Transforming Lives through Business

Be a one-stop for all financial services, by using tech-led innovation and harnessing the best talent, to provide sustainable long-term returns for a better tomorrow

One-stop financial

access for India

We provide financial solutions for everyday needs of our customers – through their lifecycle – enabling individuals and businesses to save, access finance for life’s needs, pay with ease, invest to grow wealth and cover risks to health, life and assets

Tech-led

innovation

We continue to innovate for the future, which is why our new businesses are building a financial ecosystem which embraces emerging technologies and the India digital stack

Harnessing the

best talent

Our people make up the universe that serves our customers and stakeholders. We are committed to harnessing the best talent, rewarding performance, imbibing the entrepreneurial spirit in them and making Bajaj Finserv not just one of the best workplaces, but an opportunity for career growth.

Sustainable

long-term returns

Our business model is proven and agile to respond real-time to changes in the business environment, helping us grow our customer franchise, deliver better customer experience, explore new markets, sustain profitability, optimize capital, strengthen the balance sheet and create shareholder value

Towards a better tomorrow: Environment, Social, Governance

We are deeply connected to local communities and work to transform lives of people, especially children and youth, through self-implemented programmes and by partnering non-profits.

One-stop Financial Access for India

Relentless customer focus

We offer access to credit to India’s millions – individuals and SMEs - for life cycle needs - from finance for consumption, to personal and home. Our insurance products range from pocket insurance for OPD and post treatment, to motor, home, and life insurance.

100+

Products

Bajaj Finance Fixed Deposits program

AAA

Stable, highest stability ratings by CRISIL AAA (Stable) by ICRA

Bajaj Allianz General Insurance Company is among the

best claims

Settlements general and health insurer, AAA rated by ICRA for claims paying ability

30 million

New loans booked in FY2023

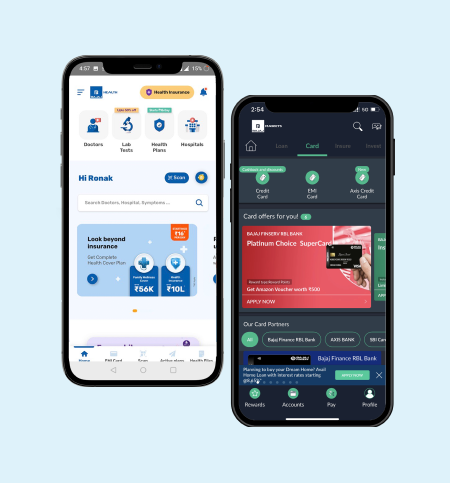

Tech-led Innovation

Even as we continue to build capabilities in products, network and people, we are continuously investing in a tech-driven financial ecosystem for our existing and potential customers, be it in lending, insurance or investments. It is heartening to see the number of new consumers who are entering and spending time in Bajaj Finserv’s open architecture financial ecosystem.

Harnessing the Best Talent

We strive to inculcate a sense of ownership in our employees. This makes our employees architects of their own career progression. They own their development with guidance and support from immediate managers and the organisation. In selecting between a ‘develop versus hire’ talent model, we emphasise on developing talent through capability building, led by our Group Learning Academy (GLA). Various other workshops and skill upgradation programmes help us build capabilities and enable business growth and excellence.

The One Finserv Group Talent mobility

A platform which enables job mobility across companies within Bajaj Finserv.

Group Young Leaders Programme

Top talent from tier 1 institutes is hired and groomed for leadership roles by moving them across roles in Bajaj Finserv companies.

30 Under 30 Programme

This junior management talent acceleration program is targeted at identifying and grooming high potential talent below the age of 30.

Group Finance Associate Programme

A program focused on developing our leadership depth and bench in the finance function across Bajaj Finserv companies by grooming Chartered Accountants for future roles.

Diversity & Inclusion initiative

Our Diversity and Inclusion council is a critical driver in fostering real organizational change. The Council ensures dedicated focus on diversity and inclusion priorities and is actively involved in introducing changes where needed.

Sustainable Long-term Returns

Balancing growth and profitability

We are committed to sustaining the trust of our stakeholders. Our diversified strategy enables optimal mix of risk and sustainable profit. Multiple levers for growth result in effective use of capital, consistent earnings growth and meaningful market share in each business.

Bajaj Finance Ltd. (BFL)

- 11.6 million crore new customers in FY2023, BFL’s highest‑ever customer franchise addition in a year

Bajaj Housing Finance Ltd. (BHFL)

- Dedicated to drive domain expertise, scalability and operating leverage

Bajaj Allianz General Insurance Company Ltd. (BAGIC)

- Focus on strong underwriting, excellent reinsurance capacity for covering large risks, strong selection of risk & prudent underwriting

- Among the most profitable general insurance businesses in the industry

Bajaj Allianz Life Insurance Company Ltd. (BALIC)

- 3-year CAGR is industry highest

- Balanced mix between institutional and proprietary retail channels

Towards a Better Tomorrow: Environment, Social, Governance

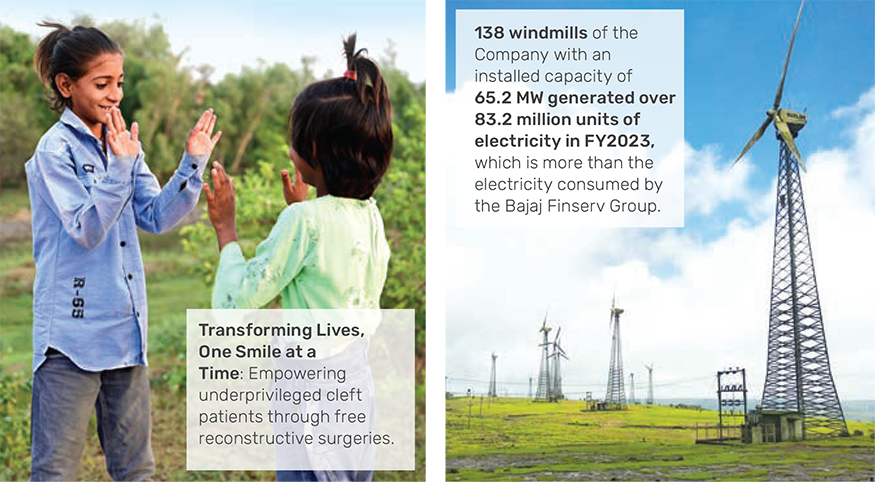

We believe that growth needs to be inclusive and equitable. Our businesses have imbibed this philosophy since inception. From making formal finance available to the unbanked sections of our population to reducing carbon footprint and improving the lives of children and youth – we have leveraged innovation to address challenges and make a meaningful impact on society and the environment.

How we positively impact the environment

- Digitisation reduced paper consumption by 400 crore sheets, saving approximately 4,80,000 trees in 3 years

- Bajaj Finance funded 15,790 e-scooters in the last 3 years

- Bajaj Allianz General Insurance insured over 1,800 renewable power generation facilities in FY2023

Creating meaningful social impact

- Enabled 66,000 life-transforming cleft surgeries for children

- Livelihood and skilling programmes include Certificate Programme in Banking Finance and Insurance, and partnerships with non-profits

Advancing financial inclusion

- Bajaj Finance extended financing to 17 million new-to-credit customers over the past 5 years

- The SME lending book grew by 36% to ` 33,628 crore in FY2023

- Bajaj Allianz General Insurance has increased its insurance coverage to MSMEs and paid claims worth ` 151 crore to more than 2,600 MSMEs in FY2023

Corporate Governance

- The materiality assessment exercise was conducted through survey-based forms and engagement with diverse stakeholders to identify relevant sustainability issues

- We are committed to strong corporate governance, which reflects in the highest standards of disclosure