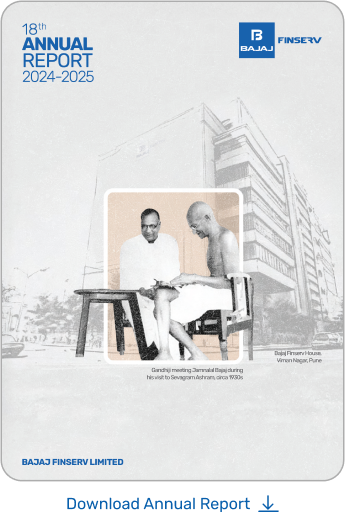

Growing with Time.

Our Legacy

The Bajaj Group owes its enduring legacy to its founder Shri Jamnalal Bajaj, a humanitarian, freedom fighter, philanthropist, social reformer and a devoted follower of Mahatma Gandhi.

He was known as much for his earnestness and strict code of ethics in business, as for his active and integral part in India’s freedom movement.

As part of the Bajaj Group, over the years, Bajaj Finserv’s foundational commitment to serve the nation has remained unwavering.

Our Purpose

- To be a place where innovation, agility and ownership thrive

- Creating responsible leaders who build long-term profitable businesses

- To delight our customers by creating constant value across the customer lifecycle

- Enhance financial inclusion, serve communities and the nation, by being the Financial Services Lifecycle Partner to every Indian

Now as Then:

New Opportunities. Unchanged Commitment to India.

Values are timeless. Our history inspires our future. Our commitment to serving India is time-tested.

As one of India’s largest and most diversified financial services groups, our companies are a financial lifecycle partner to India’s mass‑affluent and middle-income population, offering financial products for every need, including loans, fixed deposits, general and life insurance, and investments.

Read more

Read more

308 million

CUSTOMERS SERVED

750+

PRODUCTS

4,200+

LOCATIONS

TOTAL DISTRIBUTION POINTS

225,000+

INSURANCE AGENTS

340,000

ACTIVE POINTS OF SALE (INSURANCE)

The Bajaj group's acquisition of 26% stake each in BAGIC and BALIC indicates our commitment to the insurance ventures and the financial services sector in India.

Dear Shareholder,

Let me begin with a tribute to Madhur Bajaj who passed away on 11 April 2025. He was until recently a director of Bajaj Finserv and other Bajaj group companies for over three decades. We will miss his valuable support which we had during his long association with the group.

Sanjiv Bajaj

Chairman & Managing Director

Read Full Statement

Read Full Statement

Anish Amin

President (Group Risk,

Assurance & Human Resource),

Bajaj Finserv Ltd.

Ganesh Mohan

Managing Director,

Bajaj Finserv Asset

Management Ltd.

Sam Subramaniam

President (Private Equity

Investments & Group Strategy),

Bajaj Finserv Ltd.

Purav Jhaveri

President (Investments),

Bajaj Finserv Ltd.

Rajeev Jain

Vice Chairman,

Bajaj Finance Ltd.

Sanjiv Bajaj

Chairman and

Managing Director,

Bajaj Finserv Ltd.

Tarun Chugh

Managing Director and CEO,

Bajaj Allianz Life Insurance

Co. Ltd.

Dr. N Srinivasa Rao

Chief Economist and President

(Corporate Affairs),

Bajaj Finserv Ltd.

V Rajagopalan

President (Legal and Taxation),

Bajaj Finserv Ltd.

Atul Jain

Managing Director,

Bajaj Housing Finance Ltd.

Anup Saha

Managing Director,

Bajaj Finance Ltd.

Manish Jain

Managing Director,

Bajaj Financial Securities Ltd.

Tapan Singhel

Managing Director and CEO,

Bajaj Allianz General Insurance

Co. Ltd

S Sreenivasan

President (Insurance and

Special Projects),

Bajaj Finserv Ltd.

Ramandeep Singh Sahni

Chief Financial Officer,

Bajaj Finserv Ltd.

Devang Mody

Managing Director and CEO,

Bajaj Finserv Health Ltd.

Kurush Irani

President (CSR),

Bajaj Finserv Ltd.

Ashish Panchal

Managing Director and CEO,

Bajaj Finserv Direct Ltd.

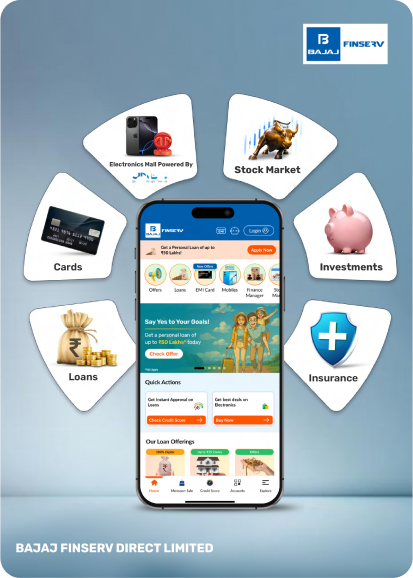

Whole Greater than Sum of Parts

A diversified financial services group with a pan-India presence

(Personal, Home)

Health care Platform

Mutual Funds, Stocks

Financial Services

Bajaj Finserv (Listed)

Bajaj Finance

(BFL)

Listed

(Consumer & Finance Business)

Bajaj Housing Finance (BHFL)

Listed(Mortgage and Developer Financing)

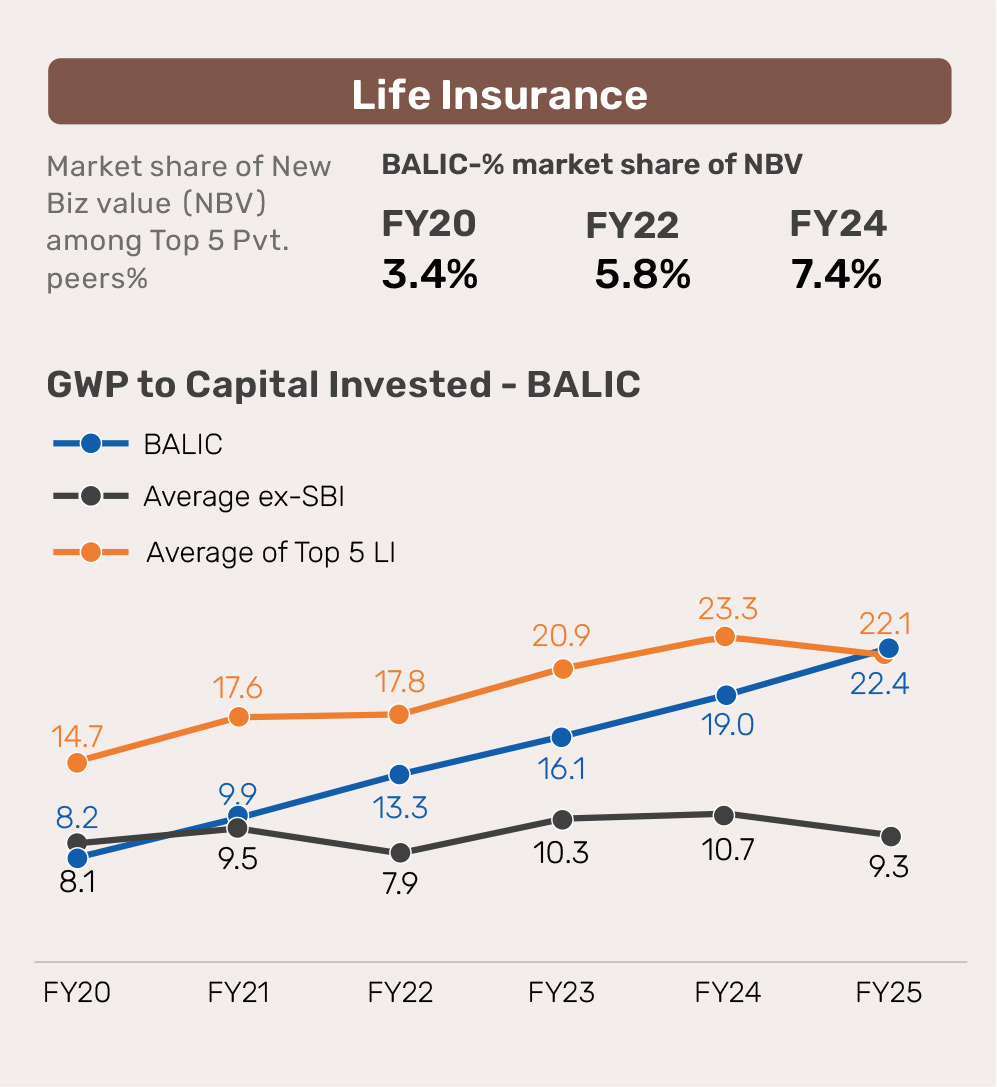

Bajaj Allianz Life Insurance (BALIC)

(Life Insurance, Retirement & Pension)

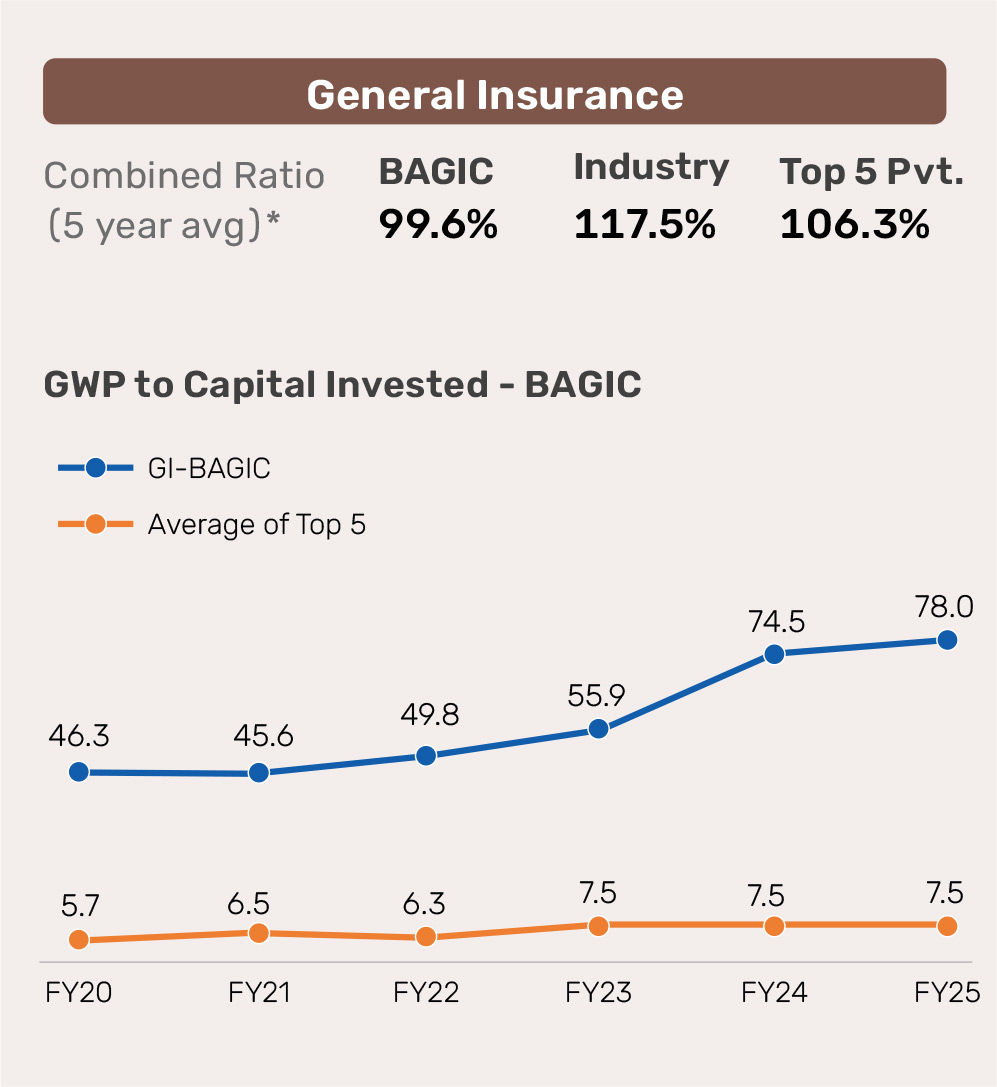

Bajaj Allianz General Insurance (BAGIC)

(General and Health Insurance)

Bajaj Finserv Asset Management

(BFS AMC)

(Mutual Funds)

Bajaj Finserv Direct (BFSD)

(Digital Marketplace)

Bajaj Finserv Health (BFHL)

(Health-tech Platform)

Bajaj Financial Securities (BFSL)

(Digital Stockbroker)

Journey through Time

FY2025 Set the Stage for

Bajaj Finserv’s Next Phase of Growth

Bajaj Finserv signed Share Purchase Agreements to acquire the 26% interest owned by Allianz SE in Bajaj Allianz General Insurance Company and Bajaj Allianz Life Insurance Company, increasing Bajaj Group’s ownership in BAGIC and BALIC to 100%

Bajaj Housing Finance successfully concluded its Initial Public Offer (IPO) of ₹6,560 crore

Bajaj Finance started to pivot to BFL 3.0 - a FinAI company

Bajaj Finserv Health entered hospitalisation claims management with the successful acquisition of 100% stake in Vidal Healthcare Services

Bajaj Finserv Direct turned cash positive in FY2025