The average Indian customer is showing an increasing affinity toward purchasing items on EMIs. This is due to the ease of access to easy loans and EMI options, thanks to the popularity of e-commerce and digital financing options for consumers. According to Indian finance experts, different types of EMI payments increased by 220% in July 2021 compared to February 2020.

While taking an EMI is easy, paying it off in a timely manner is not. It requires good financial planning and discipline to stick to the payment schedule, ensuring that no EMI payment is missed. So, if you find it difficult to put money aside each month to pay for the EMI, remember one of the benefits of timely EMI payments is that it helps you avoid falling into a debt trap.

There are some tried-and-true methods to ensure that your EMI payments are always made on time and in full. Let's begin with the benefits of paying EMI on time.

Tips to maintain your creditworthiness

Staying financially disciplined is essential if you want to keep your credit profile strong, and one of the easiest ways to do this is by paying your EMIs on time. Still, managing multiple payments and keeping track of due dates can feel challenging. The following practical tips can help you stay on top of your finances and maintain good credit-worthiness with ease.

Use the autopay facility

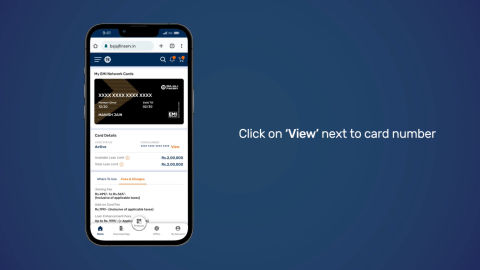

Most banking and payment apps now offer an automatic payment option. Once you activate it, your EMI is deducted on the chosen date each month, helping you avoid missed payments as long as your account has enough balance.

Pick an EMI plan that suits your budget

Before selecting a tenure, review your monthly expenses and income. Choosing the right repayment period makes your EMIs manageable and reduces the chance of delays. With your Bajaj Finserv Insta EMI Card you can enjoy EMI tenures of up to 3 to 60 months. Check your eligibility now by entering your mobile number and OTP.

Maintain a healthy income-to-EMI ratio

Ideally, your monthly EMIs should not exceed 40–50% of your income. This keeps your finances stable and prevents repayment stress.

Build an emergency fund

Unexpected events can disrupt your cash flow. Having a savings buffer ensures you can continue paying EMIs even during difficult times.

Align your EMI cycle with your earnings

Choose a repayment schedule—monthly, quarterly, or half-yearly—that matches the timing of your income. This is particularly helpful for those with seasonal or irregular earnings.

Consolidate multiple loans

If you have several EMIs, consider combining them into a single loan. This simplifies tracking and helps you stay organised.

Bottom Line

Before taking a loan, think about your monthly financial commitment. Never, under any circumstances, let your monthly EMI exceed 50% of your gross income. You never realize when an unforeseeable event will impact your ability to repay your debts.

It is wise to improve your credit history and open the door to future borrowing opportunities by taking advantage of timely payments.

For more details, you can connect with Bajaj Finserv executives to get your queries answered regarding EMIs. Simply reach out to us at https://www.bajajfinserv.in/reach-us.