02

Transformation through Technology

Technology is a gamechanger. It enables us to anticipate customer needs, respond faster and more precisely.

We are excited about the opportunities offered by AI to build remarkable customer experiences and help our businesses grow. At Bajaj Finserv, we are driving digital transformation by leveraging Gen AI across businesses and functions for improved efficiencies.

Bajaj Finance is pivoting into a BFL 3.0 - a FinAI Company, with AI enabled technology architecture, which integrates AI across all its processes to significantly improve customer engagement, grow revenue, reduce Opex, reduce credit costs, enhance productivity and strengthen controllership.

Some of this includes conversational AI for sales, responsible and explainable AI for risk management, AI-driven engagement and training to increase productivity, and co-pilot and auto‑pilot in operations, services and audit. Integration of AI across all its processes will not only deliver significant operating leverage but also create a virtuous growth cycle.

Our businesses are data-driven, and we believe new-age technologies will continue to be key enablers for making our customers’ lives financially better, improving their experiences, constantly stepping up risk management efforts, fraud prevention and operating efficiencies.

300+

GEN AI PROJECTS ACROSS COMPANIES

603 million

VISITS ON BFL WEBSITE

70.6 million

NET INSTALLS ON BAJAJ FINSERV APP OF BFL

81.8%

DIGITAL SERVICING AT BAGIC

38.7%

SERVICE REQUESTS INITIATED ON APP AND WEB BY BFL

7.7 million

LOAN REPAYMENT RECEIPTS GENERATED ON APP AND WEB BY BFL CUSTOMERS

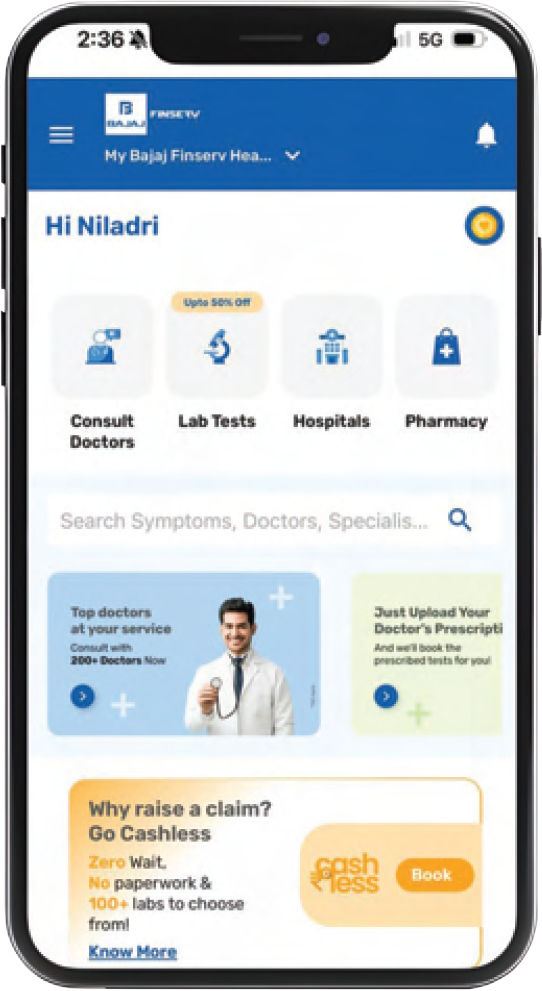

Bajaj Finserv Health

APP-FIRST APPROACH, MICROSERVICE-SCALABLE ARCHITECTURE, AI-LED ABUSE MANAGEMENT SERVICES