience.

Loan modifications: If you need to make changes to your loan, such as adjusting the repayment plan, this number is used to identify your account.

Documentation: It is essential for documentation purposes and can be used when submitting loan-related documents or requesting a statement of account.

Avoids confusion: It helps avoid confusion with other loans and ensures that only the relevant loan information is accessed, especially when managing multiple loans.

How to check a medical equipment loan account number?

To check your medical equipment loan account number, follow these simple steps:

Loan documents: The easiest way to find your account number is by referring to the documents you received when your loan was approved. This could be the loan agreement or a loan sanction letter.

Online banking portal: Most financial institutions provide online services where you can log in to your account and access details about your loan, including the account number.

Customer support: Contact your loan provider’s customer support for assistance. You will need to provide some personal details to verify your identity.

Bank statements: If your loan payments are automatically deducted, the account number is often listed in your monthly statement.

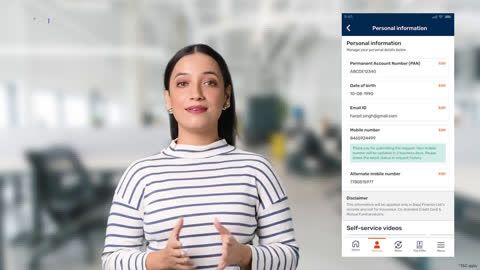

Mobile application: Many lenders have mobile apps where you can check all your loan-related details, including the account number.

Once you’ve located your medical equipment loan account number, you can use it to track repayments and other loan information.

How to find a medical equipment loan account number online?

Here are a few pointers for finding your medical equipment loan account number online:

Visit the lender’s website: Go to the lender’s official website and log into your account using your credentials. You’ll typically find your loan account number under the "Loan Details" or "Loan Overview" section.

Online loan management portal: Some financial institutions, such as Bajaj Finserv, provide portals where you can manage your loan and access your account number directly. Bajaj portal login for easy access.

Email notifications: When your loan is sanctioned, lenders usually send confirmation emails containing important details, including your loan account number.

Loan management app: If the lender has a mobile app, download and log in. Your loan account number should be readily available in the app’s dashboard.

Loan repayment schedule: Your loan repayment schedule, available online, also typically lists your account number along with repayment dates. Repayment schedule can be used to cross-check.

Other offline ways to check medical equipment loan account number

Loan approval letter: When you initially apply for the loan, you will receive an approval letter. This letter typically includes the account number.

Visit the branch: You can physically visit the branch of the lending institution and ask for the account number. Be sure to have your identity documents for verification.

Call customer service: Contacting the customer service department of the lender allows you to request your account number. They may ask for your personal details or loan-specific information.

Account statements: If you’ve been paying off the loan, your monthly statements will display the loan account number. You can request these from the branch if you don’t have access to them online.

Loan agent or broker: If you went through a loan agent or broker, they may be able to provide you with the loan account number on your behalf.

How to use your medical equipment loan account number?

Access loan information: Use your account number to access all loan-related details, such as outstanding balance, loan term, and interest rates, both online and offline.

Loan repayments: The account number is used to make repayments. When paying by cheque or online, this number ensures the payment is linked to the correct loan.

Track loan progress: You can monitor your loan's progress through online portals or customer support, helping you manage repayments effectively.

Modify loan terms: If you need to request changes such as extending the loan term or changing the EMI amount, the account number will be required for identification.

Loan closure: When you're ready to repay the loan in full, the account number helps ensure that the closure process is completed correctly.

Conclusion

In conclusion, understanding your Medical Equipment Loan account number is essential for seamless loan management. Whether you're checking your loan status, making payments, or requesting adjustments, this number serves as a unique identifier that streamlines the entire process. Whether you prefer accessing information online via your lender’s website or app or opting for offline methods, knowing how to find and use your account number ensures hassle-free transactions. For more details on repayment schedules and managing your loan, refer to the repayment schedule and Bajaj portal login.

Read More

Wrong Linking Account For Medical Equipment Loan Emi Deduction |