ANCHORED IN PURPOSE

ADVANCING WITH RESPONSIBILITY

ENVIRONMENTAL, SOCIAL AND

GOVERNANCE REPORT

(ESG) 2024-2025

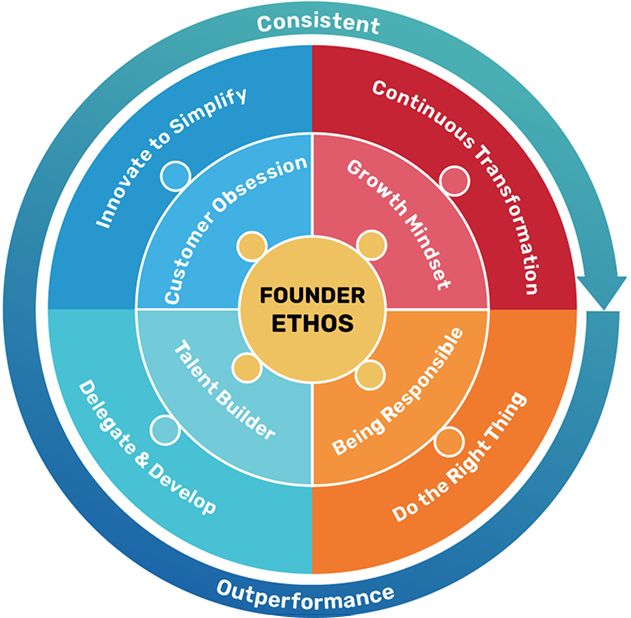

Rooted in a legacy of business innovation, community development and service to the nation, ESG principles are deeply integrated with our businesses at Bajaj Finserv. As the holding company for the financial services businesses of the Bajaj Group, we carry forward our tradition of building responsible, long-term and sustainable enterprises.

About Bajaj Finserv

The Company is an unregistered core investment company (CIC) under Reserve Bank Regulations. It is the holding company for various financial services businesses under the Bajaj group. With a vision to be a diversified financial services group with a pan-India presence, it offers lifecycle financial solutions for its various customers.

BFS Group: Key Financial Metrics

*Attributable to owners of the Company. | ^Only for material subsidiaries (i.e. BFL, BHFL, BAGIC and BALIC). | CAGR: Compound Annual Growth Rate.

BFS Footprint

BFS Group - Diverse Business Portfolio

Bajaj Finserv conducts its lending operations through Bajaj Finance Ltd. (BFL).

BFL serves mass affluent and rural customers through the following categories:

Consumer Lending

Personal Loans

SME Lending

Auto Finance

Rural Lending

Gold Loans

Commercial Lending

Loans against Securities

Deposits and other Partnerships

BFS' insurance participation is through Bajaj Allianz General Insurance Company Ltd. (BAGIC) which provides non-life (Property and Casualty) and Health insurance products and Bajaj Allianz Life Insurance Company Ltd. (BALIC) which provides life insurance and retirement plans (together referred as 'Insurance subsidiaries').

- Bajaj Finserv Direct Ltd. (BFSD)

- Bajaj Finserv Health Ltd. (BFHL/EBH)

- Bajaj Finserv Asset Management Ltd. (AMC)

Our ESG Focus Areas

At Bajaj Finserv, we believe transformational impact comes from focused, strategic action. Guided by our Responsible and Sustainable Business Conduct Policy, we have identified eight priority areas aligned with our long-term ESG goals - areas where we can drive the greatest sustainable change and create lasting value for all stakeholders.

Prev

Prev

Governance

Governance